Updated September 13, 2023

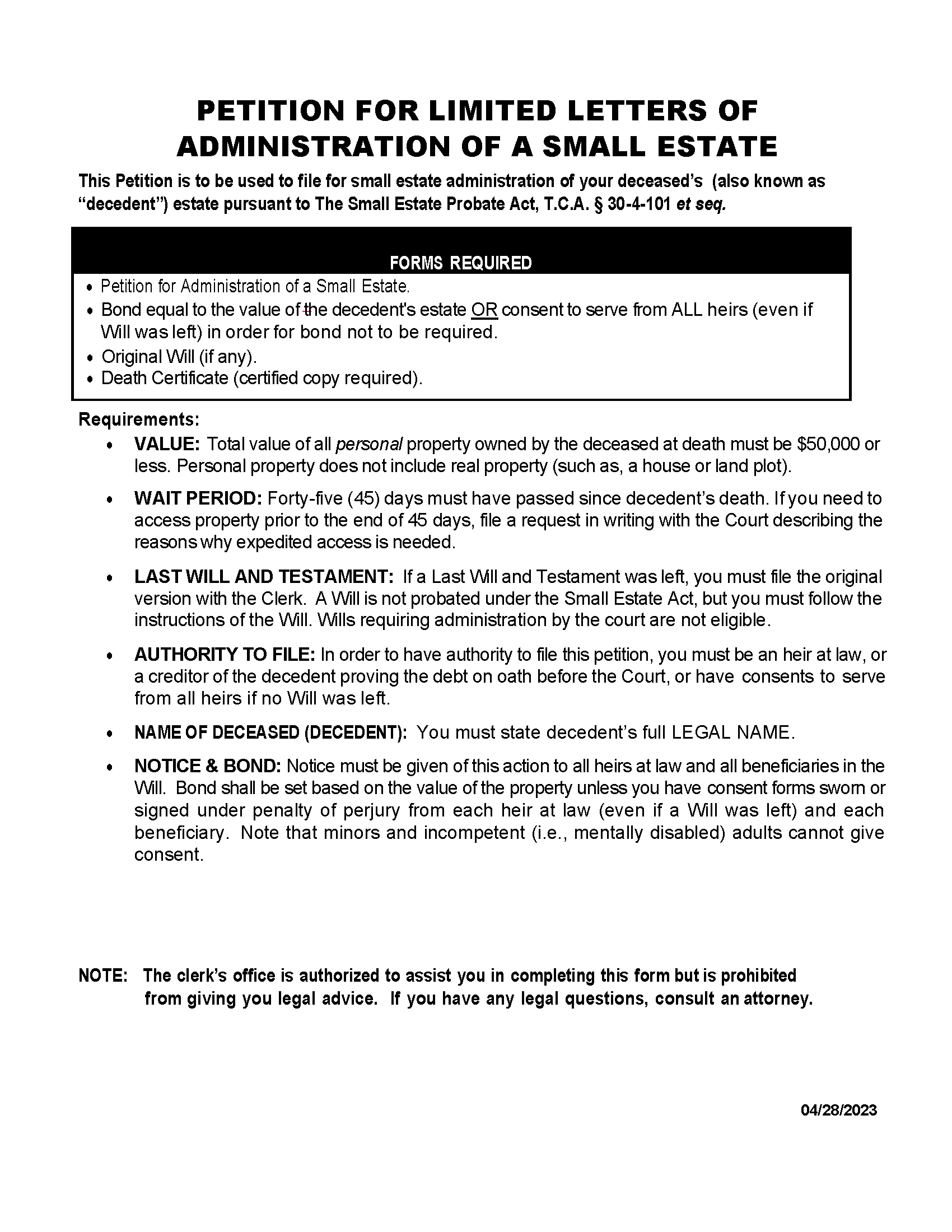

A Tennessee small estate affidavit is a petition for a small estate’s administration in the county where the deceased individual, the “decedent,” resided. A petitioner may file as the decedent’s personal representative to claim part or all of the estate to which they are entitled. This process avoids the lengthy and expensive probate procedure for estates valued at less than $50,000 and made up of only personal property. If the court approves and issues limited letters of administration, the personal representative can assume full responsibility of managing and distributing the decedent’s estate.

Laws

- Days After Death – 45 days (T. C. A. § 30-4-103(1)(A))

- Maximum Amount ($) – $50,000 (T. C. A. § 30-4-102(9))

- Property – The decedent’s estate must contain only personal property and no real property. (T. C. A. § 30-4-102(8))

- Bond – Unless exempt, the petitioner must post bond and make it payable to the clerk of court for an amount equal to the value of the estate.

- Exceptions – Bond is not required if the petitioner is a sole heir of the decedent’s will or, in absence of a will, a sole heir by way of law. Bond may also be waived by the written consent of all heirs (T. C. A. § 30-4-103(3))

- Filing Fee(s) – The amount the clerk shall charge and receive differs from county to county and varies on the number of documents (will, death certificate, waiver of bond, etc.) affixed to the affidavit. The total usually falls anywhere between $100 to $150. (T. C. A. § 30-4-103(4))

- Signing – The affiant is required to sign the document in the presence of a notary public or deputy clerk, who also has to sign and append their seal.

- Statutes – Title 30, Chapter 4 (Small Estate Probate Act)

How to File (4 steps)

1. Wait 45 Days

The personal representative has to wait at least 45 days after the decedent’s death before the probate court clerk will accept the filing.

2. No Other Personal Representative

Confirm that there are no existing appointments or petitions for the role of the personal representative of the estate. This can be done by searching the Tennessee Courts Public Case History.

3. Complete Paperwork

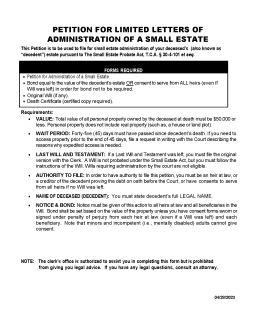

Gather and complete the following documents for filing:

- Copy of the Decedent’s Will (if any, obtain through the County and Municipal Records Archives)

- Small Estate Affidavit