Updated September 13, 2023

An Ohio small estate affidavit is a form that, when approved, hastens the distribution of the assets of a decedent’s estate to the rightful recipients. This helps the estate avoid the traditional probate process, which can be long and expensive depending on the nature of the estate. Ohio has several two different methods for settling an estate that are quicker than the traditional method, which is known as full administration. The first is called relief from administration; the second is summary release from administration.

Relief from administration can only be used for estates that are valued at $35,000 or less, or up to $100,000 when the applicant is the decdent’s surviving spouse. Summary release from administration is available only when the value of the decedent’s estate is the lesser of $5,000 or the cost of the decedent’s funeral expenses. It is also available for estates worth up to $4,000 when the applicant is the decedent’s spouse, who is the sole heir and is obligated to pay funeral expenses.

Laws

- Appraisal – For relief from administration, the petitioner is responsible for having the estate appraised if necessary. The appraiser they chose must be approved by the court (R.C. § 2113.03(C))

- Days After Death – No Statute.

- Maximum Amount ($) – For relief from administration, $35,000 (R.C. § 2113.03(A)(1)) or $100,000 if the decedent is survived by a spouse who is named in their will or their spouse is entitled to receive their full estate per R.C. § 2105.06. (R.C. § 2113.03(A)(2)). For summary release from administration, $5,000 (R.C. § 2113.031(B)(1)) or $40,000 if the applicant is the decedent’s spouse and sole heir, and must pay for funeral expenses. (R.C. § 2106.13(A)).

- Publishing – For relief from administration, the petitioner is required to publish a notification of the petition filing in a wide, generally circulated newspaper in the county of the decedent’s final place of residence, unless the notices are waived or found unnecessary by the court (R.C. § 2113.03(B)). For summary release from administration, no requirement.

- Signing – The petitioner, their attorney (if they have one), and a probate judge all are required to sign the affidavit.

- Statutes – Chapter 2113: Executors And Administrators – Appointment; Powers; Duties; Chapter 2016: Rights of Surviving Spouses.

How to File (4 steps)

Note: The following steps are for the relief from administration process. If the estate qualifies, obtaining summary release from administration is easier. The necessary form may be found here.

1. Appraisal

2. Complete Paperwork

- Application to Relieve Estate from Administration

- Decedent’s Will (if it exists)

Video

How to Write

Download: PDF

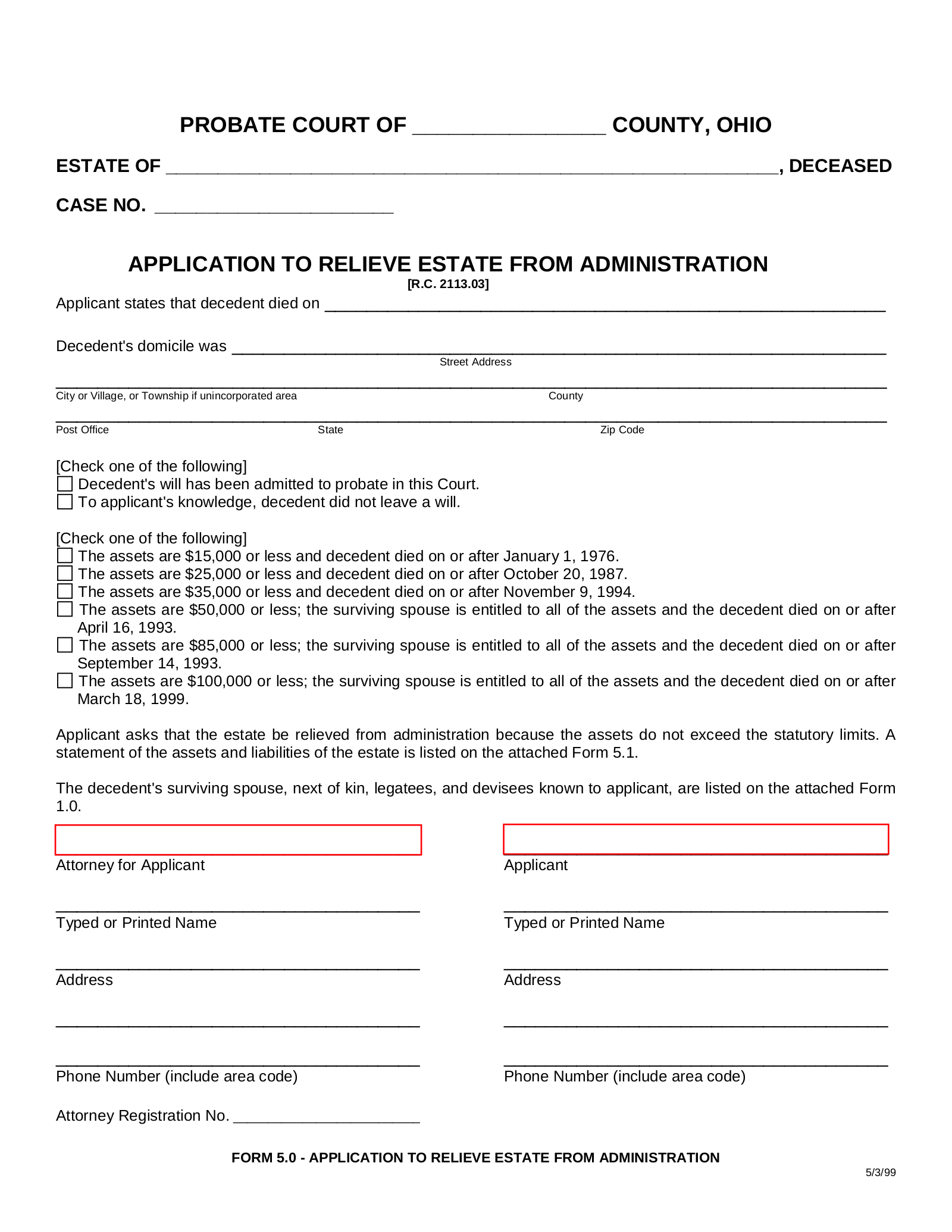

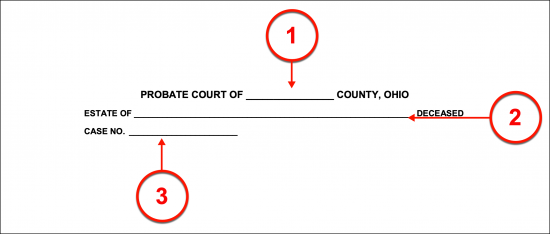

(1) County Court Name. Complete the title of this petition with a presentation of the county where the Applicant for the Ohio Decedent’s estate.

(2) Ohio Decedent Name. Identify the concerned estate by recording the (legal) name of the Ohio Deceased.

(3) Case No. The case filing number for this document (as assigned by the State of Ohio) should be reported.

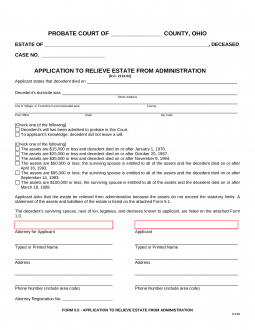

Application To Relieve Estate From Administration

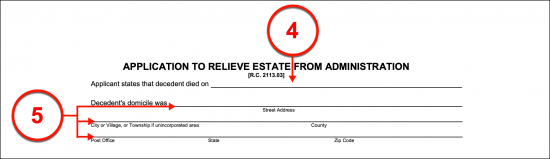

(4) Date Of Ohio Decedent’s Death. The calendar date formally marking the Ohio Decedent’s death should be obtained from the death certificate documenting his or her passing then recorded on this form.

(5) Location Of Ohio Decedent Residence. The entire address (street address, city, county) of the Ohio Decedent’s home or place of residence along with the Post Office, state, and zip code where this residence is located should be documented.

(6) Probate Status Of Ohio Decedent Estate. One of two statements should be selected to indicate the status of the Ohio Decedent’s will. Select the first checkbox if the Ohio Decedent’s will is under probate or mark the second checkbox to declare that the Ohio Decedent’s estate has not been probated.

Applicable Statute To Ohio Decedent With No Surviving Spouse

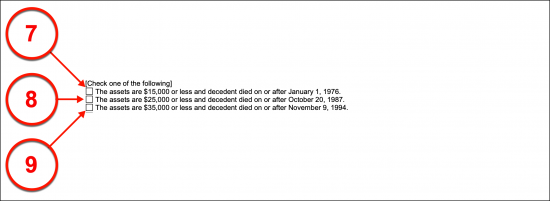

(7) Ohio Decedent Death On Or After January 1, 1976. The date of the Ohio Decedent’s death will bear on the allowable value for a small estate in the State of Ohio. Thus, one of several statements to define whether the dollar value of the Ohio Decedent’s estate qualifies it at the time of his or her death to be considered a small estate must be selected through its corresponding checkbox. For instance, if the Ohio Decedent’s estate was worth (as a total) less than fifteen thousand dollars ($15,000.00) at the time of his or her death and he or she was pronounced dead on January 1, 1976 or after this date, then the first statement on this topic should be selected.

(8) On Or After October 20, 1987. Select the second statement if the Ohio Decedent’s death occurred anytime on October 20, 1987 or after and his or her estate’s value does not surpass twenty-five thousand dollars ($25,000.00).

(9) On Or After November 9, 1994. If the Ohio Decedent’s estate was worth less than thirty-five thousand dollars ($35,000.00) at the time of his or her death and he or she has passed away on or after November 9, 1994 then the third statement option must be selected.

Applicable Statute To Ohio Decedent With Surviving Spouse

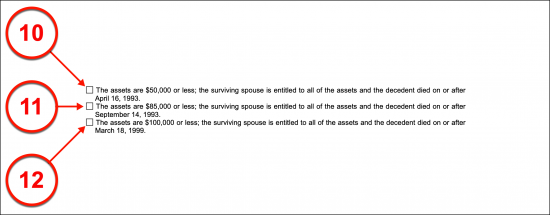

(10) On Or After April 16, 1993. Select the third checkbox if the Ohio Decedent was survived by his or her Spouse, was declared dead on April 16, 1993 or after this date, and whose estate’s worth was less than fifty thousand dollars ($50,000.00).

(11) On Or After September 14, 1993. Mark the checkbox corresponding to the fifth statement if the Ohio Decedent had a Spouse at the time of his or her death, his or her estate’s value is less than eighty-five thousand dollars ($85,000.00), and his or her date of death was declared on or following September 14, 1993.

(12) On or After March 18, 1999. The final statement should be selected if the Ohio Decedent’s estate was worth less than one hundred thousand dollars ($100,000.00), he or she was pronounced death on or after March 18, 1999, and was survived by a Spouse.

Attorney Signature

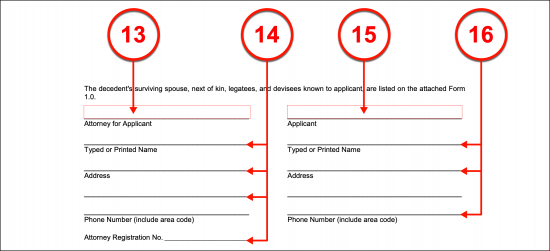

(13) Attorney For Applicant Signature. The Attorney working with the Ohio Petitioner or Applicant should sign his or her name to verify that the information being submitted (to his or her knowledge) is accurate.

(14) Attorney Information. After providing a signature the Attorney must submit his or her printed name, address, phone number, and Attorney Registration Number.

Signature Of Ohio Applicant To Decedent Property

(15) Applicant Signature. The Applicant to the Ohio Decedent’s estate should sign his or her name.

(16) Ohio Applicant Information. In addition to signing this form, the Ohio Applicant must print his or her name, address, and phone number to spaces proved.

Waiver Of Notice

(17) Ohio Decedent Heirs Entitled To Notice. It is imandatory that a production of every Heir or Successor to the Ohio Decedent who has provided a written waiver to receive notice of this filing is named in the “Waiver Of Notice” area.

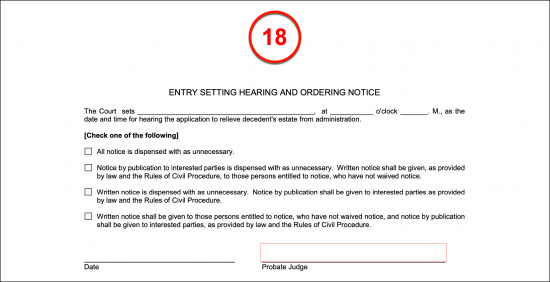

Entry Setting Hearing And Ordering Notice

(18) Probate Judge Order. The response to this filing will take place in the form of a court order. The Probate Judge reviewing this estate and the Petitioner’s request will issue a formal order regarding the affidavit filed.