Updated September 13, 2023

A Maryland small estate affidavit is a document used by an individual who believes they have legal rights to all or part of a deceased loved one’s estate. It requires that the petitioner have specific details about the estate, the property in question, and any other potential heirs to the estate. This form and procedure can be utilized in Maryland when the estate in question holds a value of no more than $50,000. It is processed through Maryland’s Office of the Register of Wills.

Laws

- Days After Death – No Statute.

- Filing Fee – MD Est & Trusts Code §§ 2-206, 5-606(b)

- $0 – $200 – $2

- $200 – $5,000 – 1% of the value of the small estate

- $5,000 – $10,000 – $50

- $10,000 – $20,000 – $100

- $20,000 – $50,000 – $150

- Maximum Amount ($) – $50,000 (MD Est & Trusts Code § 5-601). For cases in which the surviving spouse is the sole legatee or heir of the decedent (and if before the filing of an initial account in administration proceedings instituted under Subtitle 3 or 4 of Title 5), the property may be valued up to $100,000.

- Publishing – The small estate must be published in a “newspaper of general circulation in the county” once per week for three consecutive weeks (MD Est & Trusts Code §§ 5-603, 7-103).

- Signing – The affiant must sign, and if they are utilizing the services of an attorney they may sign as well.

- Statutes – Estates and Trusts, Title 5, Subtitle 6 (Small Estates)

How to File (3 steps)

1. Complete Documents

- Bond of Personal Representative (RW 1115)

- Copy of Death Certificate – This can be obtained through Maryland’s Division of Vital Records.

- Copy of vehicle title and book value (if the decedent owned a vehicle).

- List of Interested Persons

- Paid Funeral Bill

- Petition for Administration of a Small Estate (RW 1103)

- Property Value Assessment from the State Department of Assessments and Taxation

- Small Estate Notice of Appointment/Notice to Creditors/Notice to Unknown Heirs (RW 1109)

- Small Estate Schedule B (RW 1137)

2. File With the Office of the Register of Wills

Video

How to Write

Download: PDF

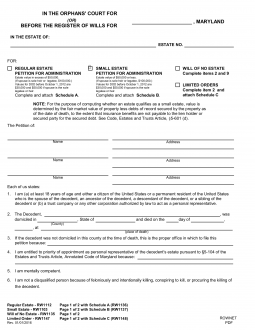

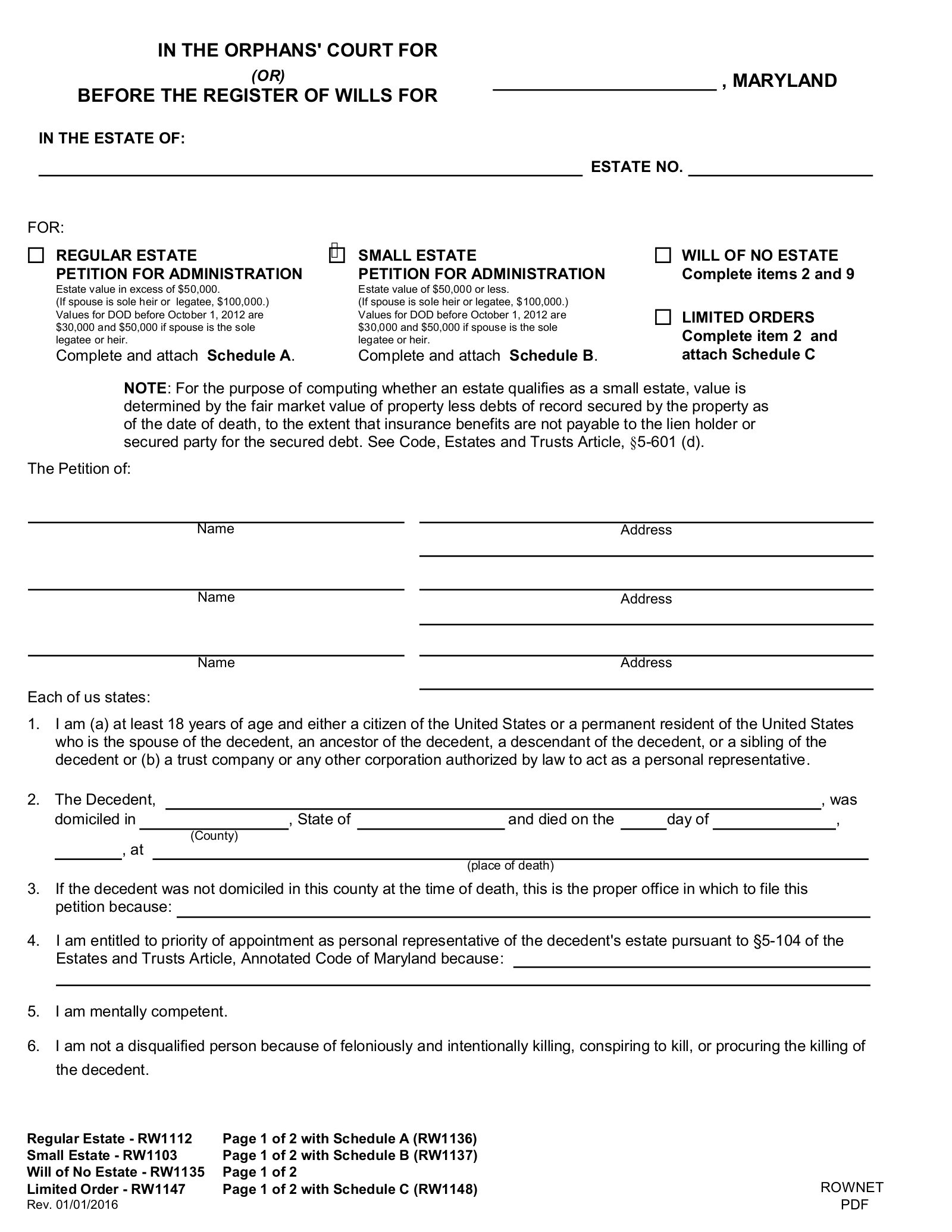

(1) County Maryland. The name of the Maryland County where the Affiant files this petition must be displayed.

(2) Maryland Decedent. Dispense the entire name of the Maryland Deceased.

(3) Maryland Decedent Estate Number. The estate number assigned to the Decedent’s remaining property should be reported.

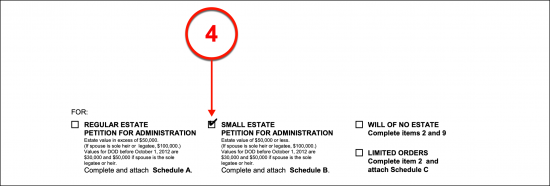

(4) Purpose. This paperwork can be used to achieve one of several goals. Currently, “Small Estate Petition For Administration” is selected. Do not select any other checkbox if the purpose is to petition for the control of the small estate documented above.

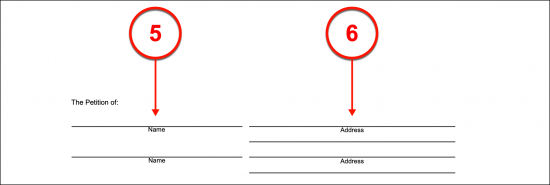

(5) Maryland Petitioner Name. The name of every Affiant (or every Petitioner) to the Maryland Decedent’s estate should be presented. Each Maryland Affiant named will be expected to execute this petition by signature.

(6) Address Of Maryland Petitioner Address. Display the residential or home address of each Maryland Affiant behind this document.

Article 2

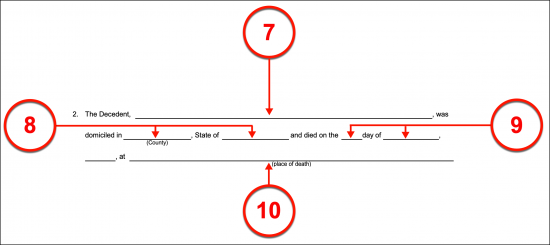

(7) Maryland Decedent Name. The name of the Deceased, or the Maryland Decedent, is required in Article 2.

(8) Address Of Maryland Decedent. Continue through the statement made in the second article with a production of the County and State where the Maryland Deceased lived or kept a residence.

(9) Date Of Maryland Decedent’s Death. The two-digit calendar day of the month, the month, and the year when the Maryland Deceased was pronounced dead should be furnished where requested in Article 2.

(10) Place Of Decedent Death. Supply the address where the Maryland Deceased died as his or her place of death.

Article III

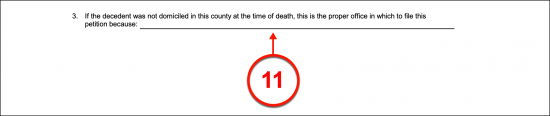

(11) Reason For Out Of County Petition. The Maryland Decedent may have been pronounced dead in a Maryland County other than where he or she resided or out of the state altogether. In such a case that jurisdiction may have its own requirements (especially if the Decedent maintained a residence in more than one state). If relevant, discuss any reason why this petition may need to be filed with a County or State other than the Maryland County where the Deceased maintained his or her residence

Article IV

(12) Reason For Entitlement. The reason for the Affiant(s) claim to the Maryland Decedent’s estate should be discussed. For instance, if the Maryland Decedent died without debt or a Spouse and the Affiant is the only child, then this would be considered a powerful reason for entitlement.

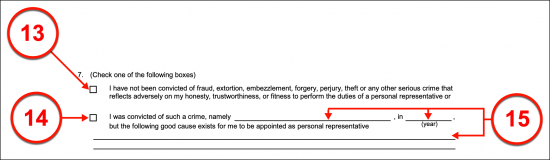

(13) No Previous Conviction Affiant. The Affiant should confirm that he or she has not been convicted of a serious crime such as fraud, extortion, embezzlement, forger, perjury, theft, and other crimes that indicate the Affiant may be acting unscrupulously.

(14) Previous Conviction Affiant. If the Maryland Affiant was convicted of a crime, then select the second checkbox.

(15) Expressing Previous Conviction. Notice the statement corresponding to the second checkbox selection will require a record of what crime(s) the Affiant was convicted of and the year of conviction. If this is the case, the Affiant must explain why his or her crime should not discount him or her to act as the Personal Representative handling the Decedent’s estate.

Article 9

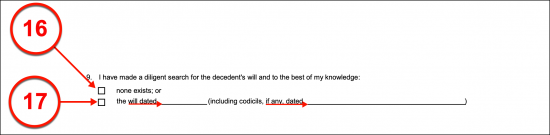

(16) Maryland Intestate Decedent. If no will was filed or created by the Maryland Decedent and the Affiant can honestly say that he or she has exhausted every search effort in finding the will, then select the first checkbox in Article 9.

(17) Maryland Decedent Will. If the Maryland Decedent had a will at the time of his or her death, then the second checkbox in Article 9 must be selected. This requires that the date of the will be reported. Any codicils (i.e. an addendum, revocation, or partial revocation to the original will) associated with the Maryland Decedent’s will should be documented.

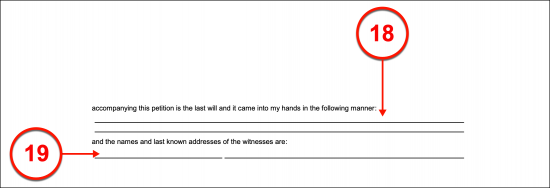

(18) Acquirement Of Maryland Decedent Will. If the Affiant has located the Maryland Decedent’s will, then a copy of it should be attached to this petition. Additionally, a report on how the Affiant came across the Maryland Decedent’s will should be documented.

(19) Last Known Witnesses Of Will. A properly executed will should have been signed before two Witnesses or a Notary Public. Therefore, if the Maryland Decedent’s will was properly executed then the name and addresses of the two Witnesses and/or Notary Public who can verify the identity of the Maryland Affiant’s will be presented.

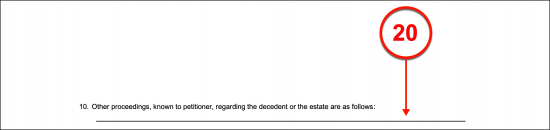

(20) Other Administration On Maryland Decedent Estate. A discussion must be engaged if the Maryland Decedent’s estate is undergoing any other administrative process. Produce the name and county of any Court or Legal Entity currently in the process of administering decisions on the Maryland Decedent’s estate.

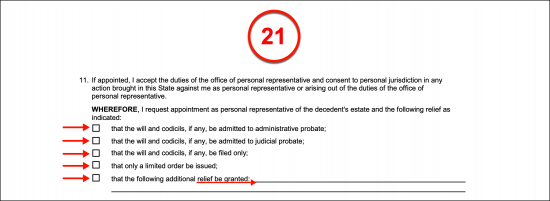

(21) Duty Request Of Maryland Decedent. The Maryland Affiant’s intention must be supported in some way. Thus, select one of the checkbox statements provided to indicate that the Affiant wishes to admit the will to administrative probate, to judicial probate, or that it only to be filed (along with any verifiable codicils), that his or her appointment as Personal Representative to the Maryland Decedent’s estate only be for a limited time, or that additional relief directly defined in the available made available for the last checkbox statement.

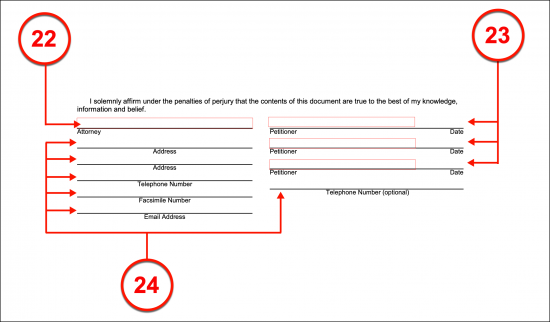

(22) Attorney Signature. The Attorney working with the Affiant should sign his or her name before a notary public along with the Petitioners

(23) Petitioner Signature And Signature Date. Each Maryland Petitioner named in this document as an Affiant must sign his or her name then dispense a record of the current date.

(24) Maryland Petitioner Contact Information. The address, telephone number, fax number, and email address where inquiries, notices, or correspondence regarding this paperwork can be reliably received by the Affiants must be presented.

Schedule B

Schedule B Must Be Completed To File A Small Estate Petition Or Affidavit.

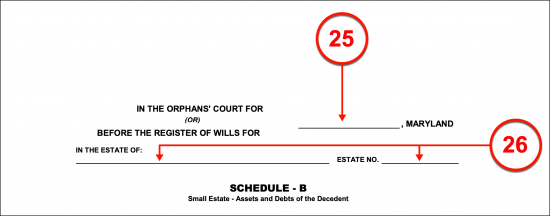

(25) Maryland County Of Petition. The County where this petition will be filed should be reported on Schedule B.

(26) Maryland Decedent Information. Produce the name of the Maryland Decedent as well as the estate number attached to his or her property.

(27) Real And Personal Property Of Maryland Decedent. The real property and the personal property of the Maryland Decedent must be defined and valued. To this end, make use of the space provided in Section 1 of this attachment to name every item, real estate, or intangible asset owned by the Maryland Decedent at the time of his or her death. It is imperative that any description of property be a comprehensive one so that all such assets can be easily identified.

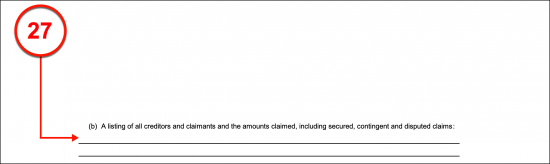

(28) Maryland Decedent Creditors And Claimants. Any Claimant (i.e. A Creditor) who seeks payment from the Decedent’s estate should be documented. Produce a list of the Creditor or Claimant’s legal name, address, telephone number, and the amount sought to Statement B.

Article 2

(29) Funeral Expenses. Produce the dollar amount of the funeral payment that should be dispensed from the Maryland Decedent’s estate (according to his or her last known wishes).

(30) Statutory Family Allowances. Sum up the family allowances (the amount that Maryland State Law requires paid to the Spouse and any Offspring of the Decedent).

(31) Administration Expenses. The costs of this filing and any other administrative expenses associated with the Maryland Decedent’s estate should be summed to one total then recorded in the second article of this attachment.

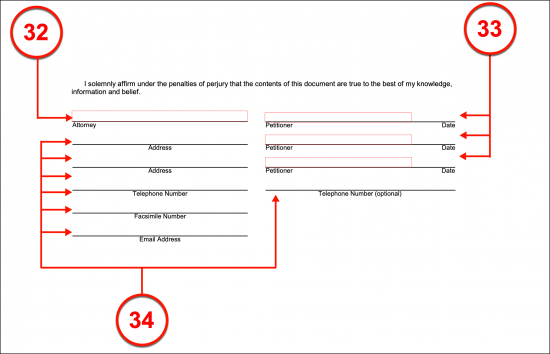

(32) Attorney Signature. The signature of the Attorney attending this matter should be submitted to this document.

(33) Petitioner Signature And Signature Date. Every Signature Affiant must sign this document as a Petitioner and produce a record of the current calendar day at the time of signing.

(34) Maryland Affiant Contact Information. The address, telephone numbers (Fax and Home/Cell), and email address of each Signature Affiant should be furnished when signing this document.