Updated September 13, 2023

A Louisiana small estate affidavit—also known as the “affidavit of small succession”—is a legal document that can be used by the surviving spouse and the adult heirs of a deceased person to transfer assets and properties that are valued at less than $125,000. It allows the successors to bypass the probate process, expediting the collection and distribution of assets. A small succession is one where the decedent leaves property in Louisiana that has a gross value of $125,000 or less or, if the death occurred at least twenty (20) years prior, leaving the property in Louisiana of any value. In addition, a small succession also includes a testate succession that leaves no immovable property in which the probate of the testament would have the same effect as if the deceased had died intestate.

Laws

- Days After Death – You must wait at least ninety (90) days to file the affidavit if the succession includes immovable property, such as real estate. (LSA-C.C.P. Art. 3434)

- Maximum Amount – $125,000. (LSA-C.C.P. Art. 3421.) A decedent’s property with a gross value of $125,000 or less at the time of death qualifies as a “small succession.” If the person has been deceased for at least 20 years, there is no value limitation.

- Publishing – Notice of a public sale of a succession property must be published once in the parish where it is located. The property should be sold between 10 and 15 days after publication. (LSA-C.C.P. Art. 3443)

- Signing – The affidavit must be signed by at least two people, including the surviving spouse (if any) and one or more competent major heirs of the deceased. Signatures must be sworn and subscribed in the presence of a notary public. (LSA-C.C.P. Art. 3432)

- Statutes – Title 5 – Small Successions (§§ 3421 — 3443)

How to File (4 steps)

- Wait 90 Days If Succession Includes Immovable Property

- Gather Information

- Fill Out and Sign the Affidavit

- File the Affidavit at a District Court

1. Wait 90 Days If Succession Includes Immovable Property

2. Gather Information

- The date of the person’s death and the location of his or her residence at the time of death

- Marital status and residence of surviving spouse

- Names and last known addresses of all surviving heirs

- A list of the deceased’s assets and properties, including descriptions and their estimated values

As you wait out the 90 days (only if succession involves immovable property), it would be a good idea to collect all the information you will need to include when filling out the affidavit.

3. Fill Out and Sign the Affidavit

In addition, the affidavit must be acknowledged by a notary public.

4. File the Affidavit at a District Court

Video

How To Write

Download: PDF

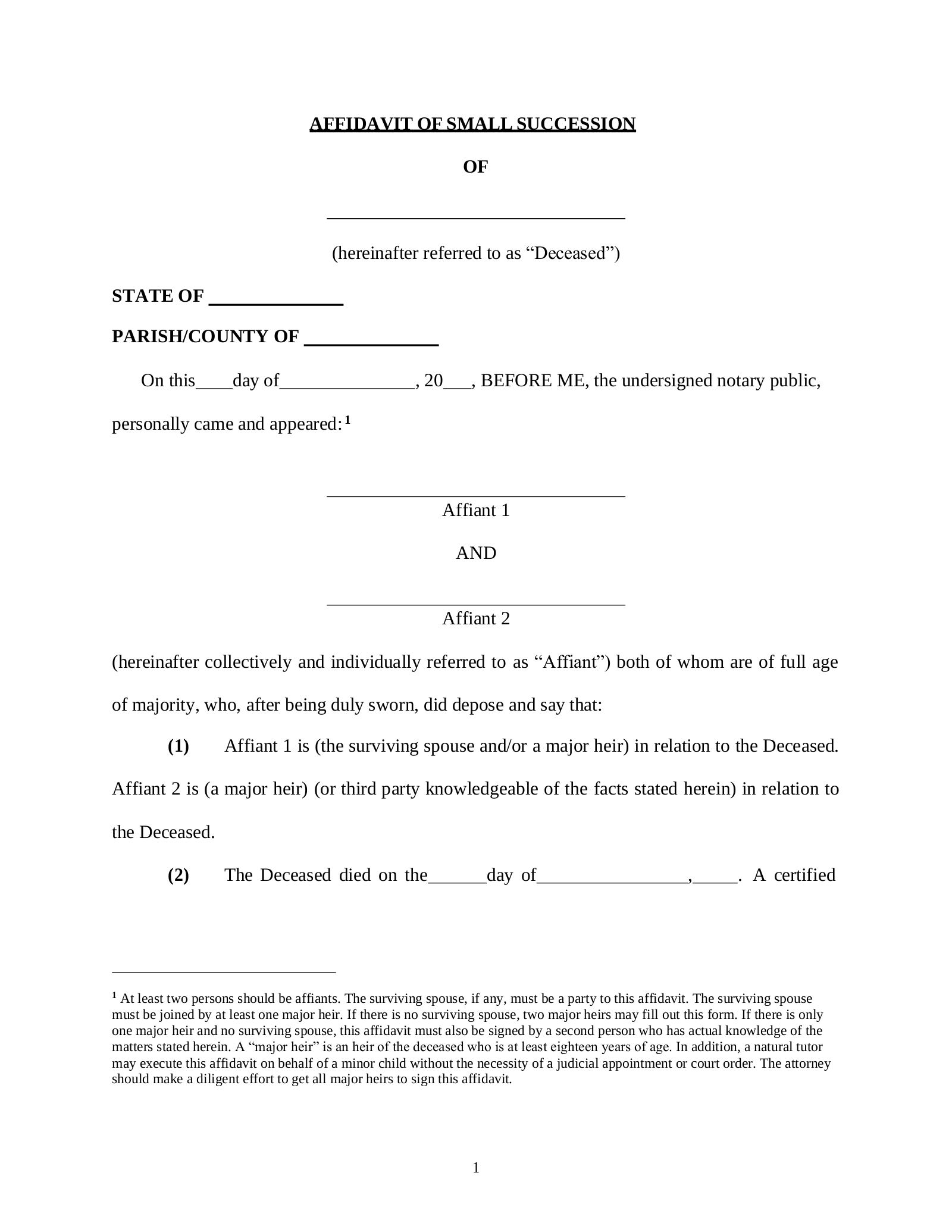

(1) Title. Furnish the full name of the Louisiana Deceased to complete the title of this document.

(2) Notary Action. The Notary Public that shall watch the Louisiana Petitioner sign this document will work with two Witnesses when verifying the identity of each Signature Petitioner or Affiant. This area introduces the document and should not be completed by the Affiant or Petitioner.

Article II

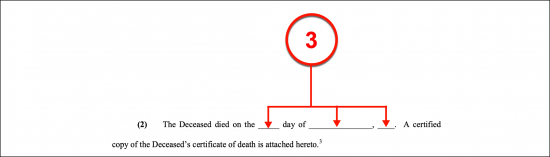

(3) Date of Louisiana Decedent’s Death. The day when the Louisiana Deceased died should be found on his or her death certificate. Review this certificate, then deliver the date of the Louisiana Decedent’s death to the space available.

Article III

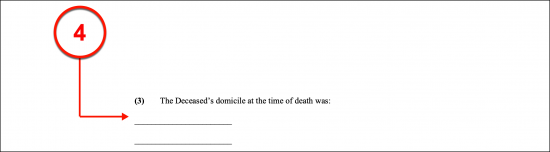

(4) Louisiana Decedents Residence. The physical address where the Louisiana Deceased lived and maintained a home must be distributed to Article III.

Article V

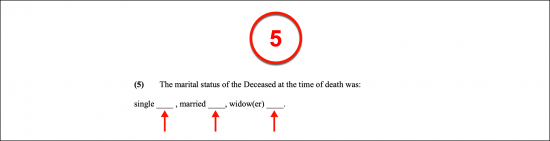

(5) Louisiana Decedent Marital Status. Place an “X” or checkmark next to the word “Single,” “Married,” or “Widow(er)” to indicate whether the Louisiana Decedent was unmarried, died while married, or was a Widow(er) at the time of his or her death.

Article VI

(6) Surviving Spouse Residential Address. Document the name of each Spouse the Louisiana Decedent was married to. This should include Spouses that have either divorced the Louisiana Decedent or perished while married to him or her.

Article VII

(7) Heirs To The Louisiana Deceased. The Louisiana Deceased may have had Heirs at the time of his or her death. If so, then each one must be presented in this petition. This requires a report on the name of every Louisiana Decedent Heir, his or her relationship with the Deceased, as well as his or her address.

Article IX

(8) Louisiana Decedent Property. Every piece of property (tangible or intangible) owned by the Louisiana Decedent at the time of his death must be documented with its monetary worth. Provide as much detail as possible including any relevant description for the purpose of the property (i.e. if it is a resource or purely recreational).

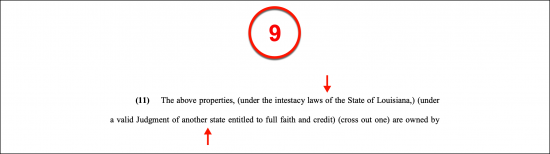

Article XI

(9) Jurisdiction Of Judgement. Indicate if the Louisiana Decedent’s property is strictly under the jurisdiction of Louisiana or another state. If the concerned estate is subject to probate judgment of another State, then cross out the first set of parenthesis. Otherwise, cross to the second set of parentheses to indicate this is a petition under the intestacy laws set by the State of Louisiana.

(10) Current Owners Of Louisiana Decedent Property. Dispense the full name of each Party that owns the Louisiana Decedent’s property regardless of where that property is located.

Article XII

(11) Indicate If Estate Was Administered. If the Louisiana Decedent’s estate has been administered then dispense the name of the Administering or Probate Court even if it is outside of Louisiana. Note, the State of Louisiana must acknowledge and view any out-of-state court as competent and acceptable before any out-of-state judgments are accepted.

Article XV

(12) Parish Of Signing. Document the name of the parish in Louisiana where this document is signed.

(13) Signature Date. The calendar date of the Louisiana Affiant’s signature must be submitted before he or she signs this document.

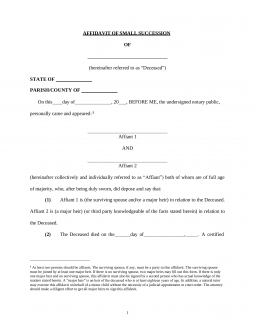

(14) Louisiana Affiant Signature. On the final page, the Louisiana Affiant must sign his or her name to this paperwork before an acceptable Notary Public.

(15) Notary Completion. The Notary Public will seek out and complete all areas of this paperwork that demonstrate that the notarization of the Louisiana Affiant’s signature has been completed.