Updated August 23, 2023

An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. Typically, payment is structured on a weekly or monthly basis with installments made by specific dates and without pre-payment penalties.

Secured Promissory Note – Requires the Borrower to place assets or property in the Note which is only given to the Lender in the event of non-payment.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is an Unsecured Promissory Note?

An unsecured promissory note acknowledges the liability of a debt that must be repaid without collateral. In an unsecured note, there is no collateral put forward in the event the borrower defaults on the loan.

An unsecured note relies heavily on the individual’s intent to pay as there is no security provided in case the borrower does not repay the loaned amount.

What Does It Include?

- Borrower’s name

- Lender’s name

- Loan terms

- Borrowed amount ($)

- Interest rate (%)

- Repayment period

- Late Fees (if any)

- Co-signer (if any)

- Prepayment penalty (if any)

How to Make an Unsecured Note (3 steps)

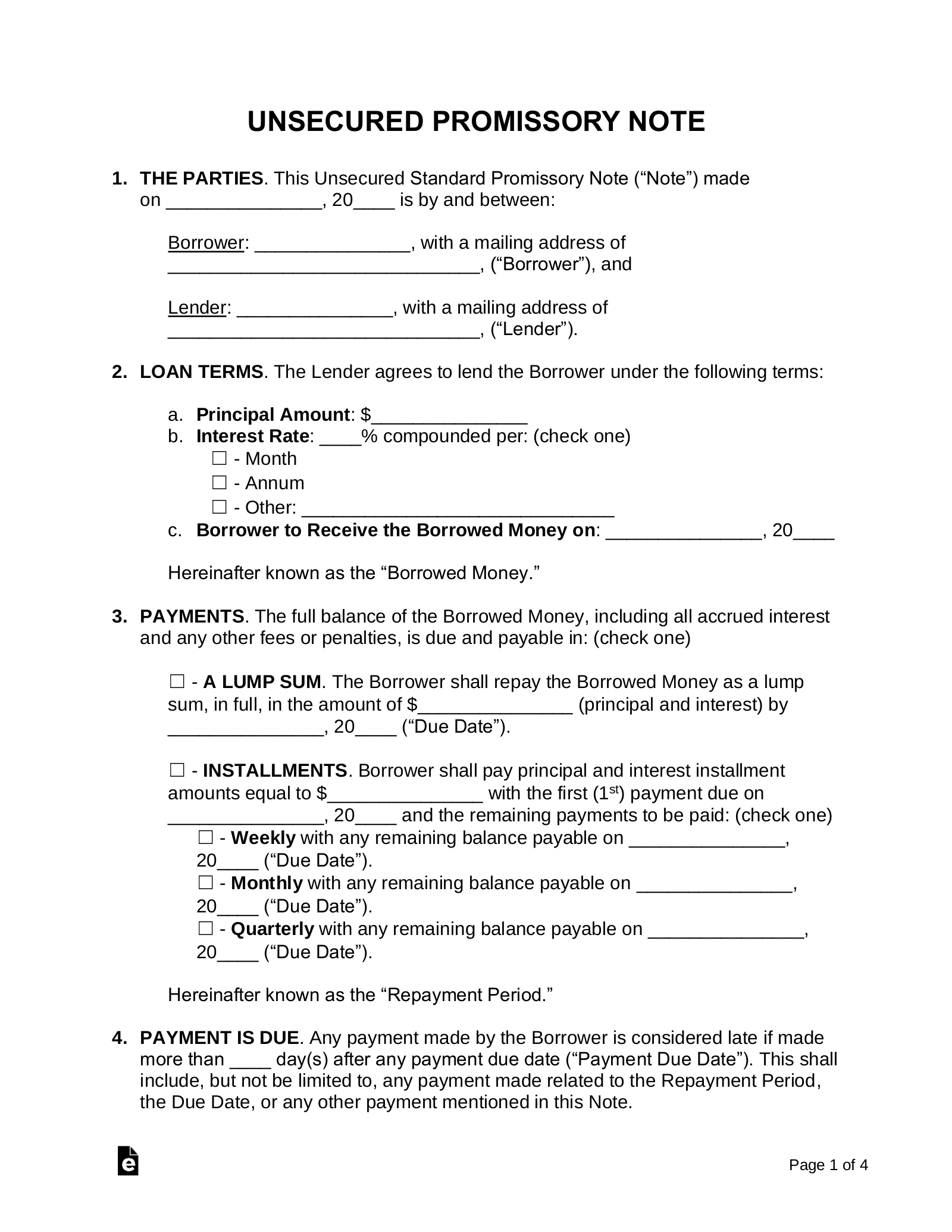

1. Repayment Type

The most important aspect of an unsecured promissory note is how the money will be paid back to the lender. Below are the following repayment types.

- Installments – The most popular repayment schedule type. Gives the lender a good feel as to how the borrower is making good on their word. If there is a problem, the lender will know if the borrower misses an installment payment.

- Interest Only payments – Only select this repayment type if the borrower has a good reputation or credit score. The borrower will only make payments on the interest of the loan until the due date, in which the entire loan amount needs to be paid.

- Lump-Sum (Due Date) – Choose this repayment type if there are no plans for the borrower to pay interest or make installment payments.

2. Fees and Default

Even though this is an unsecured note, there still needs to be repercussions if the borrower misses a payment or fails to comply with the terms in any way.

- Interest Fee – This note gives the borrower 15 days to correct a default before the lender can charge interest on the amount due.

- Late Fee – This allows the lender to set a customized day count after the date the payment is due. If the borrower fails to pay after said days, the lender can charge a late fee.

3. Conclude Agreement

Before signing the note, make sure to read the document in its entirety (only 3 pages long). If you want to make changes to the language in the document, download it in Word. The principal sum is the amount lent to the borrower, make sure this number is correct. When both parties are in agreement, sign the note and include 2 witnesses.

Enforcing an Unsecured Promissory Note

Though an unsecured promissory note doesn’t have collateral attached to it, a lender can still collect from a defaulting borrower. You can send a demand for repayment to the borrower, file a suit in court, or enlist the help of a collection agency. An unsecured promissory note is still a legally-binding document after all.

The risk is that even if your party takes these measures to collect a payment, it often comes with additional fees that may cut into your investment. And even if you take these routes, there are no guarantees that the borrower can pay back the loan in full. So you might suffer a loss.

It’s important to be sure before signing an unsecured promissory note that the lender is willing to take the risk and that the borrower is capable of paying back the loan. When everything is prepared properly, an unsecured promissory note can make the loan filing process quick and efficient.

How To Write

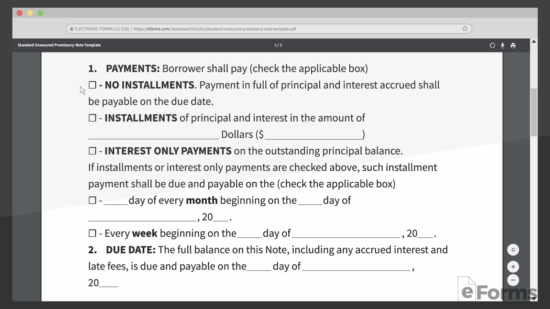

Download: PDF, MS Word, OpenDocument

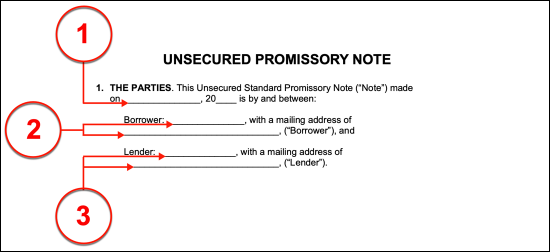

I. The Parties

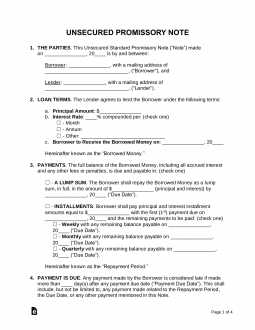

(1) Formal Date Of Unsecured Promissory Note. The date that first binds the Participants of this agreement to comply with its conditions must be documented before continuing.

(2) Identity Of Borrower. The name and mailing address of the Borrower must be submitted to the First Section. This will identify the Party who shall borrow and repay the loan being discussed.

(3) Lender Name And Address. The Party who shall loan money to the Borrower must be identified as the Lender. To this effect, locate the “Lender” area in Section One then supply the full name and the complete mailing address of the Lender in this note.

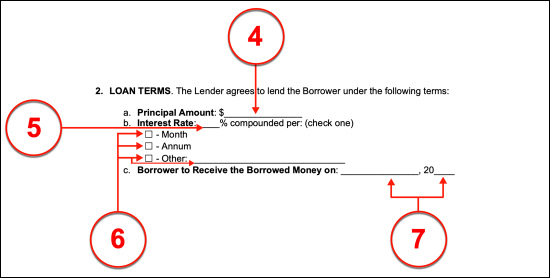

II. Loan Terms Unsecured Promissory Note

(4) Principal Amount Of Concerned Loan. The loan being made must have its dollar amount solidified. Present the exact dollar amount making up the loan that will be made to the Borrower in the space provided by Statement (A) found in Section Two.

(5) Applicable Interest Rate. Many Lenders will expect an additional amount of money paid in addition to the original loan amount. Generally, this is calculated and applied as a percentage of the owed amount. The percentage to be used as the “Interest Rate” must be documented in Statement (B).

(6) Compounding Interest. How often an interest payment is assessed must be defined by selecting the “Month” checkbox for once a month payments, “Annum” checkbox for once a year payments, or “Other” checkbox then describing when the above interest rate will be applied to the owed amount.

(7) Date Of Loan Receipt. The day when the Lender is to deliver the loan amount to the Borrower must be reported in Statement (C).

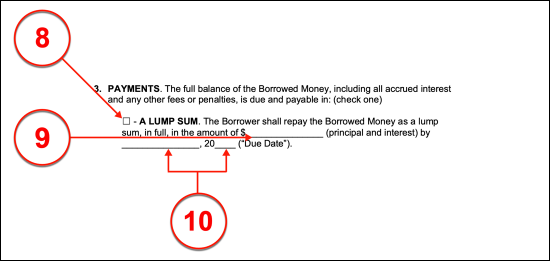

III. Payments Required Of The Borrower

Select Item 8 Or Item 11

(8) Lump Sum Option. The payment schedule the Lender and Borrower agree should be followed for the repayment of the loan requires definition. In some cases, these Parties will decide that the repayment of the loan should be made in one payment for the full amount that the Borrower owes. If “A Lump Sum” repayment of the loan will be required of the Borrower, then indicate this by placing a mark in the first checkbox of Section Three.

(9) Required Lump Sum Payment. After it has been established that repayment should be made as a single lump sum, the amount that is owed should be documented. To this end, supply the dollar amount of the loan should be added to the applied interest then reported in the first space of the “Lump Sum” statement.

(10) Due Date For Lump Sum Payment. Record the final date when the on time lump sum payment must be submitted to the Lender by the Borrower.

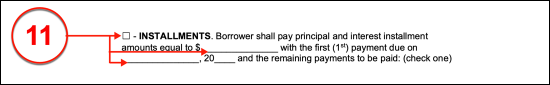

(11) Installment Option. The Parties in this note (the Lender and the Borrower) may have decided that the repayment of this loan should be made across two or more installment payments that are each equal in value. If so, then select the “Installments” statement from Section Three. Once chosen, the first blank line should be supplied with the dollar amount each installment payment should consist of while the next two spaces should be used to display the date when the first installment payment will be due from the Borrower.

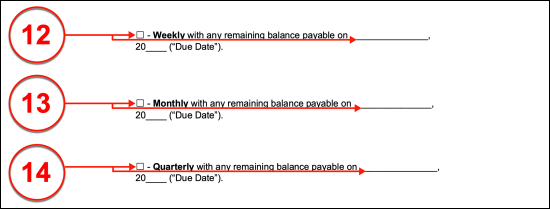

To Complete Item 11 Choose Item 12 Or Item 13 Or Item 14

(12) Weekly Installments. If a “Weekly” payment schedule will be followed by the Borrower, then the mark the checkbox labeled “Weekly” and supply when the date when the final loan payment required will be expected.

(13) Monthly Payments. If the Borrower will be required to submit payment (only) once every month, then select the “Monthly” checkbox. The calendar date that marks when the last loan payment will be due must be produced in this statement if it has been selected.

(14) Quarterly Payments. The Lender can schedule “Quarterly” payments where the Borrower will need to make a loan payment once every three months. If so, then the third installment option should be selected and the final date of payment documented.

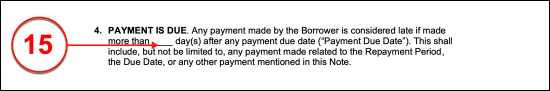

IV. Predetermined Grace Period

(15) Payment Deadline. Now that the due date has been established for the repayment of the loan, a period of days after this due date should be held in reserve as a grace period. This will allow the Borrower to make a payment within a reasonable amount of time of the due date while not being penalized for being unable to submit this payment exactly in time. For instance, a delay in the postal service may occur. Supply the number of days making up this grace period in the area provided in Section Four.

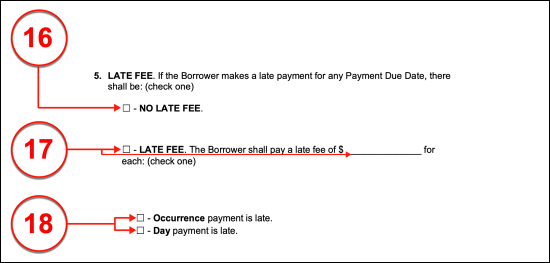

V. Late Fee Status

Select Item 16 Or Item 17

(16) No Late Fee Option. If the grace period of a due date has expired and the Lender has not received payment, then he or she will have the option to add a late fee. If the Lender does not intend to engage this option then the “No Late Fee” option should be chosen by marking the first checkbox in Section Five. It bears mentioning that if this checkbox is selected, then the Lender may not charge a late fee in addition to owed payment but does retain the right to enforce the promise this agreement represents.

(17) Late Fee Requirement. If a fee will be owed when the Borrower has not submitted an expected payment by the date it is due or within the predetermined grace period, then the checkbox corresponding to the words “Late Fee” should be marked and the dollar amount that will be considered the late fee must be submitted to the empty line attached to the dollar sign.

(18) Late Fee By Occurrence Or By Day. The late fee discussed may be imposed in one of two ways. If the Lender will only charge the Borrower the late fee amount once when it is late, then select the “Occurence” checkbox however, if the late fee will be imposed on a daily basis for every day payment is not received, then select the checkbox “Day.”

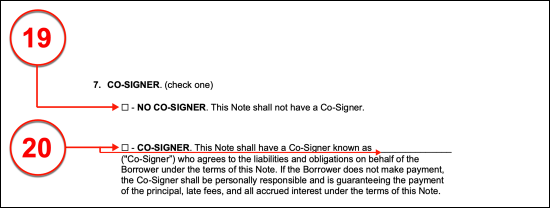

VI. Co-Signer

Select Item 19 Or Item 20

(19) No Co-Signer Needed. If the Lender will not require that a Co-Signer participate in the promise of repayment this note represents, then the “No Co-Signer” checkbox in Section Seven will need to be selected.

(20) Co-Signer Name. Many Lenders of an unsecured loan will require that a Co-Signer serve to guarantee that the amount owed by Borrower will be paid back even if the Co-Signer must pay an unpaid and overdue loan payment that the Borrower has defaulted on. If so, then the “Co-Signer” option must be selected and the legal name of the Party or Entity who shall guarantee Borrower’s ability and promise to pay and will prove this intent by signature must be presented as the Co-Signer.

VII. Prepayment Penalty Status

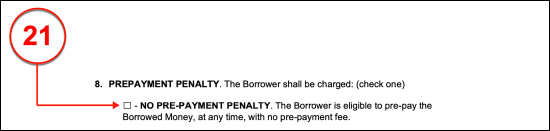

Select Item 21 Or Item 22

(21) No Penalty For Prepayment. This promissory note will enable the Lender and the Borrower to establish whether or not a penalty will be owed for early payment(s). If the Lender will accept early payment(s) of the owed amount without penalizing the Borrower, then select the checkbox labeled “No Pre-Payment Penalty”

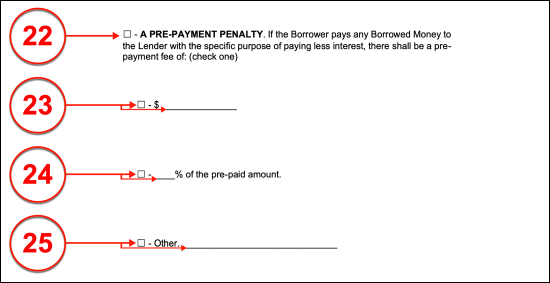

(22) Prepayment Penalty. If an early payment of the loan will be subject to penalty then the second checkbox found in Section Eight should be selected.

Choose Item 23, Item 24, Or Item 25 To Complete Item 22

(23) Cash Pre-Payment Penalty Imposed. The penalty for paying early requires description. Thus, if a single dollar amount will be considered the penalty that the Borrower must pay for an early payment then the first checkbox in the pre-payment option must be marked and the dollar amount of the penalty recorded.

(24) Interest Of Pre-Paid Amount Penalty. If the penalty will be a percent of the amount that was pre-paid then the second checkbox must be marked and the percent used to calculate the penalty recorded.

(25) Other Pre-Payment Penalty. A final option provided will be “Other.” If neither of the previous definitions accurately describe the penalty the Lender shall impose, then mark the “Other” checkbox. Once done, define the penalty amount or the way the penalty amount must be completed

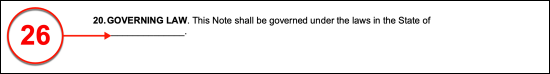

VIII. Governing Law

(26) Applicable State Laws. The State laws that shall apply to the Borrower, the Lender, the loan, and this document must be identified by naming the appropriate State in Section Twenty.

IX. Additions To Note

(27) Additional Requirements. This note must include every condition, safeguard, term, or provision that the Parties have agreed to. If there are any such items that have not been included or discussed in the above note then utilize Section Twenty One to document each additional agreement made between the Lender and the Borrower that should be considered part of the conditions presented in this agreement.

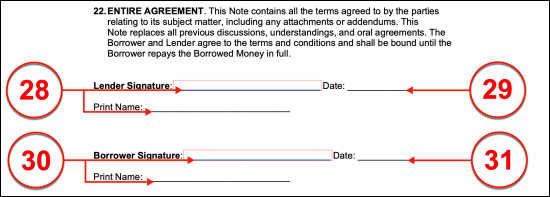

X. Entire Agreement

(28) Lender Signature. The Lender issuing the loan according to the provisions in this document should sign his or her name as well as print it. This signature will be the instrument used to bind the Lender to the conditions and terms above.

(29) Signature Date Of Lender. The date when the Lender signs this document is required in order to complete the signature acknowledgment of this document that he or she must provide.

(30) Borrower Signature. The Borrower is required to sign this document once it has been completed and print his or her name. This will serve as an acknowledgment of the content of the completed note above.

(31) Date Of Borrower Signature. In addition to the signature that the Borrower has produced, the date when this signature was provided must be dispensed.

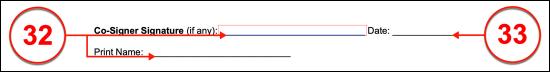

(32) Co-Signer Signature. Naturally, if this note calls for a Co-Signer to act as a guarantee that the loan shall be paid back, then that Co-Signer must submit his or her acknowledging signature and the printed version of his or her name so that this Co-Signer requirement can be satisfied.

(33) Signature Date Of Co-Signer. After the signature process is complete, the Co-Signer must deliver the current date where it is requested.