Updated September 13, 2023

A South Dakota small estate affidavit is a document that can help a person using it, known as an “affiant,” avoid traditional probate proceedings. It is available for an estate, consisting of personal property, that is valued less than $100,000. Only individuals who are legally entitled to the estate can utilize the functions of this form. The affiant assumes the role of the personal representative of the estate. This means they are responsible for managing all aspects of the estate, including but not limited to formal notifications, property distribution, and debt remittance.

Laws

- Days After Death – Thirty (30) days (SDCL § 29A-3-1201(a))

- Maximum Amount ($) – $100,000 (SDCL § 29A-3-1201(a)(1))

- Signing – The applicant is required to sign the affidavit in the presence of a notary public, who also has to sign the form and affix their seal.

- Statutes – Title 29a (Probate Code), Chapter 29A-3, Part 12. Collection of Personal Property by Affidavit and Summary Administration Procedure for Small Estates

How to File (5 steps)

- Wait Thirty (30) Days

- No Personal Representative

- Complete the Affidavit

- Department of Revenue

- Present the Affidavit

2. No Personal Representative

3. Complete the Affidavit

Video

How to Write

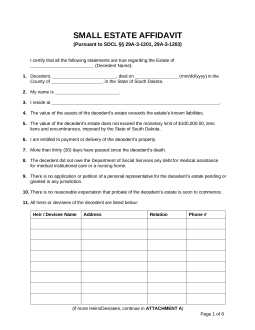

Download: PDF

(1) South Dakota County. Identify the South Dakota County where this paperwork will be filed.

(2) Name Of South Dakota Affiant. The Petitioner for the South Dakota Decedent’s estate should be named in the declaration statement at the beginning of this petition.

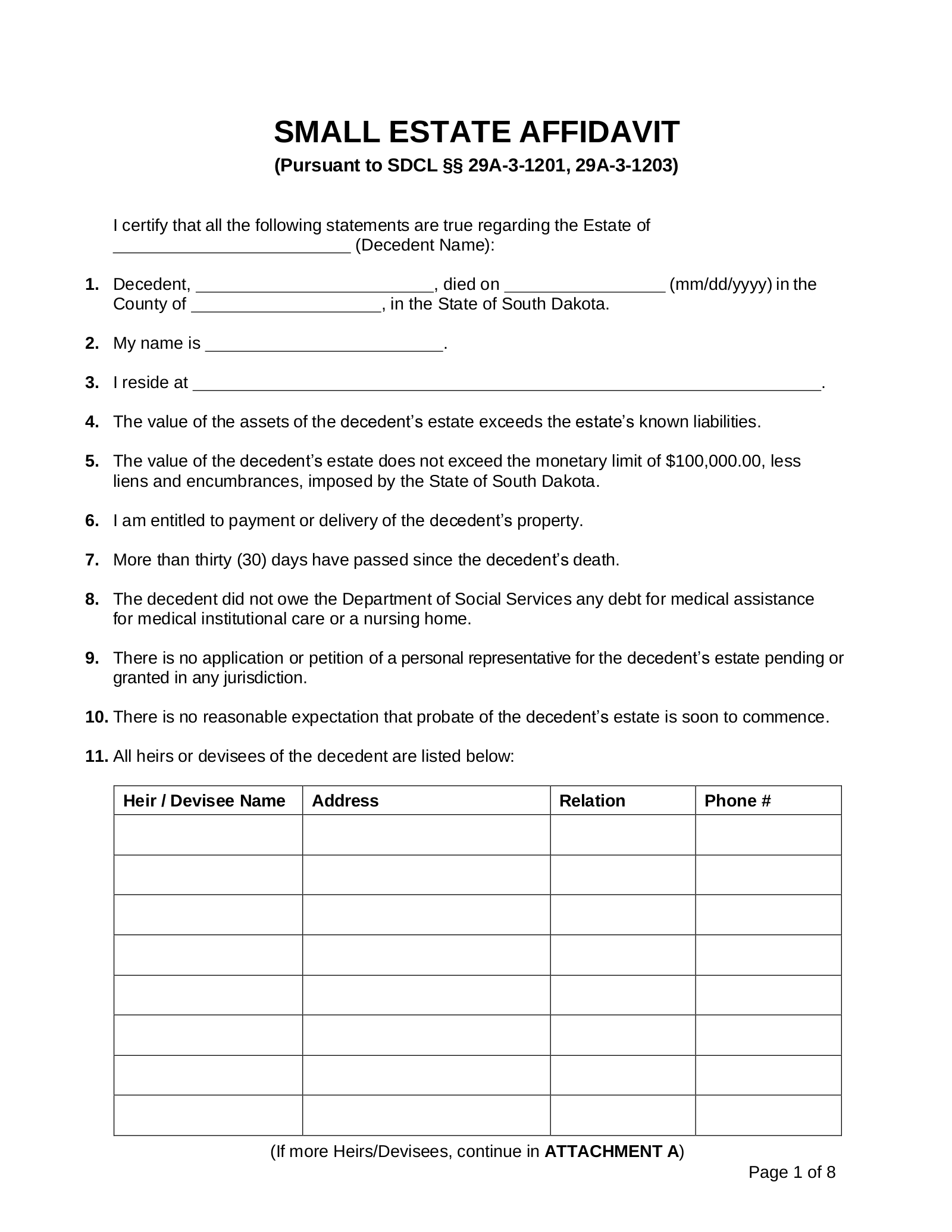

(3) Post Office Address. If the Petitioner for the South Dakota estate maintains a P.O. Box or a mailing address that differs from his or her home address, record his or her mailing address in the first article.

(4) Residential Address. The home address of the South Dakota Petitioner must be documented in the second article.

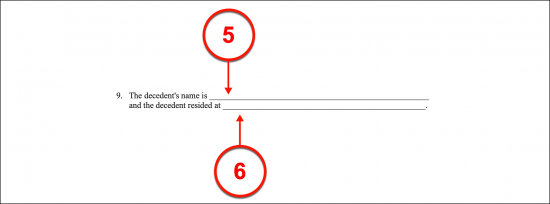

(5) Name Of South Dakota Decedent. A record of the South Dakota Deceased’s formal or legal name must be produced.

(6) Residence Of South Dakota Decedent. The residential address where the South Dakota Decedent lived should be reported with the identity of the Decedent in the ninth article.

(7) Signature Of Affiant. The Petitioner for the South Dakota Decedent’s estate, also referred to as the Affiant, must sign his or her name to this paperwork before a Notary Public.

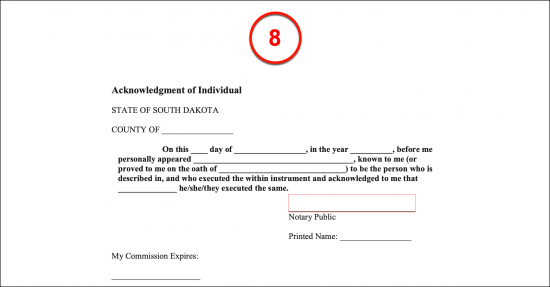

(8) Notary Public. The notarization of the South Dakota Affiant’s signature must be performed by a licensed Notary Public. This Party shall act to verify that he or she has personally seen the Affiant sign this document as part of the notarization process.