Updated September 13, 2023

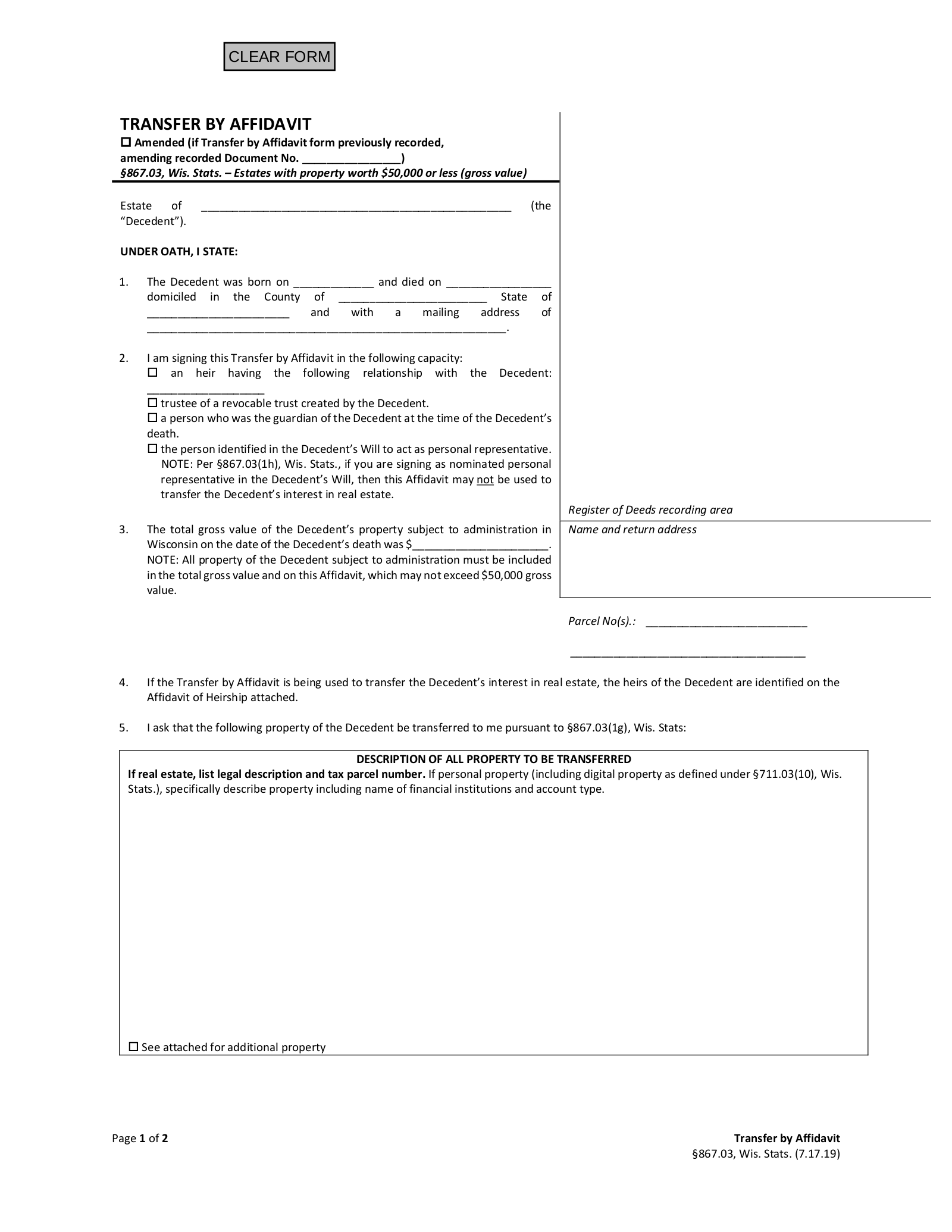

A Wisconsin small estate affidavit, also known as a Transfer by Affidavit, helps heirs, successors and beneficiaries of estates valued at $50,000 or less receive what they are entitled to more quickly than through traditional means. This form can be used by an heir of the decedent, a trustee of a trust created by decedent, a person named in the will to act as a personal representative, or the decedent’s guardian at time of death. A third party is obligated to turn over property belonging to the estate after receiving a properly executed affidavit.

Laws

- Days after Death – No statute. There is no law that obligates a successor to wait for a period before using the affidavit to collect assets.

- Maximum Amount ($) – $50,000. State law defines a small estate as worth less than $50,000. This does include real estate. (W.S.A. 867.03(1g))

- Real Estate – If a successor is making a claim to the decedent’s interest in real estate, or a lien on real estate, the Affidavit of Heirship and Affidavit of Service must be signed and notarized in addition to the Transfer by Affidavit form. (W.S.A. 867.03(1p))

- Signing Requirements – Forms must be signed in the presence of a notary public.

- Statute – Probate, Chapter 867. Probate – Summary Procedures

How to File (5 steps)

- Gather Information

- Prepare Affidavit(s)

- Notify Department of Health Services

- Get All Forms Notarized

- Collect the Assets

1. Gather Information

2. Prepare Affidavit(s)

If you are claiming real estate, you’ll have to download and complete the Affidavit of Heirship and Affidavit of Service in addition to the Transfer by Affidavit. In this case, you must also provide copies of these affidavits to the decedent’s heirs, either by mail or personal service, thirty (30) days before filing the forms with the Register of Deeds Office in the county in which the real estate is located. You can find your local office by using this locator. You will be required to show proof of notice under Subsection 1m.

3. Notify Department of Health Services

Video

How to Write

Download: PDF

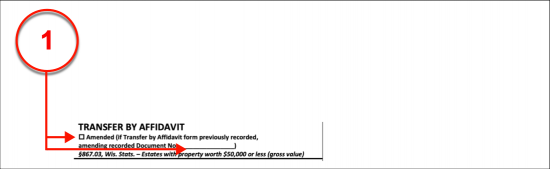

(1) Status Of Affidavit. The purpose of this transfer petition should be established at the onset. If this is an amended petition that shall provide corrected information to a previously filed affidavit, then select the checkbox at the top of the page and report the document number the original paperwork was assigned. If this is not the case, then leave this area unaltered so that it will be assumed that this paperwork is the first petition filed by the Wisconsin Affiant.

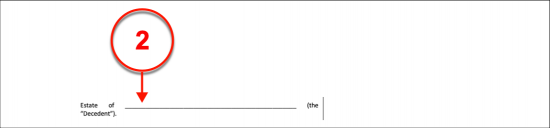

(2) Wisconsin Deceased. The entire name of the Wisconsin Deceased should be presented to identify the concerned estate. He or she will be considered the Decedent whose property will be sought by the Wisconsin Deceased.

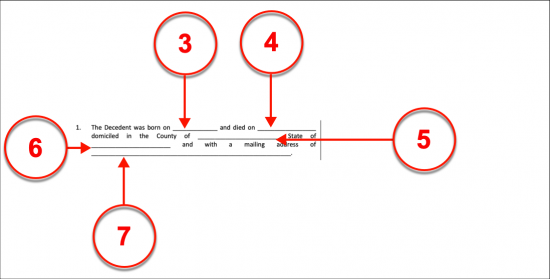

Article 1

(3) Birth Date Of Wisconsin Deceased. The date of birth of the Wisconsin Decedent is required at the beginning of Article 1.

(4) Date Of Wisconsin Decedent Death. Furnish the date of the Wisconsin Decedent’s death. Such information is easily found on the death certificate that was issued.

(5) County Of Wisconsin Decedent Residence. The name of the County where the Wisconsin Deceased lived or maintained a residence should be dispensed.

(6) Verify State. Deliver the name of the State where the Wisconsin Decedent’s residence is located.

(7) Wisconsin Decedent Mailing Address. The Decedent may have maintained a mailing address that is different from his or her home address. If this was the case, then this additional address must be documented. Provide it as the concluding information in the first article.

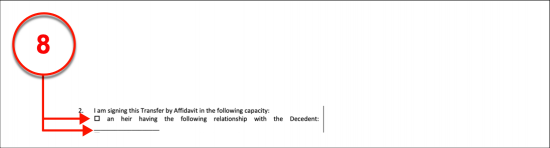

Article 2

(8) Heir Acting As Wisconsin Affiant. The Party who will submit this paperwork to the courts in the effort to claim the Wisconsin Decedent’s assets is known as the Affiant. This Party must be classified correctly for this purpose therefore, several options have been presented in the second article. If the Wisconsin Affiant is the Heir of the Decedent then the first checkbox statement must be marked and the relationship held between Affiant and Wisconsin Decedent should be documented.

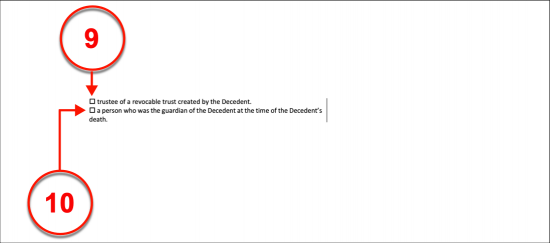

(9) Trustee Of Wisconsin Decedent. Select the second statement’s checkbox if the Affiant is a Trustee named by the Wisconsin Decedent.

(10) Guardian As Wisconsin Affiant. Mark the third checkbox to establish the Affiant as the appointed Guardian of the Wisconsin Deceased.

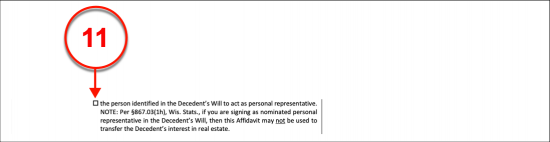

(11) Nominated Personal Representative Of Wisconsin Decedent. If the Affiant has been named in the Wisconsin Decedent’s will as the Personal Representative of the Deceased, then select the final checkbox statement.

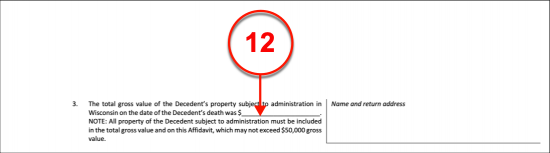

Article 3

(12) Gross Value Of Wisconsin Decedent Estate. The gross value of the Wisconsin Decedent estate must be calculated then reported since the state of Wisconsin places a strict limit on how much value a small estate may have. Currently, if the value of the Wisconsin Decedent’s estate is less than $50,000.00 then it may be considered a small estate. If it is greater than fifty thousand dollars then such a value will disqualify the estate from this status.

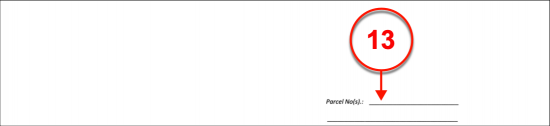

(13) Parcel Number. All real property owned by the Decedent must be documented beginning with each property’s parcel number. If the Wisconsin Affiant did not own any real estate at the time of his or her death, then these lines may be left unaltered.

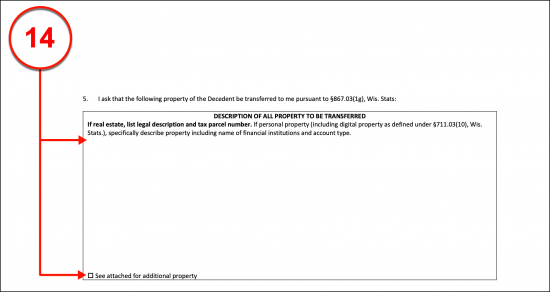

Article 5

(14) Real Property Of Wisconsin Decedent. All the property in the Wisconsin Decedent’s estate requires documentation. These assets must be defined with a complete description and must include real property. For instance, if the Wisconsin Decedent owned real estate then the physical address, the legal description, and its parcel number should be documented. If the estate of the Wisconsin Decedent consisted of intangible assets (such as a bank account) then the name of the Financial Institution and the account number where these assets are held should be defined. If an attachment must be furnished to provide a complete report, then select the checkbox provided to indicate the presence of this additional paperwork and attach the additional information to this document.

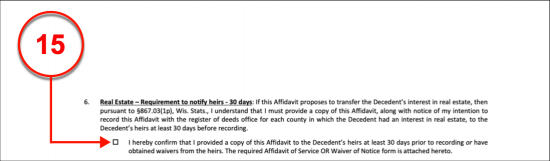

Article 6

(15) Real Estate – Requirement To Notify Heirs. The Registry of Deeds must be informed of this affidavit if the Affiant seeks real estate from the estate. He or she will need to verify that the Registry of Deeds will be mailed a copy of this affidavit at least thirty days prior to recording.

Article 7

(16) Decedent Spouse. The check box provided to the statement made by the seventh article should be selected if the Wisconsin Decedent was married at any time in his or her life.

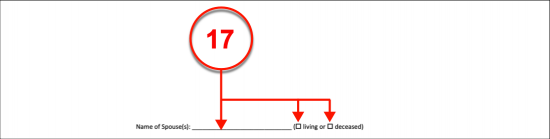

(17) Name Of Spouse. The full name of the Wisconsin Decedent’s Spouse must be documented. Additionally, it must be shown whether or not the Spouse is still “Living” or “Deceased” by selecting the appropriate definition.

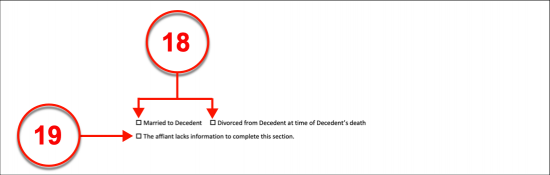

(18) Marital Status At Time Of Death. Indicate whether the Wisconsin Decedent and the Spouse were still married at the time of his or her death or if they had divorced by the time the Wisconsin Decedent passed away.

(19) Lack Of Information. If the Wisconsin Affiant does not have enough information to complete this section then he or she should select the final checkbox statement. This selection may be made even if part of Article 7 was provided with information.

Article 8

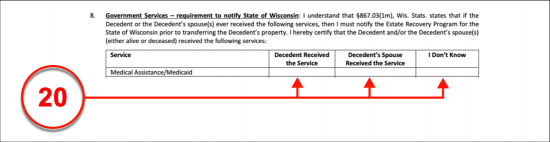

(20) Medical Assistance/Medicaid. If the Wisconsin Decedent has received Medical Assistance in the State of Wisconsin then place a mark in the first column of the table in Article 8. It should also be noted if the Wisconsin Decedent’s Spouse received medical assistance by marking the second column. If the Affiant does not have such information available and can neither verify nor deny that the Decedent and/or Spouse received medical assistance while in the State of Wisconsin, then the third column should be marked.

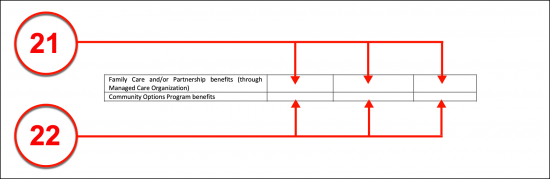

(21) Family Care And/Or Partnership Benefits. Indicate if the Wisconsin Decedent and/or his or her Spouse received assistance from a Managed Care Organization (i.e. family care or partnership benefits) by placing a mark in the first and second column respectively. If this information is not known then place a mark in the column “I Don’t Know.”

(22) Community Options Program. Use the first and second columns to indicate if the Wisconsin Decedent and/or his or her Spouse were participants in a Community Options Program by filling in the appropriate column with an “X” or a checkmark. If no information is available to the Affiant on this matter then the third column should be marked.

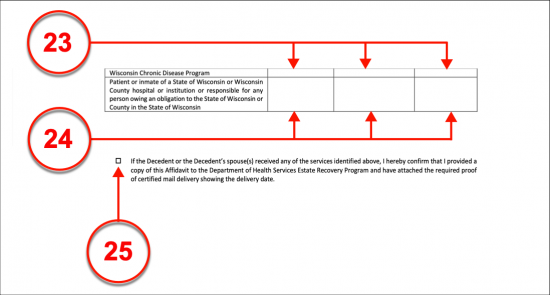

(23) Wisconsin Chronic Disease Program. Use the first two columns to indicate if the Wisconsin Deceased or his or her Spouse were admitted to a Wisconsin Chronic Disease Program and received benefits. If this is unknown then declare a lack of information by marking the third column.

(24) Patient Or Inmate. If either the Wisconsin Decedent or his or her Spouse was admitted to a County Hospital or similar Institution Patient or was an Inmate in the State of Wisconsin and received benefits as a result, then mark the first and/or second columns to indicate the receipt of such benefits. The third column has been provided should there be no information available regarding this topic.

(25) Wisconsin Affiant Signature. The signature of the Wisconsin Affiant should be made under the observance of a Notary Public. This act should only be performed when all the information presented in this affidavit has been verified as true and all attachments completed.

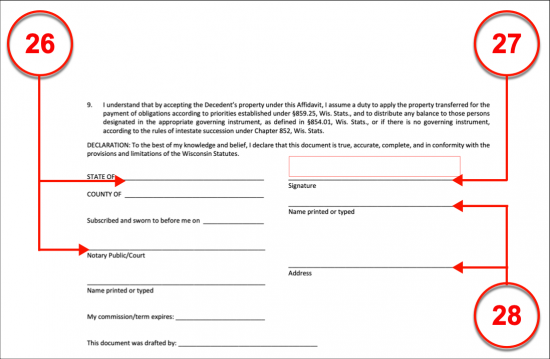

(26) Wisconsin Affiant Signature. The signature of the Wisconsin Affiant should be made under the observance of a Notary Public. This act should only be performed when all the information presented in this affidavit has been verified as true and all attachments completed.

(27) Wisconsin Affiant Printed Name. The name, as well as the address of the Wisconsin Affiant, must be presented in print along with his or her signature.

(28) Notary Public. The signature provided by the Wisconsin Affiant will be authenticated by the Notary Public attending the signing.

(29) Preparer. If someone other than the Affiant has supplied the information to this paperwork (before a notarized signature was produced) then he or she must self-identify with a production of his or her full name.