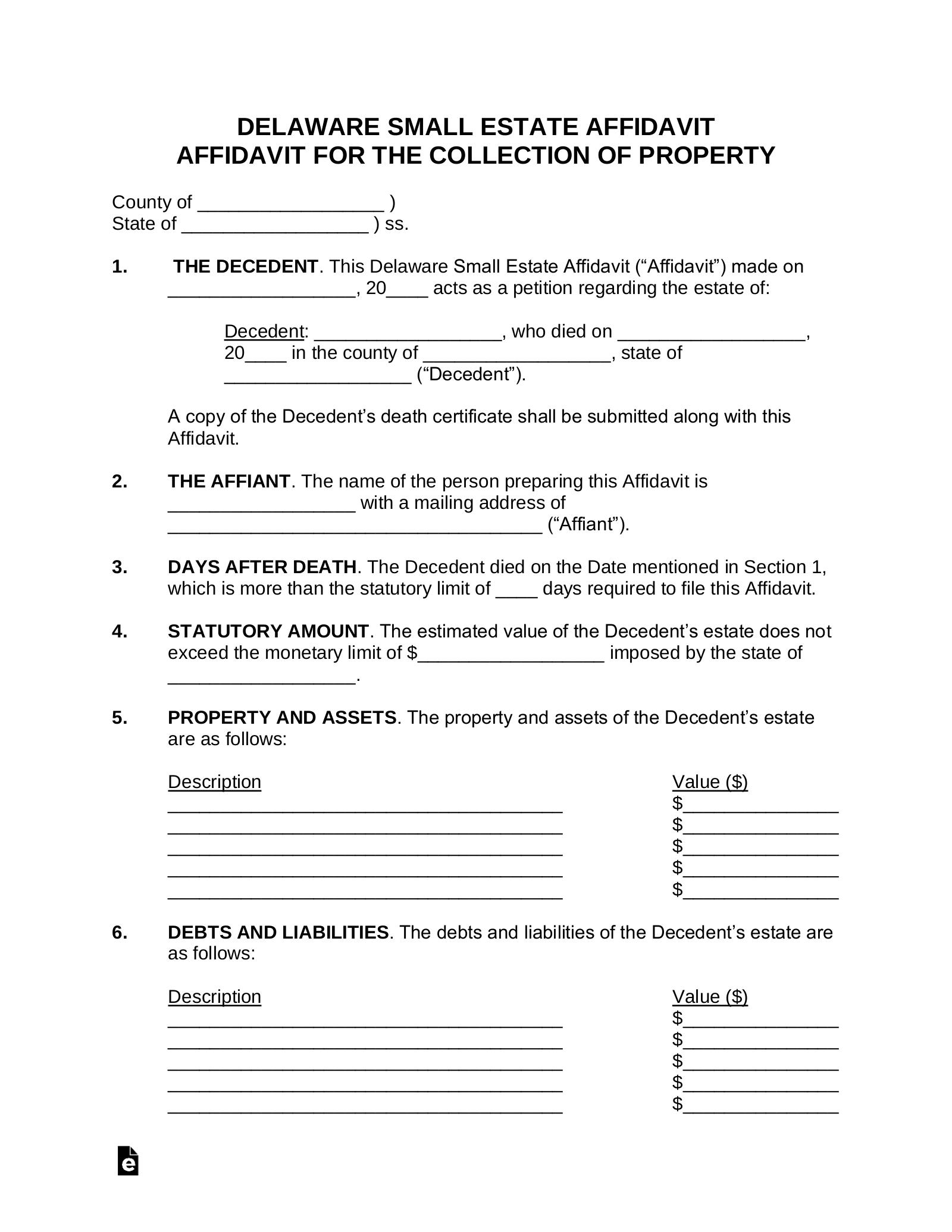

Updated September 12, 2023

A Delaware small estate affidavit is a legal document that enables an heir or beneficiary of a will to collect property that formerly belonged to a person who has died, known as a decedent. For example, it allows a person to claim ownership from a person’s estate if they have a boat, ATV, or motor vehicle. The affidavit is an alternative to the probate system, and is traditionally a faster way for beneficiaries of the decedent’s will (or heirs if the decedent died intestate) to collect what they are owed.

As the name suggests, the affidavit process is only available for “small estates,” those with a total value below a maximum established by Delaware law.

Laws

- Days After Death – At least thirty (30) days must have passed since the death of the decedent before the affidavit may be used. (12 Del. C. § 2306(2))

- Maximum Amount ($) – The total value of the decedent’s estate must be less than $30,000. The estate also cannot include any real estate owned by the decedent, even if the value of the real estate when combined with other assets is less than $30,000. (12 Del. C. § 2306(3))

- Signing – No Statutes for the affidavit itself, although the death certificate, which is required to be turned in with the affidavit, must be notarized. (12 Del. C. § 2309)

- Surviving Spouse Allowance – If the decedent had a surviving spouse, the spouse is automatically entitled to up to $7,500 of the estate before an affidavit may be processed. (12 Del. C. §§ 2306, 2308)

- Statutes – Title 12, Chapter 23 (Accounting and Distribution)

How to File (3 steps)

2. Verify Eligibility

The person who ultimately fills out the affidavit is known as the “affiant.” The affiant should catalog the decedent’s assets to assure that their total value is less than $30,000. This affiant must make sure that there is no pending petition for an appointment of a personal representative. This may be done by consulting the Register of Wills in the county where the decedent resided. Kent County residents, go here; New Castle County residents, go here; Sussex County residents, go here. The register will also be able to provide information about whether the decedent had a will.

3. Visit an Office, or Request a Form

Although this form may be used as a guide, the actual affidavit is not available electronically, and the process must be completed in coordination with the Register of Wills. Affiants may the register’s office in the county where the decedent lived. Alternatively, affiants may go to their register’s website and request that a form be sent be mail. In either case, applicants will need a notarized death certificate for the decedent. Once completed, the affidavit will be issued to the person that the decedent’s will named as executor of the estate. If the decedent died intestate, the affidavit will be issued to the decedent’s closest living relative.