Updated September 13, 2023

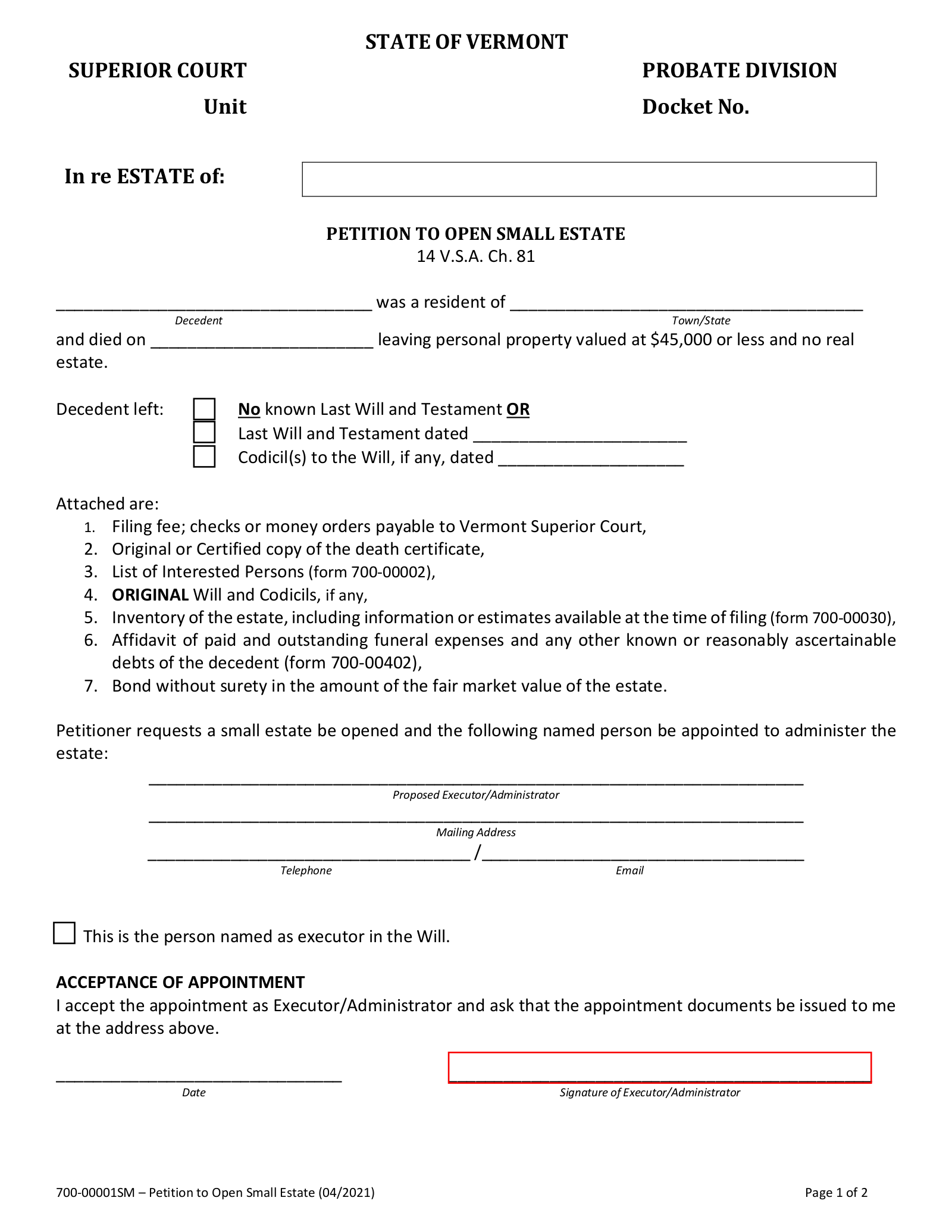

A Vermont small estate affidavit, also known as the ‘Petition to Open Small Estate’, can be used to speed distribution of assets for estates valued at $45,000 or less. The affidavit cannot be used to claim real estate. The form must be filed with a local probate court before a named successor can act as the executor/administrator of the estate.

Laws

- Days after Death – No statute. Vermont state law does not specify a period of time that must pass before a small estate affidavit can be filed.

- Filing Fee – $50-$110. (32 V.S.A. § 1434(a)(30))

- Maximum Amount ($) – $45,000. A small estate is defined as not exceeding a fair market value of $45,000. (14 V.S.A. § 1901(c))

- Signing Requirements – Form must be signed in the presence of a notary public.

- Statute – Title 14, Chapter 81 (Small Estates)

How to File (5 steps)

- Gather Information

- Prepare Affidavit

- Prepare Additional Documents

- Sign and Notarize

- File with Probate Court

1. Gather Information

2. Prepare Affidavit

3. Prepare Additional Documents

4. Sign and Notarize

5. File with Probate Court

Video

How to Write

Download: PDF

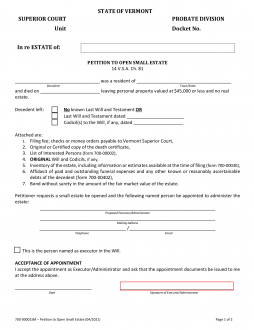

(1) Superior Court Unit. Furnish the Vermont County of the Superior Court handling this matter. This can be quickly achieved by selecting the appropriate county from the drop-down menu provided.

(2) Docket Number.

(3) Vermont Decedent Identity. Name the Party who has passed away and whose Vermont estate is being discussed. Note that the Deceased will often be referred to as the Vermont Decedent.

(4) Town And State Of Vermont Decedent Residence. The location of the Vermont Decedent’s home should be identified by the Town and the State where it is located.

(5) Date Of Vermont Decedent Death. Document the exact calendar date reported as the Vermont Decedent’s date of death.

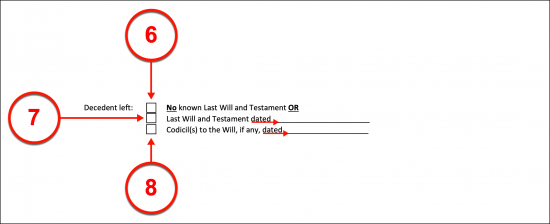

(6) Assumed Intestate Vermont Decedent. If it is unknown whether a will has been issued by the Vermont Decedent or it is known that he or she has not issued a will, then the first checkbox definition to this status should be selected

(7) Last Will And Testament Of Vermont Decedent. If a will was made by the Vermont Decedent, then select the second status definition by marking the corresponding checkbox. The will should be further identified with the date when it was executed (signed).

(8) Codicils Issued On The Will. If the Vermont Decedent made and executed written adjustments to his or her will then select the third statement and record the date of each cocidil made by the Utah Decedent. Note, do not select this statement if the Decedent has not made a will.

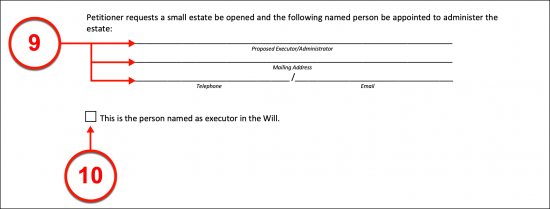

(9) Naming The Estate Administrator. The desired Administrator of the Vermont Decedent’s estate may have been named in the will as such or be named to this position through this paperwork. Furnish the full name, the complete mailing address, and the current telephone number and email address of the desired Administrator of the Vermont Decedent’s estate.

(10) Predetermined Executor As Administrator. Select the checkbox declaration if the desired Administrator was named in the Vermont Decedent’s will as the estate’s Executor.

(11) Dated Acknowledgement. The desired Administrator or Executor must accept this appointment by providing the current calendar date and his or her signature of acceptance.

(12) Signature Executor/Administrator. The concerned Administrator (Executor) must sign this declaration to show his or her acknowledgment of the obligations that he or she must fulfill.

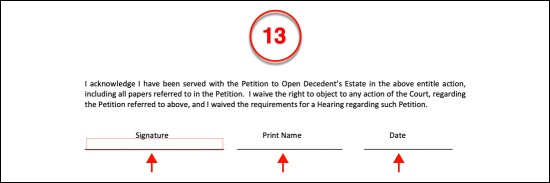

(13) Signature Consent Of Surviving Spouse And Heirs. The Spouse of the Vermont Decedent will need to approve the appointment made. He or she should sign the consent area to do so, print his or her name, then document the current date. If the Vermont Decedent has any Heirs then each one must also provide signature consent to this document by signing his or her name, printing his or her name, and delivering the current date.

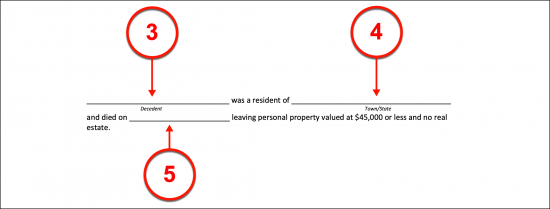

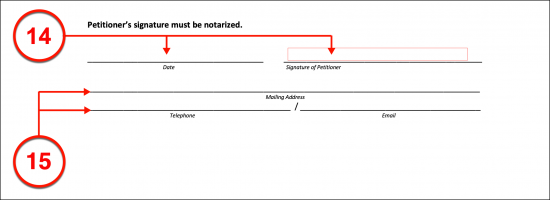

(14) Dated Signature Of Vermont Affiant. The Petitioner or Vermont Affiant will need to sign his or her name while a Notary Public oversees this action immediately after supplying the current date.

(15) Vermont Affiant Contact Information. The home address, the telephone number, and the email address where the Vermont Affiant can be found and contacted reliably should be dispensed to this area as part of the signature process.

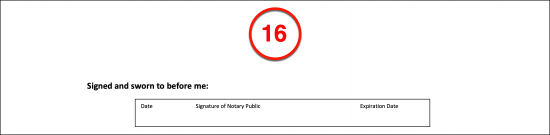

(16) Notary Public For Vermont Affiant Signature. The Petitioner’s signature will need to be validated as authentic. The Notary Public will witness the signature and serve as an instrument to verify the Affiant’s identity during the notarization process.