Updated September 13, 2023

A Minnesota small estate affidavit is used to collect property from the estate of a deceased person, known as the decedent. If the decedent has any loved ones that believe they are heirs to all or part of their estate, those loved ones can present this document to the individual responsible for the estate and/or property in order to collect what is rightfully theirs. This process is used in Minnesota to avoid probate court if the value of the estate is no greater than $75,000.

Laws

- Days After Death – Thirty (30) days (M.S.A § 524.3-1201(a))

- Maximum Amount ($) – $75,000 (M.S.A § 524.3-1201(a)(1))

- Signing – The affiant is required to sign in the presence of a notary public.

- Statutes – Chapter 524, Article 1, Part 12 (Collection of Personal Property by Affidavit and Summary Administrative Procedure for Small Estates)

How to File (3 steps)

2. Complete Documents

- Affidavit for Collection of Personal Property

- Copy of Death Certificate

Video

How to Write

Download: PDF

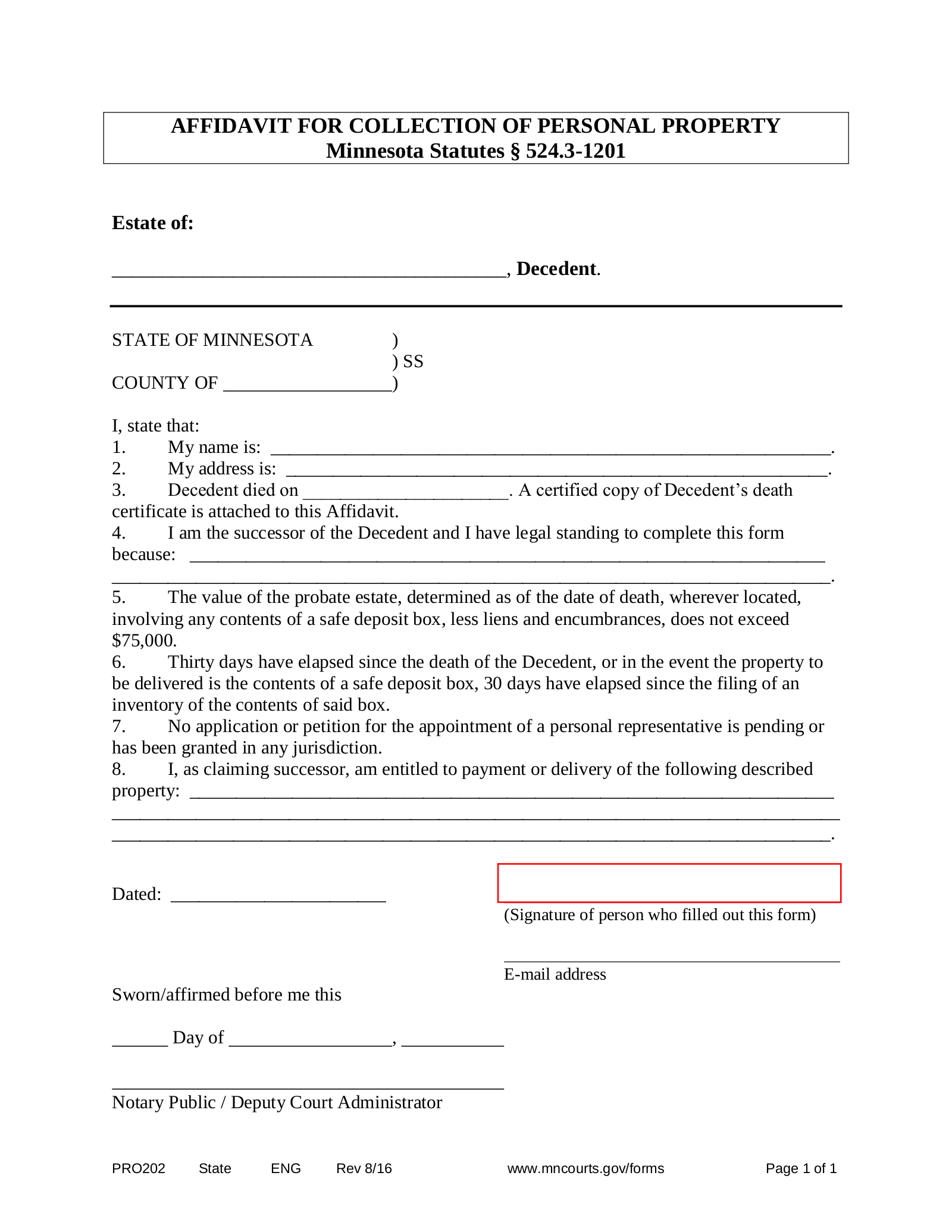

(1) Name Of Minnesota Deceased. The identity of the Minnesota Deceased (or Decedent) is needed to introduce this document. His or her complete name must be produced in the space provided.

(2) County Of Minnesota Deceased. It will be important to also establish the Minnesota County where this petition is made and filed.

Article 1

(3) Name of Minnesota Petitioner. The Person who is seeking the Minessota Decedent’s estate is needed in the first article of this document. This Party is sometimes referred to as the Petitioner or Affiant behind this form.

Article 2

(4) Address Of Minnesota Petition.

(5) Date Of Minnesota Decedent Death. Consult the death certificate developed for the Minnesota Deceased to verify and report the actual date of the Decedent’s death. It is important to note that the State of Minnesota will not consider this petition legal unless there have been at least thirty days between the formally declared date of the Minnesota Decedent’s death (as reported on his or her death certificate) and the date of this document’s execution.

Article 4

(6) Basis For Minnesota Petitioner Claim. The right to claim the Minnesota Decedent’s property must be explained. Thus, establish the reason the Affiant should receive the desired property. For instance, the Petitioner (or Affiant) may be a close family member such as the Minnesota Decedent’s Spouse.

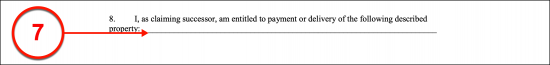

Article 8

(7) Minnesota Decedent Estate Assets. Whether the Minnesota Affiant intends to collect part of the Decedent’s estate or all of it, every property that he or she expects to claim control of must be documented. A clear description should be dispensed with the value of the property that the Minnesota Affiant wishes to claim should be produced. For instance, if the Minnesota Affiant intends to claim a laptop, then the manufacturer, O/S, serial number, and value should be reported. Similarly, if he or she intends to collect a bank account of the Decedent’s then the name of the Bank holding the account, the account number, and the amount that must be dispensed to the Affiant should be defined. If necessary, this report may continue on an attachment since it must be a complete listing of what the Affiant expects from the Minnesota Decedent’s estate.

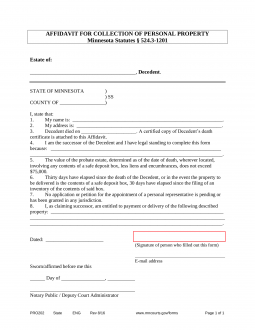

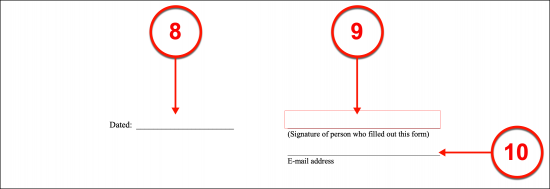

(8) Signature Date Of Minnesota Petitioner. After reviewing the information presented to verify its accuracy, the Minnesota Affiant may execute this document by signature. When doing so, the Minnesota Petitioner must declare the current calendar date.

(9) Signature Of Minnesota Petitioner. The Minnesota Petitioner should only sign his or her name under the instruction of a Notary Public.

(10) Affiant Email Address. The Minnesota Affiant should document the e-mail address where he or she can be reliably contacted.

(11) Minnesota Notary. The Notary Public, who must have an active commission, will complete the notarization process so long as the Petitioner has successfully followed his or her direction.