Updated September 13, 2023

A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased person’s estate. The petitioner, or affiant, can only use this affidavit if they have a lawful claim to the estate. This helps estates of low values to avoid long and expensive probate proceedings.

Laws

- Days After Death – Thirty (30) Days (N.C.G.S.A. § 28A-25-1(a))

- Filing Fee – $10 facilities fee, $30 General Court of Justice fee, and any additional miscellaneous fees that may apply to the specific estate (N.C.G.S.A. § 7A-307).

- Maximum Amount ($) – $20,000 (N.C.G.S.A. § 28A-25-1(a)) For cases in which the affiant is the surviving spouse and sole heir of the decedent, the amount may total up to $30,000.

- Signing Requirements – All affiants are required to sign and each signature must be separately notarized before a notary public or acknowledged before the court clerk.

- Statutes – Chapter 28A, Article 25. Small Estates

How to File (4 steps)

- Wait Thirty (30) Days

- No Personal Representative

- Complete Documentation

- File with the Superior Court

2. No Personal Representative

3. Complete Documentation

- Affidavit for Collection of Personal Property of Decedent

- Copy of Decedent’s Will (if any)

Video

How to Write

Download: PDF

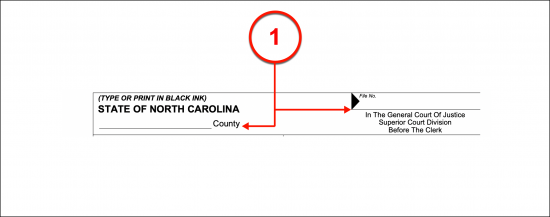

(1) North Carolina County And File Number. Begin by identifying this document with the North Carolina County of its issue and the filing number the General Court Of Justice has assigned to this estate’s paperwork.

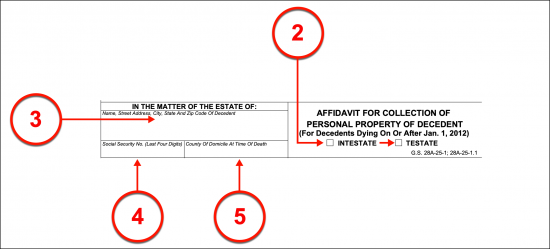

(2) Status Of North Carolina Decedent’s Will. Locate the title of this document then indicate if the North Carolina Decedent has died without a will in place by selecting the checkbox marked “Intestate” or if he or she did produce a will before he or she died, then select the checkbox labeled “Testate.”

(3) North Carolina Decedent Information. The full name of the North Carolina Deceased, as well as his or her entire address.

(4) Social Security Identification. The final four digits of the North Carolina Decedent’s social security number are required to aid in clearly identifying the North Carolina Decedent.

(5) County of Domicile At Time Of Death. The name of the North Carolina County where the Decedent maintained his or her home should be recorded.

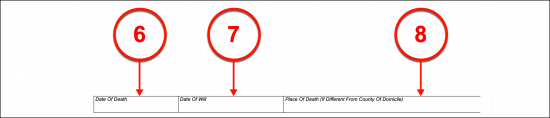

(6) Date Of North Carolina Decedent Death. Furnish the date noted on the North Carolina Decedent’s death certificate as the date of death.

(7) Date Of Of North Carolina Decedent’s Will. If the North Carolina Decedent produced a will by the time of his or her death then the date of this will must be documented.

(8) Place Of Death. If the North Carolina Decedent passed away outside of his or her residential county, then furnish the County and State reported on his or her death certificate as the place of death.

North Carolina Affiant 1

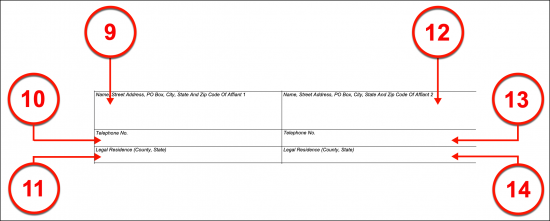

(9) Name And Address Of First North Carolina Affiant. This paperwork allows two Affiants to participate. The name of the First North Carolina Affiant should be recorded with his or her address.

(10) First North Carolina Affiant’s Telephone Number.

(11) Legal Residence Of First North Carolina Affiant. Record the county as well as the state where the First North Carolina Decedent lives.

(12) Second North Carolina Affiant’s Name And Address. The name and the address of the Second North Carolina Affiant must be furnished where requested. If there is only one Affiant, then this area may be left blank.

(13) Second North Carolina Affiant’s Telephone Number.

(14) Home County And State Of The Second North Carolina Affiant.

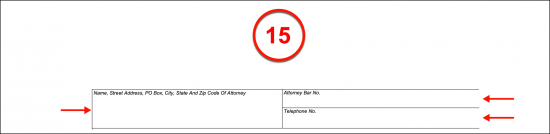

(15) Affiant Attorney Information. The name and business address of the Attorney representing the North Carolina Affiant(s) is required in the next area.

Article 1

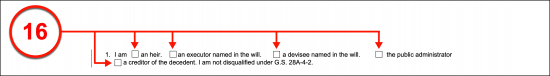

(16) North Carolina Affiant Status. Select the checkbox that best defines how the North Carolina Affiant was related to the Decedent

Article 3

(17) North Carolina Decedent Estate Status. Now that the paperwork and the Petitioner(s) have been properly presented, a declaration for the status of the will must be made. If the North Carolina Decedent did not have a will then mark the “Intestate” checkbox in the third article otherwise, mark the second checkbox (labeled “Testate”) to indicate the North Carolina Decedent did have a will at the time of his or her death.

Article 4

(18) For Decedent Death Before 10/01/2009. Different statutes will be applied depending upon when the North Carolina Decedent was pronounced dead. Therefore, if the North Carolina Decedent died on or before October 1, 2009, then Statement A must be selected.

(19) For Decedent Death After 10/01/2009. If he or she died after October 1, 2009 and the affiant is the Surviving Spouse or Sole Heir then select Statement B.

(20) Intestate North Carolina Decedent. Select the checkbox accompanying the fifth article if the North Carolina Decedent died with a will that has been probated in every County where the North Carolina Decedent owned real property.

Article 7

(21) North Carolina Decedent Estate Claimants. It will be up to the Affiant to furnish a production of the identity of every Heir to the North Carolina Decedent’s estate along with his or her age. This information should be furnished to the first two columns in the table available.

(22) Relationship. The way an Heir is related to the North Carolina Decedent should be documented.

(23) Mailing Address. The full mailing address where the Heir of the North Carolina Decedent can be reached must be supplied to this paperwork.

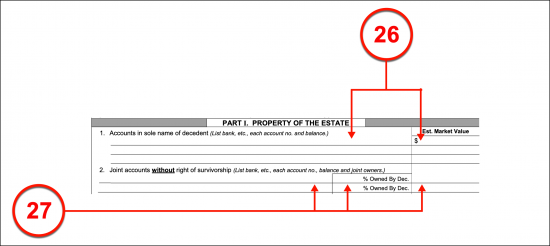

Article 1

(26) Accounts Of North Carolina Decedent. A record of all financial accounts held by the North Carolina Decedent should be supplied. Make sure that the North Carolina Decedent is the only name listed as the Owner of all accounts listed here. Each one should be defined by the Financial Institution where the North Carolina Decedent funds are stored along with the account number.

Article 2

(27) Shared Accounts With No Right To Survivorship. If the North Carolina Decedent participates in the joint ownership of one or more financial accounts where no clear Survivor is named to receive his or her funds, then each one of these joint accounts must be listed in the second article. Document the Bank or Financial Institution where each such account is held, the names on the account, the account number, and the portion or percentage of the funds that belong to the North Carolina Decedent in each account.

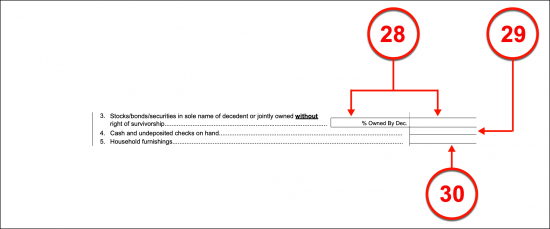

Article 3

(28) Stock/Bonds/Securities Owned Without Right Of Survivorship. Every stock, bond, or security that was owned by the North Carolina Decedent with no clear Successor must be documented. The percentage owned by the North Carolina Decedent of each such stock, bond, or security should be dispensed to the left column while the dollar amount defining the estimated market value of each should be documented on the right.

Article 4

(29) Cash And Undeposited Checks On Hand. Produce the total amount of cash and undeposited checks held by the North Carolina Decedent in the second column of the fourth article.

Article 5

(30) Household Furnishings. Assess the value of all the furniture owned by the North Carolina Decedent then record the total sum of the worth of these items in the right-hand column of Article 5.

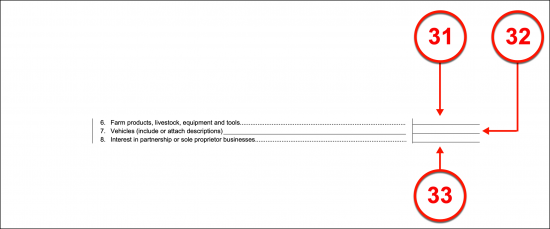

Article 6

(31) Farm Products, Livestock, Equipment Of North Carolina Decedent. The value of every farm product, livestock, equipment, and tool owned by the North Carolina Decedent should be added to a single sum. This sum must be reported in the second column of the sixth article.

Article 7

(32) Vehicles Owned By North Carolina Decedent. Identify every vehicle owned by the North Carolina Decedent by reporting each one’s manufacturer (make), model, year of production, VIN (vehicle identification number), and color in the area provided on the left in the seventh article. Total the value of the North Carolina Decedent’s vehicle then produce this number on the right.

Article 8

(33) North Carolina Decedent Interest In Partnership Or Sole Proprietor Businesses. If the North Carolina Decedent owned an interest in a Partnership or was the Sole Proprietor of a Business, then furnish the value of his or her ownership in the eighth article.

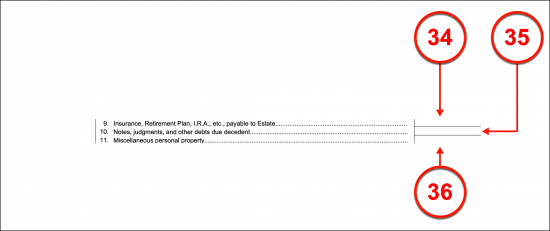

Article 9

(34) Insurance, Retirement Plan, IRA. The total dollar amount of all insurance and retirement benefits that are set to be paid to the estate of the North Carolina Principal should be documented.

Article 10

(35) Notes, Judgements And Other Debts Due To Decedent. All money due to the North Carolina Decedent at the time of his or her death from debts or judgments should be added to a single total then reported in the tenth article.

Article 11

(36) Miscellaneous Personal Property Of The North Carolina Decedent. If the North Carolina Decedent owned any other personal property that has not been reported above (other than real estate) then sum the value of these remaining items in the eleventh article.

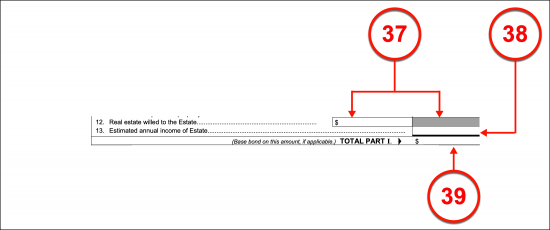

Article 12

(37) Real Estate Willed To The Estate. If the North Carolina Decedent has willed real property to his or her estate or a specific Executor of his or her estate, then the value of all such property must be reported in Article 12.

(38) Estimated Annual Income Of Estate. Record the dollar amount of yearly earnings from the North Carolina Decedent’s estate in the thirteenth article.

Article 13

(39) Total Amount Of North Carolina Decedent Estate. Add all the values recorded above to a single total then present it after the thirteenth article.

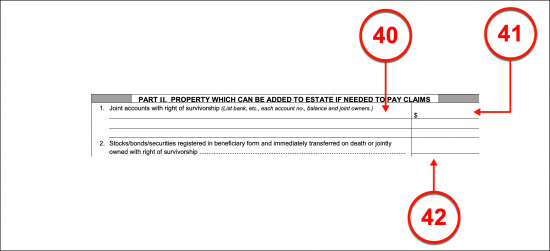

Part II. Property Which Can Be Added To Estate If Needed To Pay Claims

(40) Joint Accounts With Right To Survivorship. All joint accounts the North Carolina Decedent participates in should be listed separately in Part II.

(41) Dollar Amount. Furnish the dollar amount contained within each joint account held by the North Carolina Decedent.

(42) Stocks, Bonds, And Securities Registered In Beneficiary From. This report will require that the financial institution where each account is held with its account number and the identity of each Joint Owner of the account. Naturally, the amount held in each account at the time of the North Carolina Decedent’s death must be reported on the left with the identifying information of these accounts while the total should be supplied to the right-hand column.

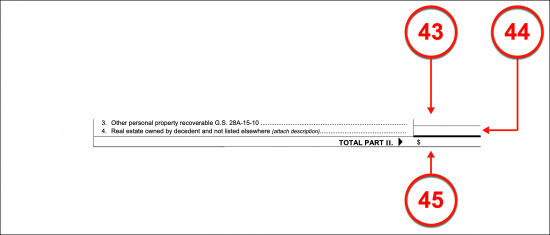

(43) Other Personal Property Recoverable Under GS 28A-15-10. If other accounts of the North Carolina Decedent, such as a trust, that automatically transferred upon the North Carolina Decedent’s death should be documented. This requires all the information needed to identify such property.

(44) Real Estate Owned By North Carolina Decedent. Report the legal description including address and deed type of each piece of real estate owned by the North Carolina Decedent at the time of his or her death that remains property of the Decedent estate even after his or her death.

(45) Total. Add all values reported in the right-hand column then produce the final result as the total amount for this report.

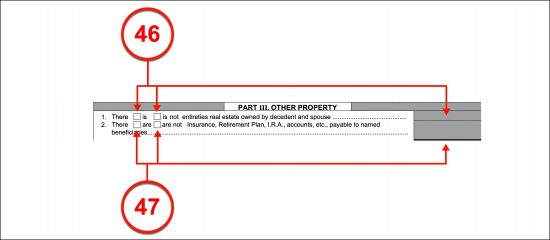

Part III Other Property

(46) North Carolina Decedent Real Estate Entireties. If the North Carolina Decedent did own real estate with his or her Spouse as Tenants then produce a record of this property’s legal description and value. While this property may not be accessed by the Affiant, it should be reported since it may be relevant to the tax directives of North Carolina statutes

(47) Insurance, Retirement Plan, IRA Accounts Payable To Beneficiaries. Dispense a report on all insurance policies, retirement plans, and IRA accounts that are payable to Beneficiaries of the North Carolina Decedent with their current value. This should include the value of each such account since some of these accounts may be a required part of calculating the North Carolina Decedent’s estate value

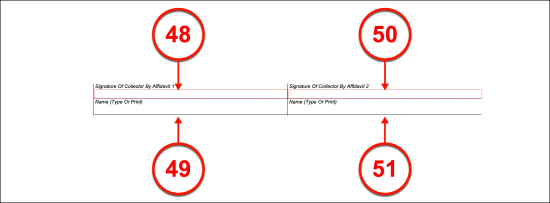

(48) Signature Of Collector By Affidavit 1. The signature of the North Carolina Affiant should be provided by the First North Carolina Affiant named at the beginning of this document.

(49) Printed Name Of Collector By Affidavit 1.

(50) Signature Of Collector By Affidavit 2. The Second North Carolina Affiant must sign his or her name.

(51) Printed Name Of Collector By Affidavit 2.

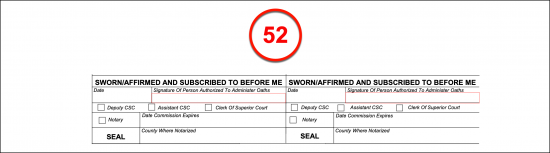

Notary For Collector By Affidavit 1 And Affidavit 2

(52) Notary Action. Each of the Affiant signature areas is accompanied with a section of notarization. Each Affiant signing this paperwork must perform this action while a Notary Public observes.

Court Certification

(53) Signature Of Deputy or Assistant CSC or Clerk Of Superior Court.

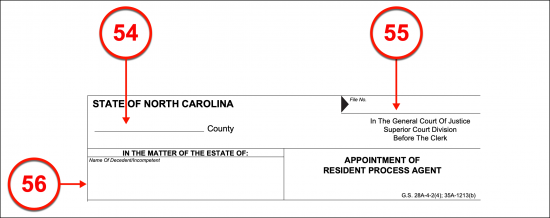

Appointment Of Resident Process Agent

(54) North Carolina County. In some cases, the North Carolina Affiant may not live in North Carolina thus, requiring a Process Agent to act on his or her behalf. Such a Party must be property identified and appointed. Begin with a record of the North Carolina County where this appointment and the concerned petition will be made.

(55) File No.

(56) North Carolina Decedent. The name of the North Carolina Deceased must be documented to properly apply this document.

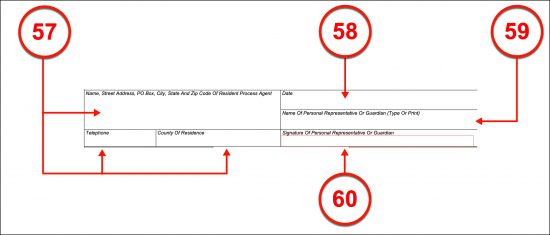

(57) Resident Process Agent Name And Contact Information. The Resident of the North Carolina County where the Affiant’s petition is filed and where the Process Agent must represent the Affiant must be identified. In addition, his or her full name and address must be provided. Note that the address used must be the physical residential address of the North Carolina Process Agent. Additionally, a request to record the Process Agent’s phone number and the county where his or her home must be satisfied with the information requested.

(58) Date Of Document

(59) Name Of Personal Representative Or Guardian. If a Personal Representative or Guardian has been appointed to the concerned estate then he or she must self-identify with a production of his or her name.

(60) Signature Of Personal Representative Or Guardian. The Personal Representative or Guardian of the estate must sign this form.

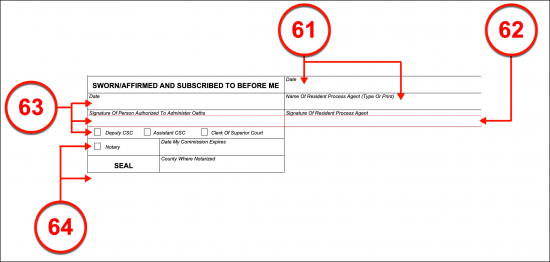

Acceptance Of Appointment

(61) Resident Process Agent. The Resident Process Agent being appointed must execute this paperwork with a signed acceptance of this appointment. This begins with a production of the date and his or her printed name

(62) Signature Of Resident Process Agent. The Signature Process Agent must sign his or her name before a qualified Administrator of oaths for the State of North Carolina and a Notary Public. He or she will follow the instructions of the North Carolina Deputy or Clerk present at the signing.

(63) Signature Of Person Authorized To Administer Oaths. The signature of the Court Administrator will be provided by a Deputy CSC, Assistant, CSC or Clerk of the Superior Court. He or she will sign this paperwork before a notary public. After noting the date, the Administrator taking the Process Agent’s Oath will identify himself or herself as a Deputy, Assitant, or Clerk of the Superior Court handling this matter.

(64) Notary Action. The Notary Public observing the North Carolina Parties signings will then produce proof of the notarization process in the space provided.

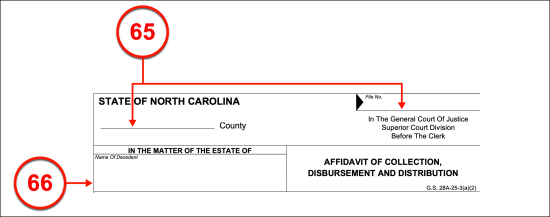

Affidavit Of Collection, Disbursement, And Distribution

(65) North Carolina County. The North Carolina County where the Decedent’s estate will disburse property and payments from must be named at the beginning of this form.

(66) North Carolina Decedent Name. The full name of the North Carolina Deceased should be presented.

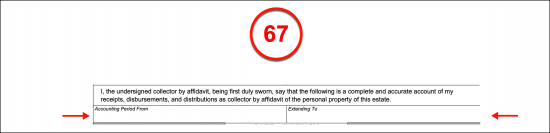

(67) Accounting Period From And Extending To. The period of accounting for the estate property must be documented by listing the first date and the final date on the disbursement receipts that will be attached to this document by the Collector by Affidavit.

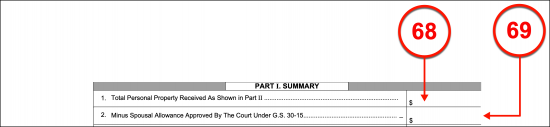

Part I. Summary

(68) Total Personal Property Received As Shown In Part II. The total value of the property that has been dispensed by the North Carolina Decedent’s estate must be presented in the first article.

(69) Spousal Allowance Approved By Court Under G.S. 30-15. The amount of money or the value of the property disbursed to the North Carolina Decedent’s surviving Spouse should be subtracted from the value reported in the first article. The resulting dollar amount should be reported in the second article.

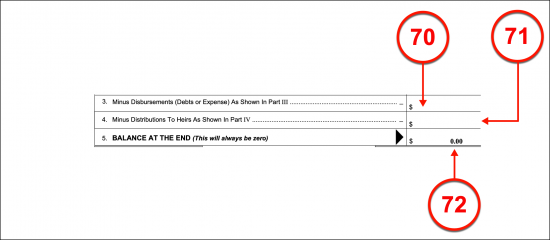

(70) Debts Or Expenses. The dollar amount of the debts paid by the North Carolina Decedent’s estate should be subtracted from the value reported in the second article. Produce the figure that results in the third article.

(71) Heir Distributions. Calculate the total amount of money (whether as cash or property) the estate of the North Carolina Decedent paid to the Heirs of the Deceased. Subtract this value from the dollar amount reported in the previous article (Article 3) then furnish the result to the fourth article.

(72) Balance At End. Confirm that the final dollar amount once all the subtractions have been made from the value in the first article.

Part II. Personal Property Received

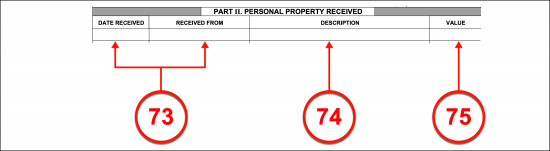

(73) Origin Of Disbursement. The source of the dispensed payments and property must be defined. For instance, it may have been an Executor of the estate, Representative, or similar Party. Record the date when each property was dispensed and the source in the first two columns.

(74) Description Of Disbursement. The property or account released to the Recipient should be documented.

(75) Value Of Personal Property Received. Use the final column of the table to report the value of a property or the amount of money dispensed to the Recipient. When the values of this column are added to one total, they must equal zero.

(76) Total. Add all dispensed values to the final box of the “Value” column.

Part III. Disbursement (Debts Or Expenses)

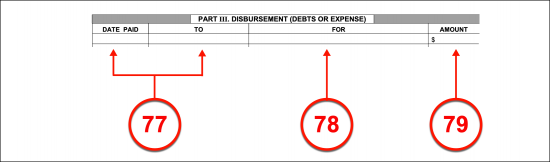

(77) Disbursement Target. In addition to the payments made to the North Carolina Decedent’s Successors, an account of the debts paid by his or her estate to Creditors should be documented. Produce the calendar date when each debt payment was made and the legal name of the Creditor receiving these funds.

(78) Reason For Disbursement. The debt paid must be defined by its origin. For instance, if the debt paid by the North Carolina Decedent’s estate was to satisfy a loan, then the account number and reason for the loan should be supplied to the third column.

(79) Amount Of Debt Payment. The dollar amount of the debt payment made by the estate must be reported in the final column.

(80) Total Debt/Expenses Payments Made. Add all the debt payments reported in the final column to one dollar amount then furnish it where requested.

Part IV. Balance Distributed To Heirs

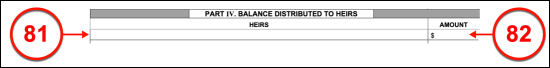

(81) Heirs. The name of each Heir to the North Carolina Decedent must be produced to the first column in Part IV.

(82) Amount Paid To Heirs. The amount of money or the property value of each Heir’s total disbursement from the North Carolina Decedent’s estate should be supplied to the second column.

(83) Total Paid To All Heirs. Add every payment to an Heir listed in the right-hand column to a single sum, then present the resulting figure where requested.

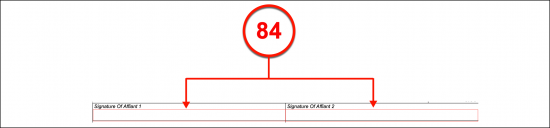

Signature Of Affiants

(84) Signature Of Affiant. The North Carolina Affiant should record the current date then sign his or her name before an Agent of the Superior Court and Notary Public. Enough room has been supplied so that two Affiants may complete this requirement.

(85) Signature Verification. The Deputy, Assistant, or Clerk of the Superior Court will take the oath of the North Carolina Affiant then complete the verification area reserved for his or her use.

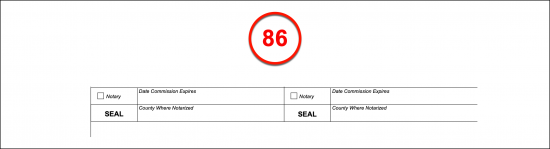

(86) Notarization. The Notary Public serving this signing will complete the notarization area provided for the signature he or she witnessed. Two areas have been supplied should there be an additional Affiant.

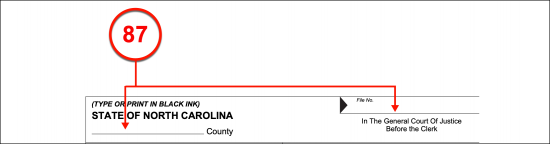

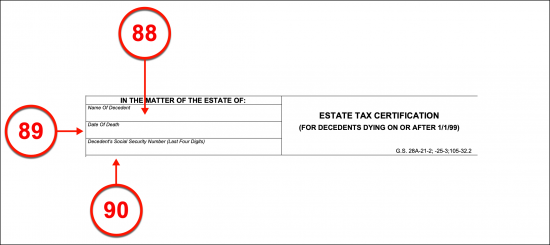

Estate Tax Certification

(87) North Carolina County Information. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter. This form should be completed if the North Carolina Decedent passed away on or after January 1, 1999.

(88) North Carolina Decedent Name. Deliver the full name of the North Carolina Decedent.

(89) North Carolina Decedent’s Date Of Death. Report the date of the North Carolina Decedent’s death should be reported from his or her death certificate.

(90) Decedent’s Social Security Number Information. Furnish the final four digits of the social security number held by the North Carolina Decedent.

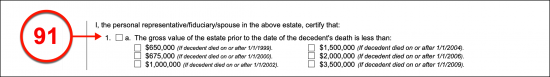

Article 1

(91) Gross Value Of Estate Prior To Decedent’s Death. The gross value of the estate will need to be established as less than the allowable amount at the time the North Carolina Decedent passed away. Several options defining the maximum amount a small estate in North Carolina may be valued at while remaining a small estate along with the applicable year of that maximum. Review the statements next to each of the checkboxes in Article 1, locate the dollar amount coinciding with the time frame that applies, then select the best definition. For instance, if the North Carolina Decedent was pronounced dead on or after January 1, 2002, but before January 1, 2004, then select the third statement from the first column of choices. Naturally, the value of the North Carolina Decedent in our example will need to be below the maximum allowed in 2002 ($1,000,000.00). Select the appropriate time frame from this list that defines the North Carolina Decedent’s death and confirm that his or her estate’s worth was valued at less than the maximum amount listed.

(92) Exemption To Federal Tax Due From North Carolina Decedent Estate. If the Decedent passed away on or after January 1, 2010, then select statement B since no federal estate tax will be due or payable.

Article 2

(93) Exemption From North Carolina State Taxes. Select the checkbox corresponding to the second article if the North Carolina Decedent’s death occurred on January 1, 2013, or after this date.

Article 3

(94) Relationship To North Carolina Decedent. If the Party completing this form is the Surviving Spouse and Sole Heir of the North Carolina Decedent, then select the third article.

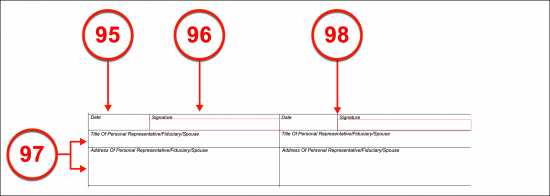

Execution Of Statement

(95) Signature Date. The date when this document is executed by the Personal Representative, Fiduciary Representative or Spouse of the North Carolina Decedent should be distributed at the time of signing.

(96) Signature Of Execution. The Party that is executing this document should sign his or her name then continue to identify himself or herself in the sections that follow.

(97) Title And Residential Address Of Personal Representative/Fiduciary/Spouse. The title held by the Signature Affiant (i.e. Personal Representative, etc.) along with his or her home address should be supplied once he or she has signed this paperwork.

(98) Second Personal Representative/Fiduciary/Spouse Signature. If there are two North Carolina Affiants behind this form, then the Second Affiant must complete the same signature process as the First Affiant. A specific area has been provided for the use of the Second North Carolina Affiant to execute this form by signature.

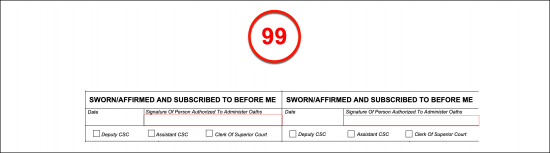

(99) Signature Verification. The Clerk, Clerk’s Assistant, or Deputy of the Superior Court handling this matter will verify that the Signature Party’s oath was received by dating and signing this paperwork, then dispense his or her credentials.

(100) Notarization. The North Carolina Notary Public observing the process above will add to the verification of the Oath Taker by notarizing the Signature Party’s act of signing.