Updated September 13, 2023

A New Jersey small estate affidavit is a form that can help heirs of a person who has died (a decedent) avoid a more lengthy process of settling the estate. This process is only available for cases in which the decedent died intestate, meaning without a will. Additionally, it’s only available for estates with a total value below a level set by the state, and only when most of that amount is going to settle the debts of the estate. There are different maximum amounts depending on whether the person claiming the property is the surviving spouse or another party

Laws

- Days After Death – No statute, although individual counties may have specific time limits.

- Maximum Amount ($) – For surviving spouses (or partner in a civil union), the total value of the estate may not exceed $50,000, with up to $10,000 after settling all debts. (N.J.S.A. 3B:10-3) For all other heirs, the total value of the estate may not exceed $20,000. (N.J.S.A. 3B:10-4)

- Signing Requirements – Must be notarized.

- Statutes – Chapter 3B:10 – Grant of Letters of Administration

How to File (3 steps)

3. Fill Out and File

Video

How to Write

Download: PDF

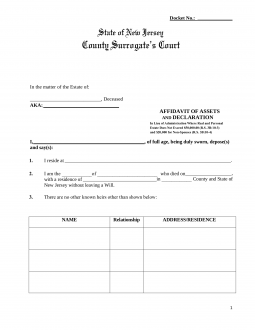

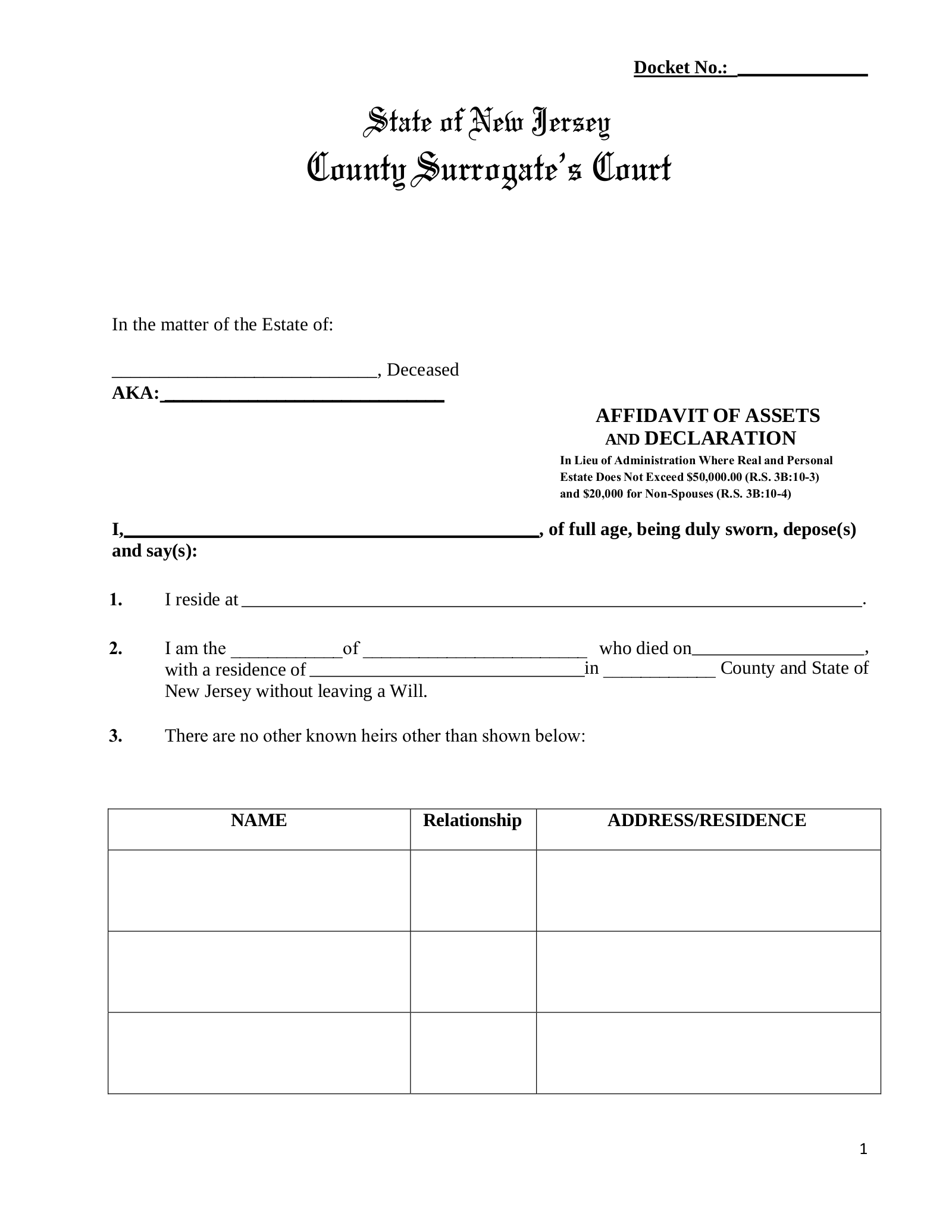

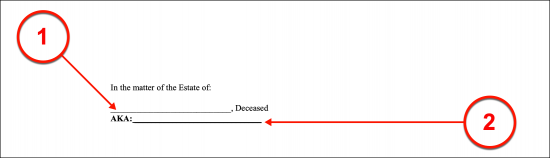

(1) New Jersey Decedent. Begin with a presentation of the New Jersey Decedent’s full name. This should be the formal name of the Deceased as it appears on the death certificate issued at the time of death.

(2) Decedent Identity. If the New Jersey Decedent was commonly known by another name (i.e. a nickname) then document this name as well.

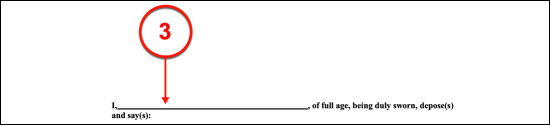

(3) New Jersey Affiant. The Successor to the New Jersey Decedent’s estate who is completing this document must be named. Therefore, identify yourself as the Affiant filing this petition for the New Jersey Decedent’s property.

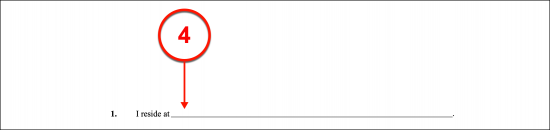

(4) Address Of New Jersey Affiant. Furnish the street address of your residence to solidify your identity as this form’s Affiant and the Successor to the New Jersey Decedent’s estate.

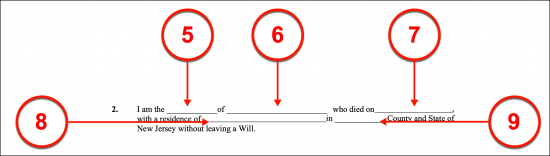

(5) Relationship To New Jersey Decedent. Define your relationship with the New Jersey Decedent to the statement made by the second article.

(6) New Jersey Decedent Name. Identify the New Jersey Decedent in the declaration being made in Article II.

(7) Date Of Death Of New Jersey Decedent. The calendar date when the New Jersey Decedent dies will be noted on his or her death certificate. Record this information to the area provided.

(8) Residence Of New Jersey Decedent. The street address of the residence where the New Jersey Decedent lived should be recorded.

(9) New Jersey Decedent County Of Residence. Document the name of the New Jersey County where the Decedent lived.

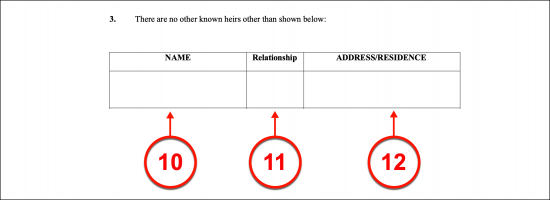

(10) Name Of Heir To New Jersey Decedent. A table presented in this document enables a clear report on the identity of every Heir to the New Jersey Decedent’s property. Make sure you have accounted for every close relative or relationship the New Jersey Decedent has by presenting each one’s name in the first column of this table.

(11) Relationship Between Heir And New Jersey Decedent. Working across every row with an Heir, document the relationship held by the Heir and the New Jersey Decedent.

(12) Residential Address Of Heir. Complete the identification process for every Heir to the New Jersey Decedent’s estate by presenting his or her residential address.

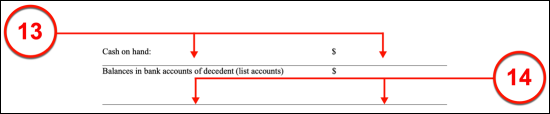

(13) New Jersey Decedent Cash On Hand. The New Jersey’s estate must be accounted for in this petition. The table in Article V presents two columns for the task at hand. The first column will require an asset to be identified while the second column requests its value. Begin with a listing of the cash the New Jersey Decedent possessed at the time of his or her death in the first row.

(14) Savings Accounts, Checking Accounts, And Other Sources Of Cash. List all the New Jersey Decedent’s savings accounts, checking accounts, and other sources of cash in the first column then displaying the amount held by each such account on the right then continue to the second row where a record of all the cash on hand the New Jersey Decedent possessed at the time of death should be presented.

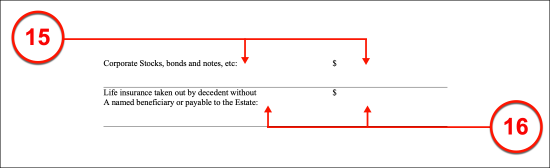

(15) Corporate Stocks, Bonds, And Notes, Etc. If the New Jersey Decedent has made investments on the market (i.e. stocks, bonds, etc.) then each investment should be listed in the second item while the value of each investment should be documented on the right.

(16) Life Insurance Taken Out By Decedent Without Beneficiary. If the New Jersey Decedent has taken out a life insurance policy with no specific Party named as his or her Beneficiary, then deliver the name of such a policy as the third item along with its value.

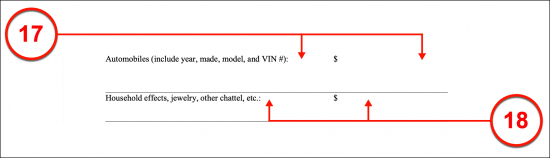

(17) New Jersey Decedent Automobiles. Every automobile owned by the New Jersey Decedent should be documented with a record of its make, model, year of manufacture, color, and vehicle identification number. In addition to this information, the value of each automobile must be documented.

(18) Household Effects Of The New Jersey Decedents. Document all the physical valuables owned by the New Jersey Decedent. Each such possession should be furnished to the left column while its value recorded on the right.

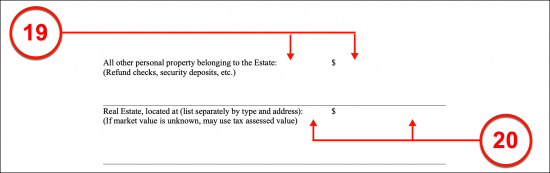

(19) All Other Personal Property Of The New Jersey Decedent. Define all remaining property owned by the New Jersey Decedent at the time of his or her death as well as its value. Exclude any real property (real estate such as a farm or a house) from this item.

(20) Real Estate Of New Jersey Decedent. If the New Jersey Decedent owned real property, then produce its deed type and address along with its market value as the final item to this table.

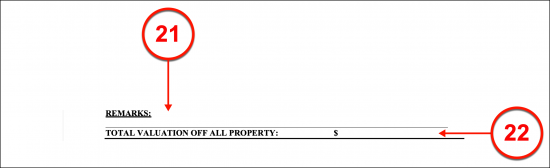

(21) Additional Remarks. As the Affiant and the Successor to the New Jersey Decedent’s property, any additional remarks that may prove relevant may be included. Since this form will be used for an Intestate Decedent (i.e. a New Jersey Decedent who did not issue a will), then any additional information that supports the Affiant’s claim should be provided. For instance, if a release of the concerned property has been given by an Heir, this should be noted and the release attached.

(22) Valuation Of All Property. Supply the total worth of the New Jersey Decedent’s tangible and intangible property.

(23) Signature Of New Jersey Affiant. The New Jersey Affiant must sign this petition while a licensed Notary Public observes and verifies its production. Once the Affiant has signed his or her name, this document should be surrendered to the Notary Public.

(24) New Jersey Notarization. Jersey Notary Public. The New Jersey Notary Public will subject the signature process to notarization and display proof of this to the final section of this paperwork.