Updated September 13, 2023

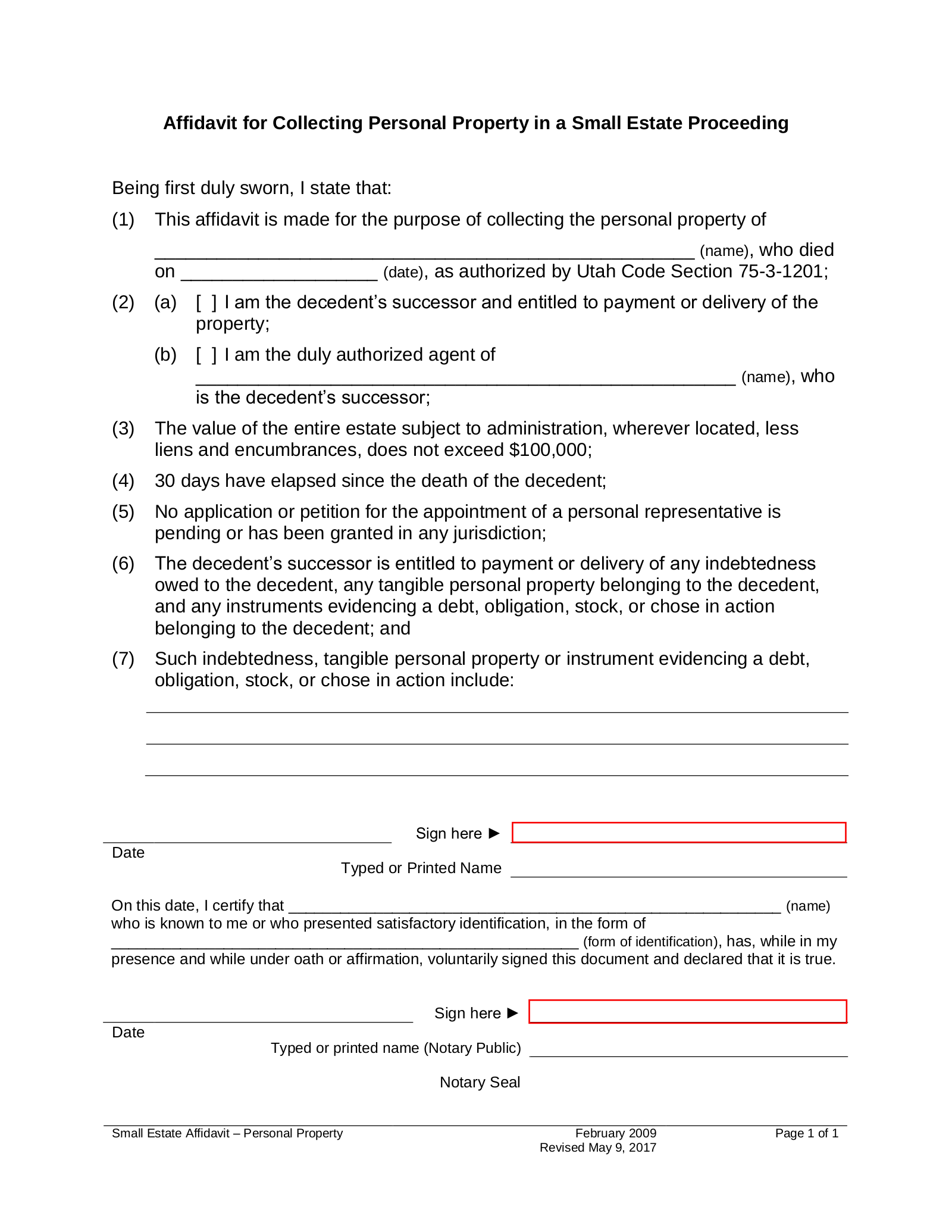

A Utah small estate affidavit, or ‘Affidavit for Collecting Personal Property in a Small Estate Proceeding’, can be used to bypass probate in cases where a person has passed away leaving $100,000 or less in assets. This form allows a successor to collect assets and property, excluding real estate, from third parties without going through a lengthy and complicated court proceeding. A separate process is required to claim title to boats and motor vehicles.

Laws

- Days after Death – State law requires thirty (30) days to pass after the decedent dies before an affidavit can be used to transfer property. (U.C.A. § 75-3-1201)

- Maximum Amount ($) – $100,000. State law defines a small estate as possessing a value, less liens and encumbrances, not exceeding $100,000. The affidavit cannot be used to transfer title to real estate. (U.C.A. § 75-3-1201)

- Motor Vehicles – A separate affidavit (Survivorship Affidavit) can be used to claim title to up to four boats, motor vehicles, trailers, or semi-trailers registered pursuant to Utah law. (U.C.A. § 75-3-1201(3)) This affidavit is presented to the Utah Division of Motor Vehicles to transfer the title of those vehicles or boats. Use this locator to find a Division of Motor Vehicles Office near you.

- Signing Requirements – Form must be signed in the presence of a notary public.

- Statute – Probate Code, Chapter 3, Part 12. Collection of Personal Property by Affidavit and Summary Administration Procedure for Small Estates

How to File (4 steps)

1. Wait Thirty (30) Days

2. Prepare Affidavit

Video

How to Write

Download: PDF

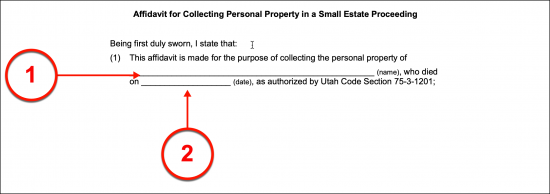

Statement 1

(1) Name Of Utah Decedent. The Utah Decedent this document discusses must be identified with his or her full name.

(2) Utah Decedent Date Of Death. Present the calendar date when the Utah Decedent was pronounced dead on his or her death certificate. This date must be at least thirty days prior to the signature date the Affiant declares in this petition.

Statement 2

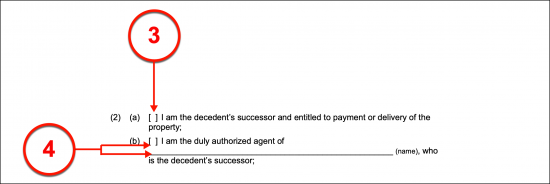

Select Item 3 Or Item 4

(3) Decedent Successor As Utah Affiant. The Utah Affiant’s status in relation to the concerned estate is a required report. The second article allows this information to be quickly presented by selecting one of two checkbox statements. If the Utah Affiant is the Successor to the Decedent’s estate (i.e. the Decedent’s Spouse, Child, or Sibling) then select statement A by marking the checkbox.

(4) Authorized Agent As Utah Affiant. If the Utah Affiant is the Authorized Agent of the Decedent’s Successor then Statement B must be selected and the name of the Successor to the Utah Decedent’s estate must be documented.

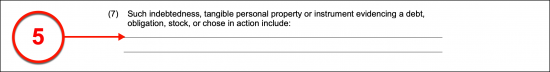

Statement 7

(5) Utah Decedent Estate. List all property (excluding real property) in the Utah Decedent’s estate along with any encumbrances or debts that the Utah Decedent’s estate is responsible to pay.

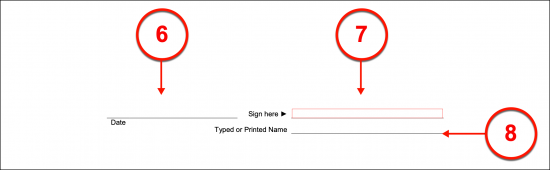

Signature Execution

(6) Signature Date Of Utah Affiant. The calendar date when this petition is executed must be supplied by the Signature Affiant just before he or she signs this paperwork. This calendar date is required to be no less than thirty days from the date of the Decedent’s death and will be verified by the Notary Public attending the signing.

(7) Utah Affiant Signature. The signature of the Utah Affiant must be supplied with a Notary Public in attendance.

(8) Printed Name Of Utah Affiant.

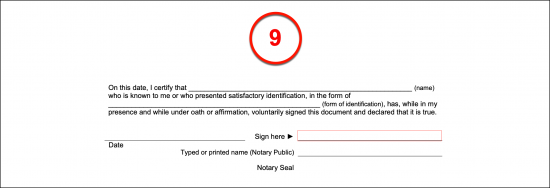

(9) Notary Public To Utah Affiant Signature. The licensed Notary Public will use the final area to show the notarization process has been utilized during the signature execution of this petition.