Updated September 13, 2023

A New York small estate affidavit is a legal document that facilitates the transfer of assets of a person who died. The document is known as an “Affidavit of Voluntary Administration,” and it allows the estate of the decedent (the person who died) to go through “voluntary administration,” which is generally a quicker and simpler alternative to the probate process for passing on assets. Voluntary administration is an option whether or not the decedent had a will. However, it is only available for estates with a total value less than an amount established by the state, and may not be used on estates containing real property solely owned by the decedent.

Laws

- Days After Death – No waiting period after the death of the decedent is required. (SCPA § 1304)

- Filing Fee – $1 per SCPA § 1304(4). (NYCourts.GOV)

- Maximum Amount ($) – $50,000. (SCPA § 1301)

- Signing – The form must be signed and subscribed before a notary public.

- Statutes – Settlement of Small Estates Without Court Administration (Court Acts of New York, Chapter 59A, Article 13)

How to File (3 steps)

1. Verify Eligibility

2. Gather Documents

3. File the Affidavit

A formal state-produced version of the form is available electronically through New Yorks’ DIY Forms application. However, any version of the form is acceptable in most counties as long as it contains the necessary information. It’s wise to contact a specific county court to determine whether or not they require the state’s version of the affidavit. Either way, the form needs to be printed out and filed in person at the surrogate’s court for the county where the decedent resided at the time of death. For help finding the court, use this the Court Locator.

Video

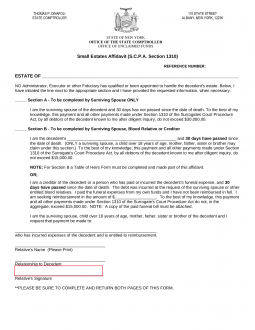

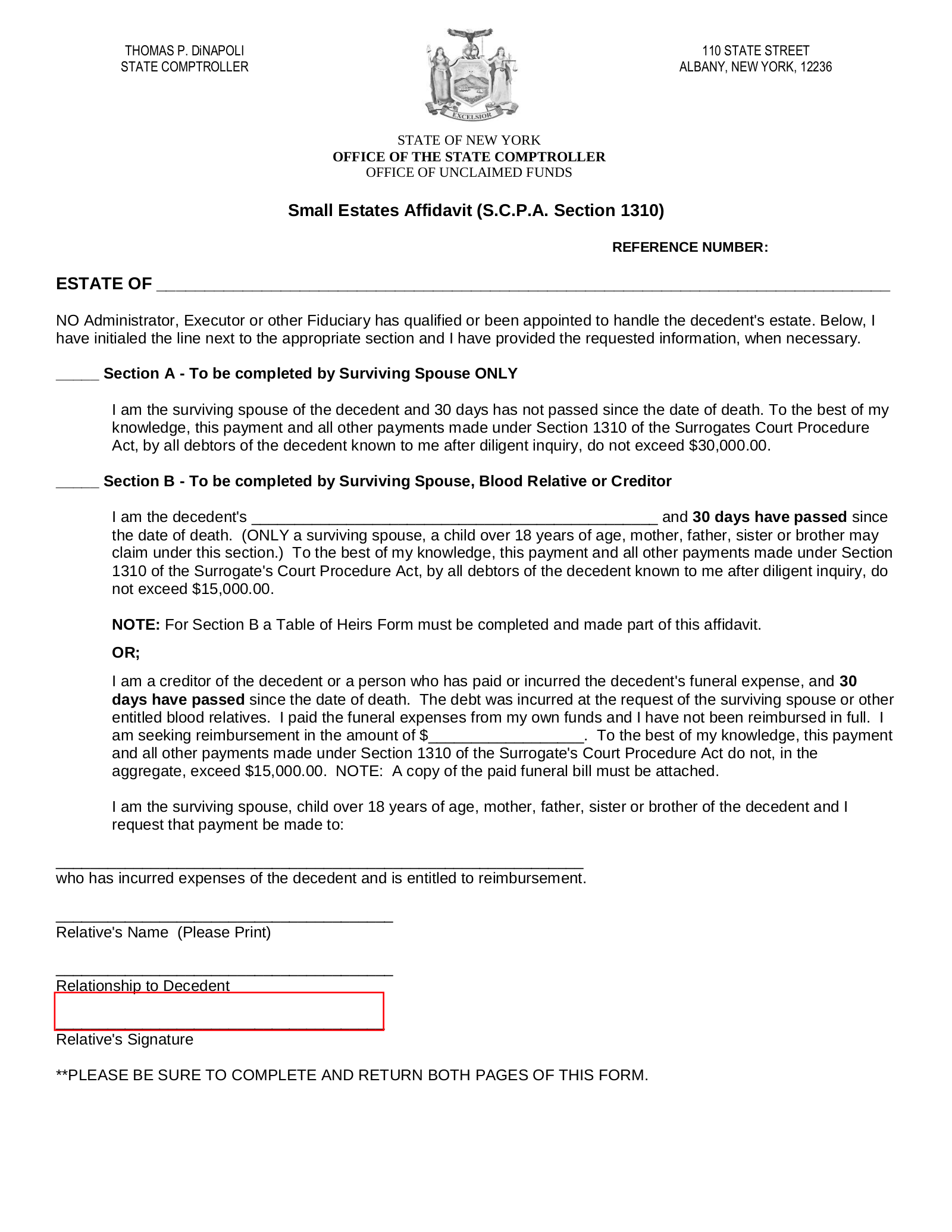

How to Write

Download: PDF

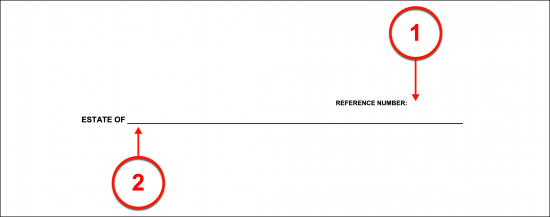

(1) Reference Number. Establish the matter being discussed by reporting the reference number that was assigned by New York State to identify this estate’s proceedings.

(2) New York Decedent. The full name of the Party who has passed away as a New York Resident must be identified at the onset of this document.

Section A – Surviving Spouse

(3) Surviving Spouse Statement. If the Affiant or Petitioner is the Spouse of the New York Decedent and seeks to receive or control a payment before thirty days have passed from the New York Decedent’s death then Section A must be completed. The statement presented will require the initials of the Surviving Spouse to place it in effect.

Section B – Surviving Spouse, Blood Relative Or Creditor

(4) Affiant Relative Status. If thirty days have passed between the date when the New York Decedent died and the date this document is notarized then Section B should be reviewed. The statement in this section can be made by the New York Decedent’s Spouse, Blood Relative, or Creditor.

(5) Affiant’s Relationship To New York Deceased. A definition to the relationship held between the New York Decedent and the Affiant is a required production in Section B.

Payment Request By Affiant

(6) Expected Payment. The dollar amount the Affiant expects to receive from the New York Decedent’s estate is needed for this petition.

(7) Target Of Payment Request. If payment from the New York Decedent’s estate is due to a Payer of his or her funeral expenses who requires reimbursement and this paperwork seeks to arrange such payment, then the full name of the Reimbursee must be documented.

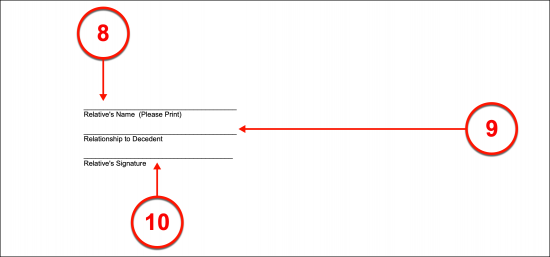

(8) Relative’s Name. The name of the Relative requesting this payment should be printed.

(9) Relationship To New York Decedent. The signature of the New York Decedent Relative seeking to arrange this payment is required by this area.

(10) Relative’s Signature. The Relative completing Section B or the Spouse completing Section A must sign this document to obtain the reimbursement for the Party who paid for the New York Decedent’s funeral expenses. It should be mentioned that regardless of whether the Affiant has filled out Section A or Section B, such a signature must be notarized. A specific area on the second page has been reserved for this notarization process. If the Affiant is a Creditor who is not a relative then both of the previous sections should be left unattended since Section C has been reserved for Creditors.

Section C – Creditor Statement Only

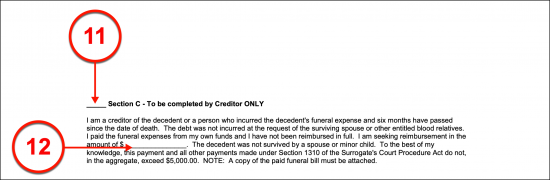

(11) Creditor Initials. If the Affiant is a Creditor of the New York Decedent who does not have a familial relationship with the Deceased and at least six-months have passed since the date of death, then Section C should be initialed by the Creditor seeking owed payment from the New York Decedent’s estate for funeral expenses that he or she covered for the Decedent. If the Creditor is a Business then a Representative of that Business may complete this area.

(12) Reimbursement Amount. Dispense the dollar amount that the Reimbursee wishes from the New York Decedent’s estate to cover the funeral expenses that were paid for.

(13) Owed Funeral Expense. Produce the dollar amount the Creditor wishes to receive for the funeral expenses that he or she paid for on behalf of the New York Decedent. Bear in mind, that a copy of the receipt must be attached.

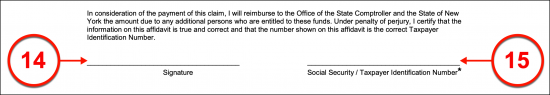

(14) Creditor Signature. The Creditor or the Crediting Entity’s Representative must sign his or her name before a New York Notary Public.

(15) Social Security Number/Taxpayer Identification Number. The Creditor’s social security number, or if a Business Entity, Taxpayer Identification Number must be submitted when he or she signs this document.

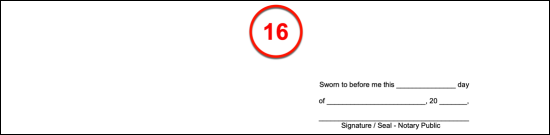

New York Notary Public Action

(16) Notarization. The New York Notary Public overseeing the Affiant signing will utilize the final area to show that the Affiant’s signature has been verified through the process of notarization.