Updated September 12, 2023

A Georgia small estate affidavit is a means to distribute the assets of certain kinds of estates more quickly than traditionally occurs. It is also known as a “petition for order declaring no administration necessary” and it may only be used in a narrow set of circumstances: when the decedent died without a will (or had a will, but it was deemed invalid), and all of the decedent’s heirs have agreed to the distribution. If the estate is eligible, this process is likely much faster than going through probate.

Laws

- Days After Death – No Statute.

- Maximum Amount ($) – No statute. However, for cases in which heirs are only seeking to obtain to access funds totaling less than $15,000 kept in a bank account of the decedent, use the Banking Affidavit of Surviving Relative, Intestate Estate Form.

- Publishing – If the estate at issue contains real property, then the court must file a certified copy of the order granting the petition with the recorder of deeds in every county where the decedent owned property. (Ga. Code Ann., § 53-2-40(d))

- Signing – Every heir must sign the petition, and the petition must be notarized. (Ga. Code Ann., § 7-1-239(e)(4))

- Statutes – Ga. Code Ann., §§ 7-1-239, 53-2-40

How to File (4 steps)

1. Complete the Petition

2. Address Outstanding Debts

3. File the Petition

4. Pay Additional Costs if Necessary

Video

How to Write

Download: PDF

Title

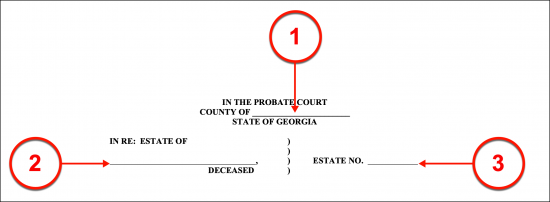

(1) County. Document the Georgia County where this petition will be filed.

(2) Georgia Deceased. The name of the Deceased Party is a mandatory entry for this form.

(3) Estate No. Dispense the Georgia Deceased’s estate number (commonly assigned by the Internal Revenue Service).

Statement 1

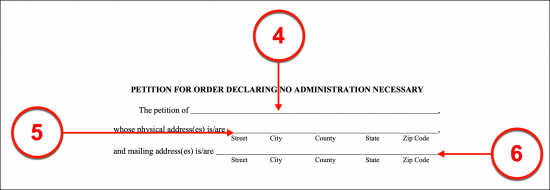

(4) Petitioner Identity. The name of the Person petitioning for the Georgia Deceased’s property should be clearly identified. His or her full name will be required in the first statement.

(5) Petitioner Physical Address. The physical address where the Georgia Petitioner resides is needed in this statement. This must consist of the building number, street, city, state, and zip code and may not be a P.O. Box number

(6) Petitioner Mailing Address. If the Georgia Petitioner has a separate mailing address then provide this as well. This may be a P.O. Box number address.

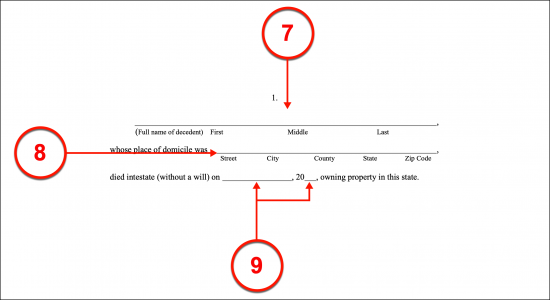

(7) Georgia Decedent. Confirm the Georgia Decedent’s name by presenting it where requested in this statement.

(8) Place Of Domicile. The physical address of the Georgia Deceased’s residence or home must be supplied.

(9) Date Of Intestate Death. This petition may only be made if the Georgia Deceased did not finalize a will by the calendar date of his or her death. Therefore, a record of his or her exact calendar date of death must be furnished.

Statement 3

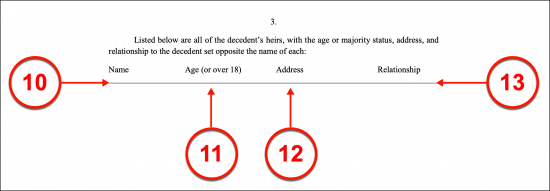

(10) Name Of Heir. It is imperative that every Heir or rightful Successor to the Georgia Deceased’s estate is accounted for and agrees with this petition. Use the table, placed in the third statement, to name each Heir.

(11) Age Of Heir. If the Georgia Decedent’s Heir is not an adult, then record his or her age.

(12) Address Of Heir. Continue to the right of each Heir’s name and age to supply his or her full address.

(13) Relationship Held By Heir. Finally, establish the relationship the Heir held with the Georgia Deceased.

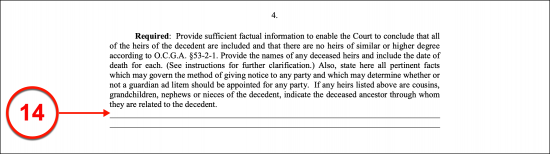

(14) Remaining Heirs Or Special Circumstances. The full name of every Heir who has passed away or Party that is connected to the Georgia Decedent’s rightful Heir and has passed away (i.e. a late Uncle to the Cousin of the Georgia Decedent) must also be documented. This will show the Georgia Probate Court that all Heirs have been accounted for. If any Heir can only be contacted by a Representative or uses a Representative (i.e. Conservator, Attorney-in-Fact, Guardian To Minor, etc) then this information should be placed in Statement 4 as well.

(15) Georgia Decedent Property. All of the Georgia Deceased’s assets that are not real property (i.e. real estate such as a house, farm, or land) must be listed.

(16) Real Property Of Georgia Decedent. If the Georgia Decedent died with real property, then produce the legal description (consult with the County Recorder or Clerk’s Office or the Deed) and the physical address of the property.

(17) No Debts On Estate. The financial health of the Georgia Deceased’s estate must be evaluated then defined. If he or she died with no debts, meaning the Georgia Decedent did not owe any Private or Business Creditors any payments, then the Petitioner must initial item (A).

(18) Outstanding Security Deed. If the Georgia Deceased has a security deed on any of his or her property that remains unpaid and is the only debt held against his or her estate then Status (B) must be initialed by the Petitioner and the full name and address of the Creditor owed payment by the Georgia Decedent’s estate must be recorded.

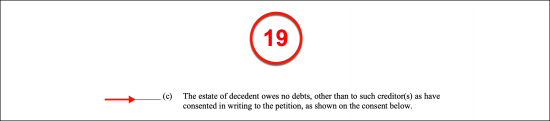

(19) Debt To Approving Creditors. The Petitioner should initial Status (C) if the Georgia Decedent died in debt but a letter of consent to approve the Petitioner’s actions in this paperwork has been obtained to be attached by the time this document is signed.

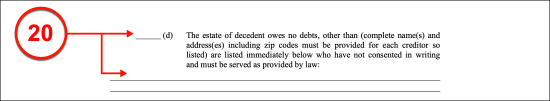

(20) Georgia Deceased Estate Debts. Definition (D) must be initialed by the Petitioner if the Georgia Decedent died with debts and consent has not been obtained in writing from his or her Creditors. If so, then list every Creditor who has not provided written consent or approval of the Petitioner’s actions. Keep in mind that if some Creditors have provided written consent while others have not, then both Status (C) and (D) should be selected.

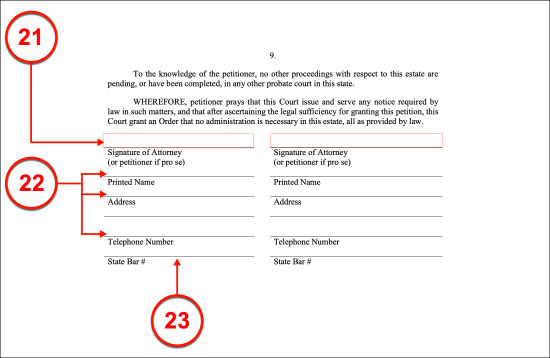

(21) Signature Of Attorney Or Petitioner. The Petitioner must sign this document to make it effective. If the Petitioner has obtained an Attorney for this matter then the Attorney may sign on behalf of the Petitioner. It is important to note that the Signature Party to this paperwork must have his or her signature verified through the actions of a Notary Public.

(22) Signature Party Name, Address, And Phone Number. The Signature Party must also print his or her complete name, address, and phone number.

(23) State Bar #. If an Attorney has completed this document’s signature area then he or she must document the bar number that allows him or her to practice law in the State of Georgia.

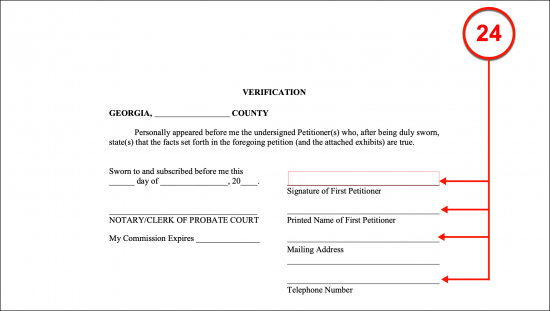

(24) Notary Public Action. The Georgia Notary Public watching the Petitioner sign his or her name will be able to prove that he or she validated the Signature Party’s identity. Once the facts surrounding the signing are documented, he or she will complete the notarization process and request that each Signature Petitioner or Attorney, participate in this procedure by signature. The Signature Parties must follow the direction of the Notary Public to complete this section. Two such areas have been provided since each Signature Party’s execution must be notarized.

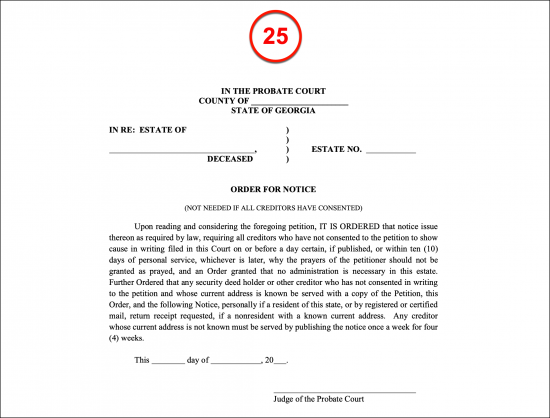

(25) Order For Notice. A Georgia Probate Judge will be issued if unanimous consent has not been issued by all the Decedent’s Creditors. This will be a fair request of notice issued to inform Creditors that a limited amount of time exists to produce any arguments that may be had.

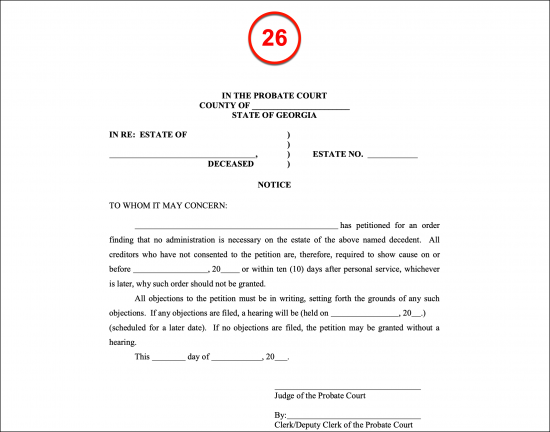

(26) Notice To Creditors. If needed, the Courts will issue a notice to the Georgia Decedent’s Creditors.

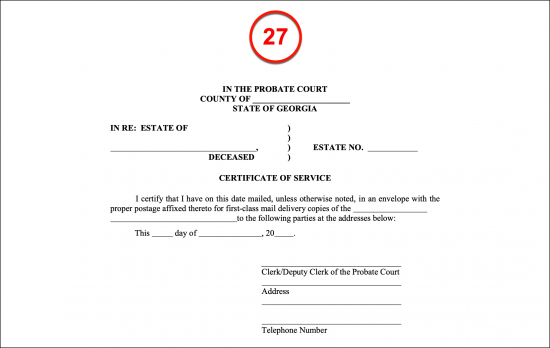

(27) Certificate Of Service. In addition to the above request for notice issued should written consent to the Affiant’s actions not be obtained from all the Decedents, a notice also issued by a Georgia County Judge should be made informing any possible Non-Consenting Creditors of the timeline where an argument can be made as well as to which Probate Court. If no response to the Judge’s statement is received from any Non-Consenting Creditor within the time frame noted, then the Petitioner’s requests may avoid Probate Court.

Agreement And Acknowledgement Of Service And Consent

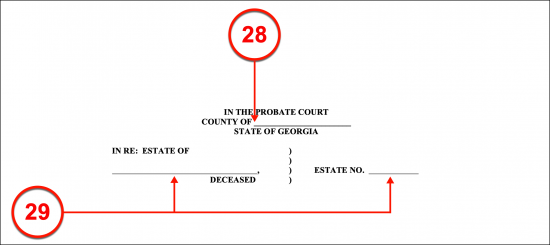

(28) Georgia County Court.

(29) Estate Information. The full name of the Georgia Decedent as well as the Estate Number assigned to his or her combined assets will be needed for the opening of this form.

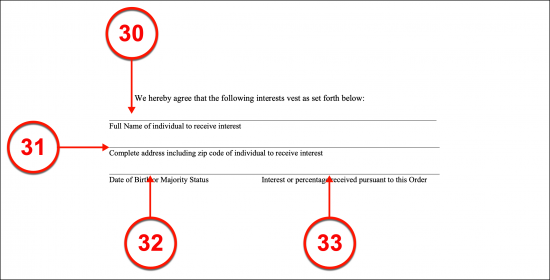

(30) Full Name Of Individual To Receive Interest. The Georgia Affiant or Petitioner (Regardless of whether this is an Heir or other interested Party such as a Creditor) who seeks to succeed the Deceased’s estate ownership or control should be documented.

(31) Complete Address Including Zip Code Of Individual To Receive Interest.

(32) Date Of Birth Or Majority Status. The Affiant’s birth date must be furnished to this document if only one Petitioner is involved.

(33) Interest Or Percentage Received Pursuant To This Order. The exact percentage of the monetary worth sought from the Georgia Decedent’s estate by the Affiant (whether Heir or Creditor) must be established. If the interested Party has no wish to pursue a collectible property or debt from the Decedent’s estate, then “Zero” may be entered. All areas defining the Interested Parties must be completed and every interested Party must be named.

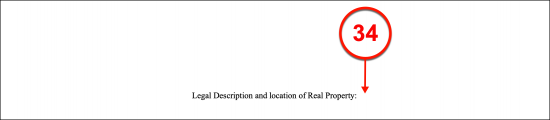

(34) Legal Description And Location Of Real Property. Identify every piece of land the Georgia Deceased owned at the time of his or her death. If a legal description of the property is not readily available it may be obtained from the County Recorder or Clerk’s office where the real property is located. The address needed to visit the Georgia Deceased’s real property must also be solidified.

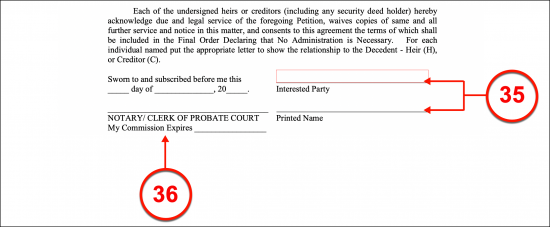

(35) Interested Party Signature Area. The Interested Party, or the Petitioner, must be ready to sign this paperwork before a Notary Public whose license is recognized by the State of Georgia. This signing will require the Petitioner’s signed name, printed name, address, and phone number. Once these items are submitted (while a Notary observes) the Notary Public will take control of this document. If the Interested Party is a Business Entity (i.e. Creditor) then a Representative may be elected by the Entity to complete the signature area on its behalf.

(36) Notary Process. The notary process will be completed when the Notary Public completes the area devoted to verifying the Petitioner’s act of signing.

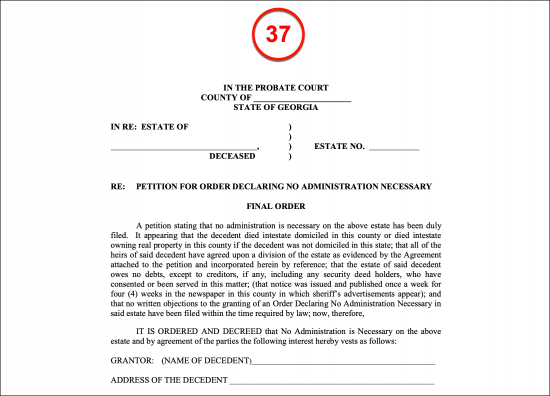

Re Petition For Order Declaring NO Administration Necessary

(37) Final Order. The Courts will make the final order and either verify the petition made, finalize the granting from the Deceased’s estate, and formally free this matter from a formal probation process.