Updated September 13, 2023

A South Carolina small estate affidavit is a document that is used to claim property from a deceased person’s estate. It can only be used for estates that are worth less than $25,000. For small estates, petitioning for this process is the first step to avoiding an expensive and time-consuming probate process. The petitioner is known as the “affiant”, and the deceased is known as the “decedent”.

Laws

- Days After Death – Thirty (30) days (Code 1976 § 62-3-1201(a))

- Maximum Amount ($) – $25,000 (Code 1976 § 62-3-1201(a)(1))

- Signing – This affidavit must be signed by both the affiant and a subscribing notary public or other individual authorized to take oaths. Then, it must also be admitted to probate by a probate judge (Code 1976 § 62-3-1201(a)(5)).

- Statutes – Title 62, Article 3, Part 12 (Collection of Personal Property by Affidavit and Summary Administration Procedure for Small Estates)

How to File (4 steps)

2. No Personal Representativek

4. File With Court

Video

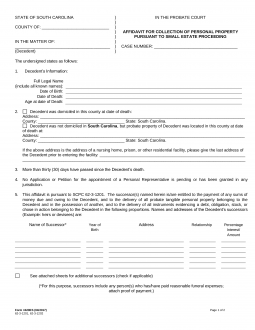

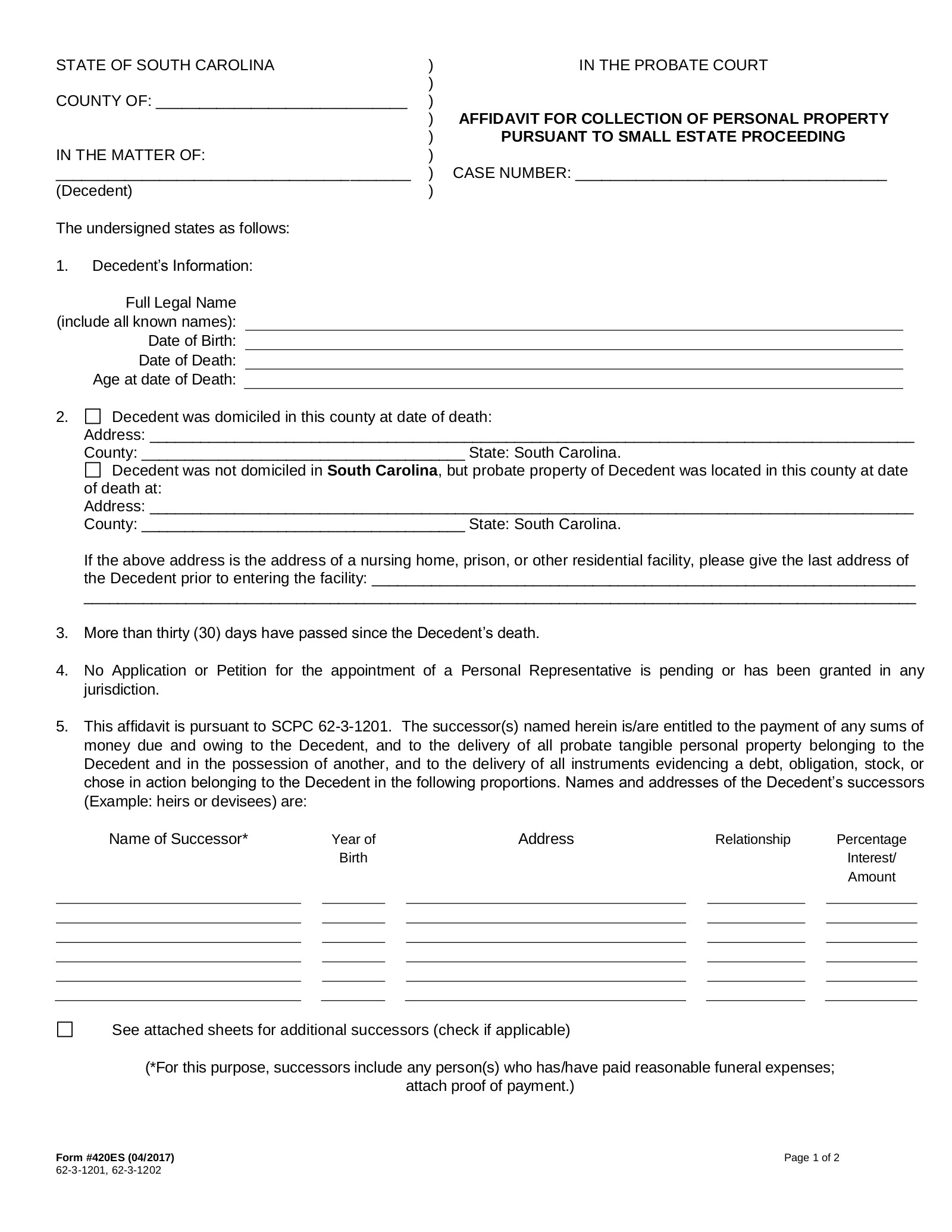

How to Write

Download: PDF

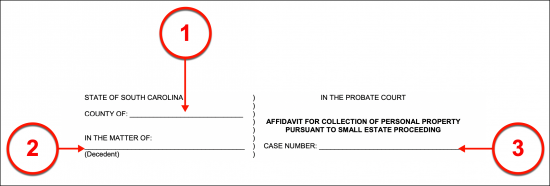

(1) South Carolina County. The County (in the State of South Carolina) where this paperwork will be filed must be identified at the start of this document.

(2) South Carolina Decedent Name. The Party who has passed away, the South Carolina Decedent, must be presented.

(3) Case Number. The South Carolina Court handling this document will have assigned a case number. Produce this number where it is requested.

Section 1 Decedent’s Information

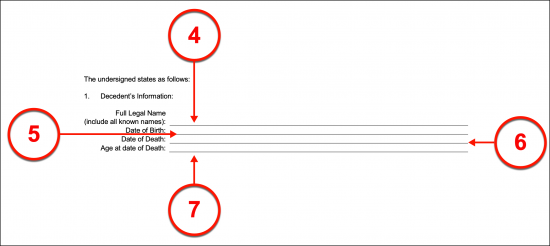

(4) Full Legal Name. The name of the South Carolina Deceased is required to begin the first topic of discussion. Supply this information accordingly. Bear in mind, this must be the full legal name of the South Carolina Decedent. A space has been provided so that all other names the South Carolina Decedent was known by, such as nicknames and/or aliases, can also be used to support the Decedent’s identity.

(5) Date Of Birth. The birth date of the South Carolina Decedent must be defined.

(6) Date Of Death. Document the calendar date of the South Carolina Decedent’s death.

(7) Age At Date Of Death. Produce the age of the South Carolina Decedent as of his or her death.

Section 2

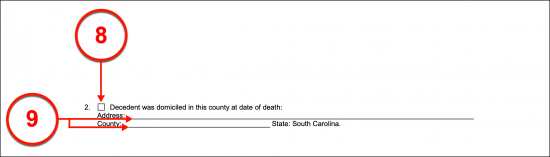

(8) Decedent Home Address At Time Of Death. The location of the South Carolina Decedent’s residence at the time of death must be declared. Therefore, if the Decedent lived in a South Carolina County at the time of his or her death, select the first checkbox of Section 2.

(9) South Carolina Address Of Decedent. If it’s been confirmed that the South Carolina Decedent maintained a residence in this state, then report the South Carolina Decedent’s home address in the space provided.

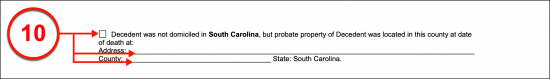

(10) Outside South Carolina State Lines. Select the second checkbox of Section 2 if the Decedent was not living in South Carolina when he or she passed away but was located in a South Carolina County when he or she died. In addition, to selecting this declaration, make sure to report the South Carolina address and county where the Decedent was found.

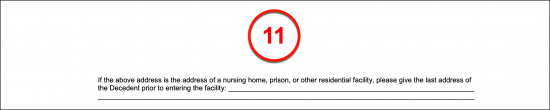

(11) Last Known Address Before Institutionalization. If the Deceased was institutionalized in a live-in facility such as a Residential Facility, Nursing Home, Prison, etc. then the last address he or she maintained as a home before being institutionalized must be documented.

Section 5

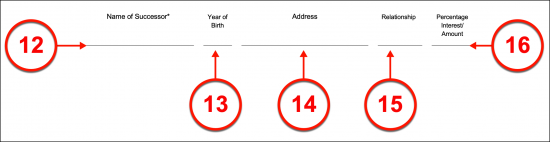

(12) Name Of Successor. The full name of every Party entitled to some or all of the South Carolina Decedent’s estate assets should be presented in the fifth article. This may include those who have paid for the South Carolina Deceased’s funeral costs. An attachment of the funeral receipts proving that such payments were made will be required for this to be a valid claim.

(13) Year Of Birth. Every Successor named must have his or her identity supported by several facts beginning with a record of the year he or she was born.

(14) Address. The residential or the home address of the South Carolina Decedent’s Successor is required.

(15) Relationship. An area in the table that Section 5 contains will require that a report on how each Successor is related to the South Carolina Decedent.

(16) Percentage Interest/Amount. The portion of the South Carolina Decedent’s estate that will be given or paid to a Successor must be recorded in the final column. If it is more appropriate, a dollar amount may be used to define the Successor’s entitlement.

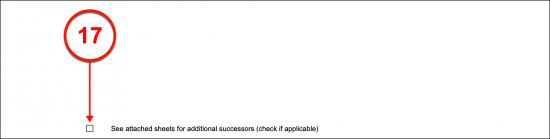

(17) Notice Of Attachment. The information this table presents may require supporting documentation or there may not be enough room to document the information of all the South Carolina Decedent’s Successors. Therefore, develop an attachment with this information, then select the checkbox statement “See Attached Sheets For Additional Successors.”

Section 6

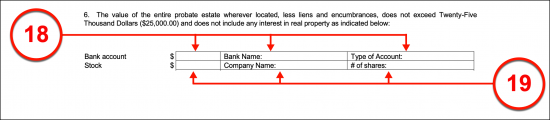

(18) Bank Account Of South Carolina Decedent. It will be important to document the South Carolina Decedent’s financial holdings beginning with the bank accounts he or she holds. List the dollar amount in every bank account held by the South Carolina Decedent, the name of every Bank where the South Carolina Decedent held such an account, and the type of account that he or she maintained

(19) Stock. If the South Carolina Decedent was a Stock Holder then present the total value of the stocks he or she held, the name of every Company he or she held stock in and the number of shares the South Carolina Decedent owned in that Company.

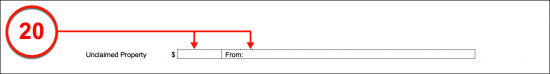

(20) Unclaimed Property. The property of the South Carolina Decedent that has not been claimed by any Creditors, Heirs, or Successors should be defined with its dollar value and a description of the Party or Entity holding this property.

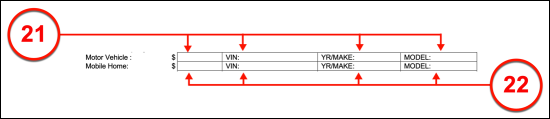

(21) Motor Vehicle. Define every automobile owned by the South Carolina Deceased with its vehicle identification number (VIN), its year, and make and model.

(22) Mobile Home. Identify the mobile homes owned by the South Carolina Deceased at the time of his or her death with a listing of every such mobile home’s vehicle identification number, year and make, and model.

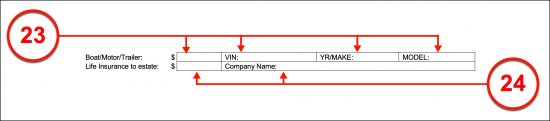

(23) Boat/Motor/Trailer. If the South Carolina Deceased owned a boat of any kind and/or trailer then the VIN, year and make, as well as the model of each boat and/or trailer owned by the Deceased must be recorded.

(24) Life Insurance To Estate. Document the name of every Company that the South Carolina Deceased held a life insurance policy with.

(25) Other. All other property owned by the South Carolina Deceased at the time of death should be described. Include any needed identifying information such as a Manufacturer’s Name, the kind of property owned, and serial number or similar description.

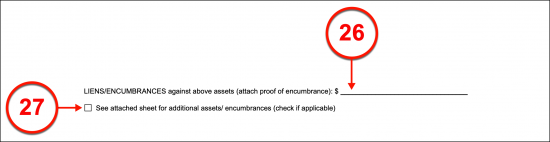

(26) Liens/Encumbrances. Research all debts held against the South Carolina Decedent, then record the total where required. Proof of such encumbrances should be attached to this document.

(27) Attachment Statement. If the South Carolina Decedent did have any encumbrances and attachments of proof will be presented with this document then, select the attachment statement’s checkbox to establish the additional material as part of this document.

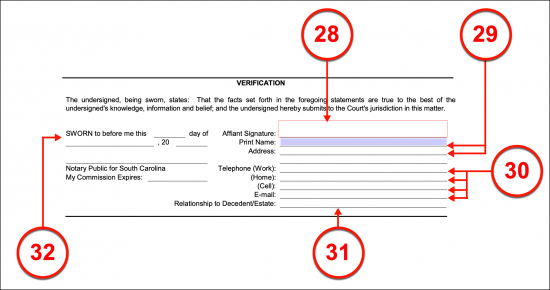

Verification

(28) Affiant Signature. The Affiant seeking control of the South Carolina Deceased’s estate must sign his or her name under the observance of a Notary Public. This signature must be notarized for this petition to be considered an authentic issue of the Petitioner.

(29) Affiant Printed Name And Address.

(30) Contact Information Of South Carolina Affiant.

(31) Relationship To Decedent/Estate.

(32) Notarization Of South Carolina Affiant Signature. The South Carolina Notary Public will complete the signature area with proof that the South Carolina Affiant’s signing is notarized

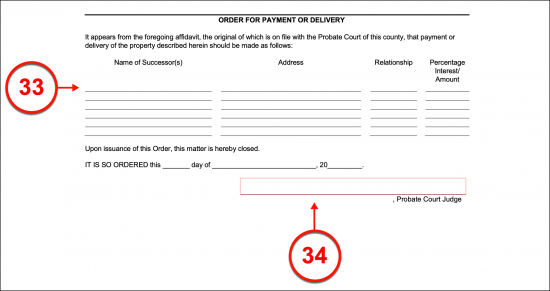

Order For Payment Or Delivery

(33) Ordered Successor Awards. Upon review, the courts will decide how the estate of the South Carolina Deceased will be handled. It will provide an order on the portion of the South Carolina Deceased’s estate to be delivered to which Successors.

(34) Proof Of Probate Court Order. The Probate Court Judge will provide his or her signature to the response area as a formal court order.