Updated August 09, 2023

An Illinois small estate affidavit provides a streamlined way for an heir to gather and distribute the assets of a person who died, provided that the estate does not exceed $100,000. This form allows an heir to collect the personal property of the decedent without going to court. It can only be used for personal property, and cannot be used for real estate.

Laws

- Days after Death – As there is no state law requiring a minimum number of days to pass after the death before the affidavit can be used, you can begin filling it out and presenting it at any time.

- Maximum – A small estate is defined as an estate with a gross value not exceeding $100,000. This includes the value of all property passing to any party either by intestacy or under a will. (755 ILCS 5/25-1)

- Signing – The affidavit must be signed and sworn before a notary public. (755 ILCS 5/25-1)

- Statute – 755 ILCS 5 (Probate Act of 1975)

How to File (4 steps)

- Step 1 – Collect Information

- Step 2 – Prepare Affidavit

- Step 3 – Swear in Front of a Notary

- Step 4 – Collect the Assets

Step 1 – Collect Information

Make a list of the decedent’s unpaid debts, including bills, and assets.

Step 2 – Prepare Affidavit

You can find this online or in-person at your local county clerk’s office. (Use this locator to find your local county clerk’s office.) Include information about assets and vehicles as well as debt information, such as funeral expenses, tax debts, money owed to employees, money, and property held in trust, debts to the state, and all other claims. Make at least one extra copy.

Step 3 – Swear in Front of a Notary

Swear, sign, and date the affidavit in front of a notary public. The affidavit does not need to be filed with a court.

Step 4 – Collect the Assets

You can show the affidavit to a person, company, or bank that can access the property of the estate. If you encounter any issues, you can file a claim in court.

Video

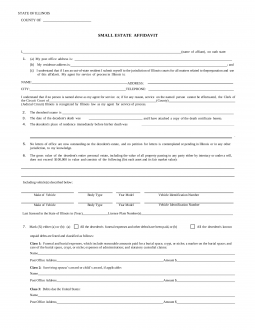

How to Write

Download: PDF

(1) Illinois County. The Illinois County of effect, typically where the Decedent maintained his or her residence at the time of death, should be established at the top of this page.

(2) Name Of Affiant. The name of the Illinois Affiant is mandatory for this paperwork. This Party will be the Individual who signs this document as a testimony to its accuracy and his or her intent. There may be more than one Signature Affiants and, if so, each should be named in this initial statement.

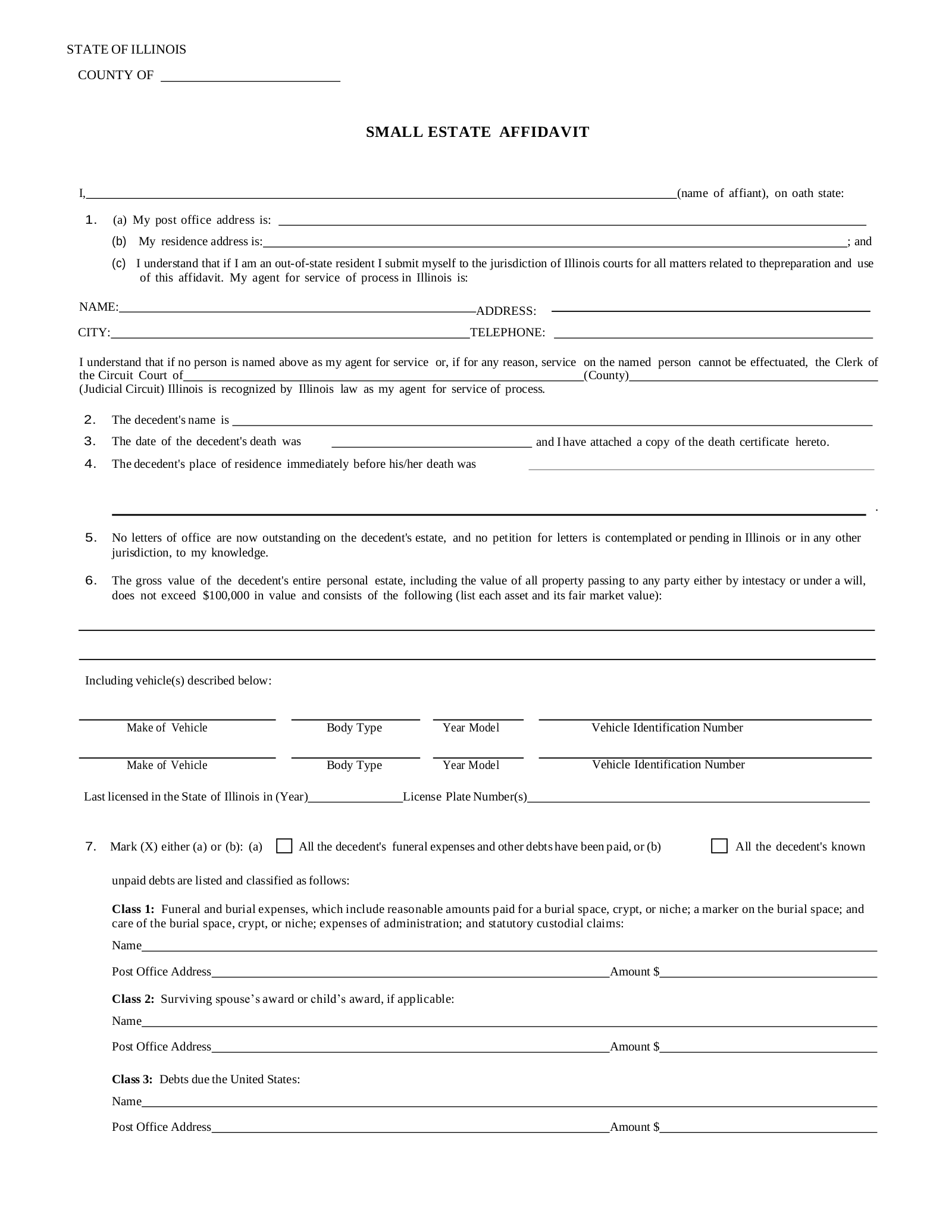

Article 1

(3) Post Office Address. If the Illinois Affiant has a PO Box or mailing address other than his or her residence, then it should be presented in this paperwork.

(4) Residential Address. Document the residential address of the Illinois Affiant.

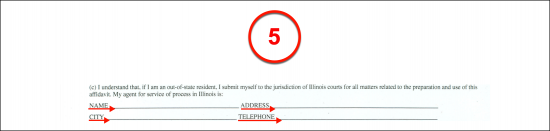

(5) Illinois Agent For Service. If the Affiant is not a Resident of Illinois then he or she can elect a specific Agent to service this document when needed. The full name, street address, city, and telephone number of such an Illinois Agent of Service should be produced where requested.

(6) County Clerk As Agent For Service. If Affiant is not a Resident of the State of Illinois and has not obtained an Illinois Agent, then a Clerk of the Illinois County Circuit Court where this paperwork is in effect may act as an Agent of Service. Produce the County and Judicial Circuit that will furnish its Clerk for this service.

Article 2

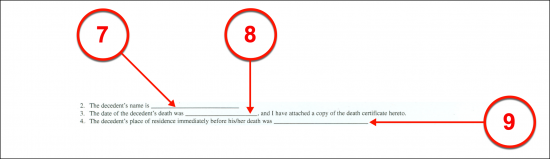

(7) Illinois Decedent Name. The name of the Illinois Decedent or the Illinois Deceased should be documented as it appears on his or her formal death certificate.

Article 3

(8) Date Of Death. Review the death certificate issued for the Deceased then document the official date of the Illinois Decedent’s death.

Article 4

(9) Illinois Decedent Residential Address.The final address where the Illinois Decedent maintained his or her residence should be presented in this document as well. Produce the building number, street name, city, and county of the Illinois Deceased’s home address.

Article 6

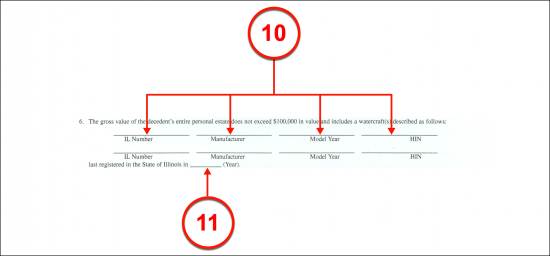

(10) Decedent Water Craft (if applicable). If the Illinois Decedent owned a watercraft then it must be accounted for when discussing his or her estate. Therefore, if he or she died as a watercraft owner, record the Illinois Number, Manufacturer, Model Year, and Hull Identification Number of the concerned watercraft.

(11) Watercraft Registration. Record the last year the Illinois Decedent’s watercraft was registered.

Article 7

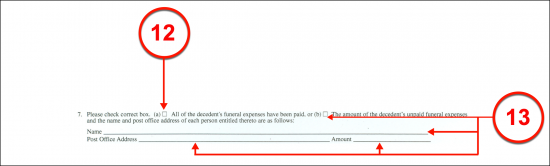

(12) Status Of Illinois Decedent Funeral Expenses. If the Illinois Decedent’s estate owes no funeral expense payments then select the first checkbox presented in the seventh article.

(13) Reimbursement For Funeral Expenses. If the Illinois Decedent’s estate is obligated to reimburse any Parties for the expenses of the Deceased’s funeral, then select statement “B.” Additionally, identify the Reimbursee along with his or her address and the amount that he or she expects to collect for the funeral.

Article 9

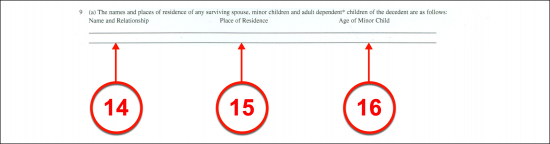

(14) Illinois Decedent Survivors Name And Relationship. If the Illinois Decedent had a Spouse or Children (Minors or Dependent Adults) then Illinois State Law will require a certain amount of money be reserved for these Survivors. If so, then the name of each such Survivor as well as the relationship he or she held with the Illinois Decedent should be documented in the first column of Article 9.

(15) Illinois Decdent Residential Address And Age. Document the residential address of each Survivor.

(16) Illinois Survivor Minor’s Age. If the Decedent has any dependent Minors then record the age of each of the Illinois Decedent’s Children to the remaining columns of the table in Article 9

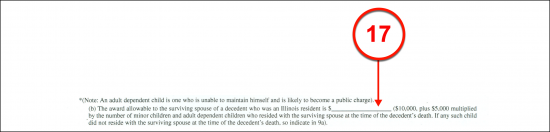

(17) Allowable Reward To Surviving Spouse. If the Illinois Decedent has a Surviving Spouse and Minors that were dependent on him or her, then the estate property must be divided between these legal Heirs. Illinois will require that the remaining property be divided as fifty percent to the Spouse and the other fifty percent to be divided (equally) between the Surviving Minors or Dependent Children of the Illinois Decedent. Record the amount that should be dispensed from the estate to the Spouse where this figure is requested.

(18) Allowable Reward To Surviving Dependent Children Or Minors. Once the estate of the Illinois Decedent has paid its debts, Illinois will require that the remaining funds be divided amongst the Decedent’s Survivors. If the Decedent did not have a Spouse then the remaining estate must be divided equally amongst the Decedents Surviving Children equally. Produce the total amount from the Decedent estate that shall be dispensed to the Deceased’s surviving Children. Bear in mind that this will include any Children that were adopted by the Illinois Decedent or born within 36 months of the Decedent’s death.

Article 10

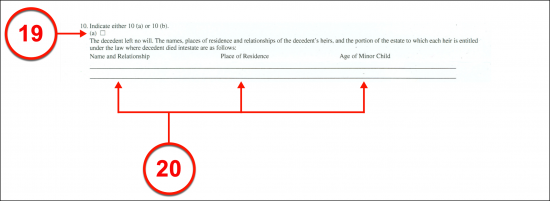

(19) Intestate Illinois Decedent. If the Illinois Decedent has not issued a will by the time of his or her death then, select checkbox “A” from article 10. This statement will need some additional clarification in the area it presents.

(20) Legal Heirs If Intestate. The table in checkbox “A” requires the name of every legal Heir to the Decedent with the relationship between them recorded in the first column, the residential address of each Heir provided in the second column, and if the Heir is a Minor, his or her age documented in the final column.

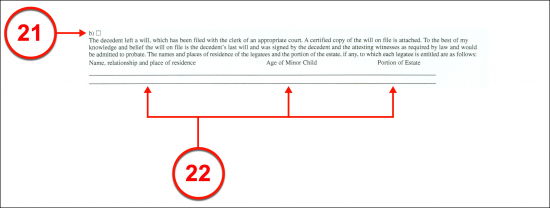

(21) Illinois Decedent Will. Select checkbox “B” if the Illinois Decedent had a will in place by the time he or she passed away. Be advised, it will be necessary to consult the will to complete this selection.

(22) Heirs Named In Illinois Decedent Will. A brief table in Statement B will require that the name of each Heir, along with his or her relationship to the Decedent and his or her residential address is produced in the first column, the age of the Heir (if a Minor) recorded in the second column, and the percentage or portion of the Decedent’s estate willed to him or her furnished to the third column.

Article 12

(23) Heir To Watercraft. As mentioned earlier, if the Illinois Decedent was the Owner of one or more watercraft, then such vehicles must be discussed. Declare the full name and residential address of the Party who should receive ownership of the watercraft(s) identified in the sixth article.

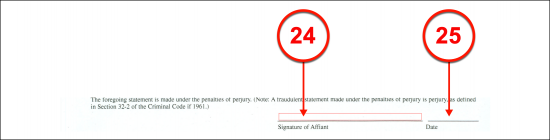

Illinois Affiant Testimony

(24) Signature Of Affiant. The Illinois Affiant should sign this document (ideally) before a notary public and two witnesses.

(25) Date. The calendar date defining when the Affiant signed his or her name should be supplied.