Updated September 12, 2023

A Colorado small estate affidavit is a legal document that can help someone collect property that is owed to them and that formerly belonged to a person who died (a “decedent.”) The process is also called a ‘Collection of Personal Property by Affidavit,’ and it is useful because it allows successors or heirs to avoid a lengthy probate process. It is only available to estates below the maximum value established by state law, and may be used only for personal property, not real property.

Laws

- Days After Death – At least ten (10) days must have passed since the death of the decedent before filing the affidavit. (C.R.S.A. § 15-12-1201(1)(b))

- Maximum Amount ($) – The total value of the personal property in the decedent’s estate, less any liens and encumbrances on that property, must be less than an amount that is set based on the year of the decedent’s death. If the decedent died in 2020 or 2021, then the value must be less than $70,000 (C.R.S.A. § 15-12-1201(1)(a)).

- Signing – The affidavit must be notarized. The Colorado Judicial Branch recommends obtaining multiple notarized copies of the affidavit.

- Statutes – Probate Code’s Article 12, Part 12 (Collection of Personal Property by Affidavit)

How to Notarize in Rhode Island (4 steps)

2. Ensure Eligibility

3. Fill out Form JDF 999k

4. Distribute Assets

Video

How to Write

Download: PDF

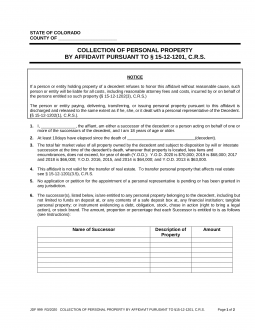

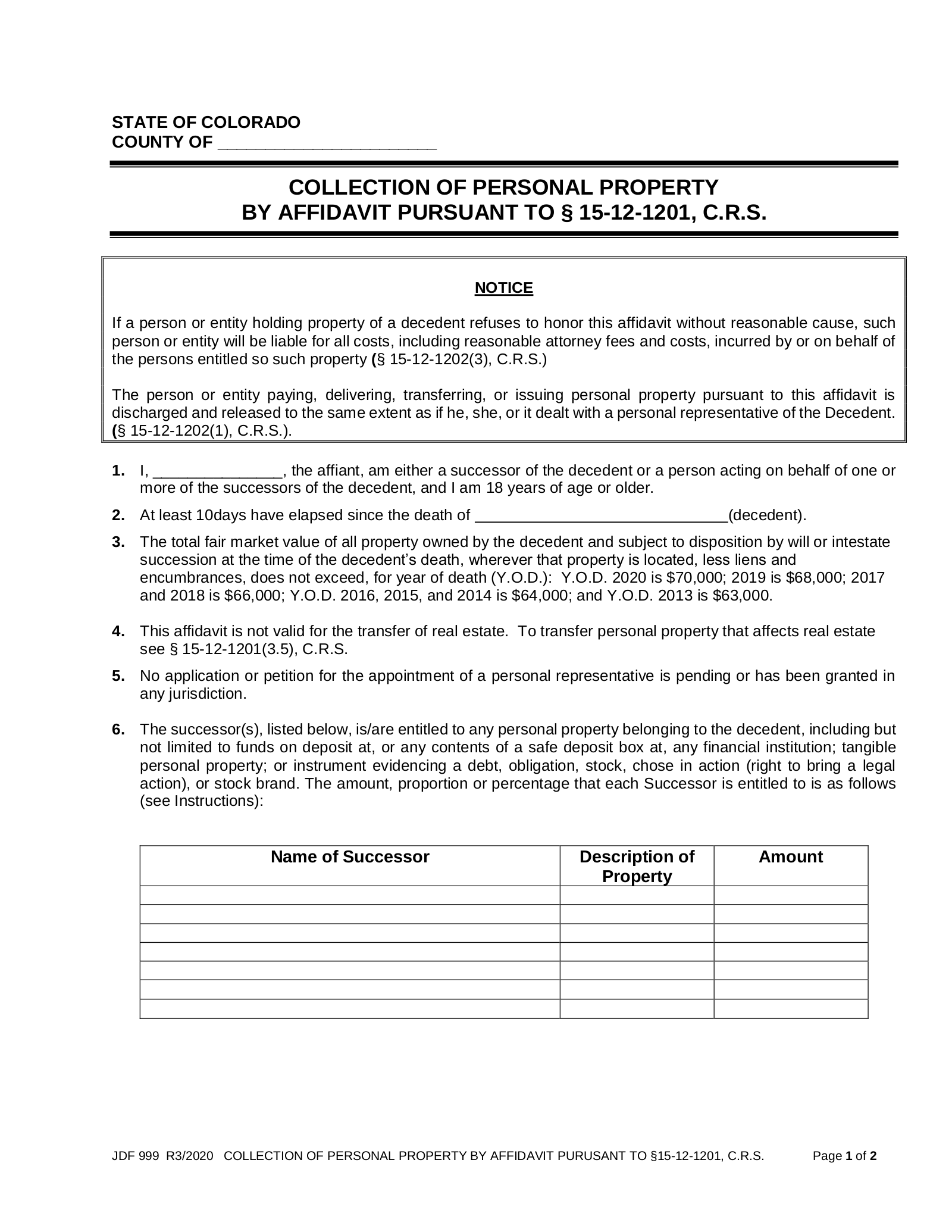

(1) Colorado County. The Colorado County where this affidavit will be in effect should be dispensed at the beginning of this document.

Section 1

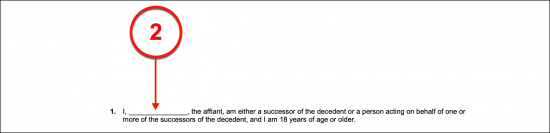

(2) Colorado Affiant. The Colorado Affiant is the Party completing and notarizing this document. This may be one Person or several People – all of whom with a valid claim to the Colorado Decedent’s estate. List each Affiant by name in the first article.

Section 2

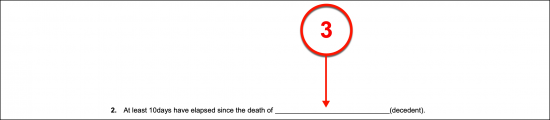

(3) Colorado Decedent. Since at least ten days must have passed since the Colorado Decedent’s death, count the number of days between the execution of this form and the calendar date of the Colorado Decedent’s death as it was reported on his or her death certificate then verify the statement made by the second article by recording the full name of the Colorado Decedent.

Section 6

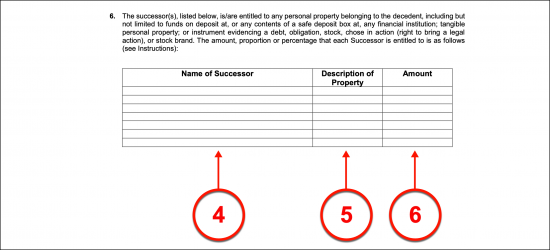

(4) Name Of Successor. A brief table included in this form will enable a report on the Successor or Successors to the Colorado Decedent’s estate. Each one should have a valid claim on the property of the Decedent by virtue of a strong and recognized relationship (i.e. a Spouse, a Sibling, a Parent, or a Child of the Decedent). List each Successor by name.

(5) Description Of Property. Define the property from the Colorado Decedent’s estate that each Successor is entitled to receive. Make sure to coordinate each piece of property listed with the name of the Successor entitled to it by working across each row.

(6) Amount. Dispense the dollar amount that each piece of property listed in the second column is worth. Record this dollar amount in the third column on the same row.

Section 7

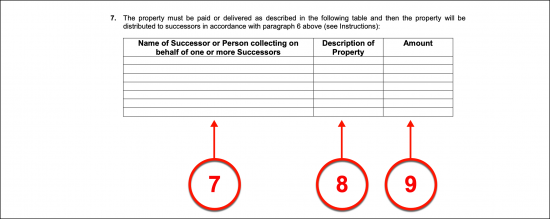

(7) Name Of Successor Or Person Collecting On Behalf Of Successors. Separate Agents may have been named by different Successors to collect the Decedent’s property. If so, record the name of each Successor or Agent who shall collect the Colorado Decedent’s property from the estate.

(8) Description of Property. Define the property of the Colorado Decedent that each Collector (whether Successor or a Successor’s Agent) shall seek to gain in the second column.

(9) Amount. Furnish the “Amount” column with the dollar value of the property that will be collected by the Successor or Successor Agent named in the first column.

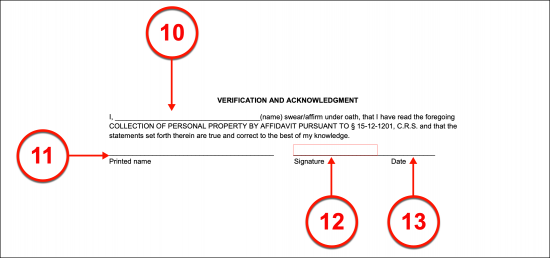

Verification And Acknowledgment

(10) Affiant Name. The end of this form shall require some basic preparation before the Affiant can execute it. Each Affiant named in Section 1 must be presented to the acknowledgment statement.

(11) Printed Name. Each Colorado Affiant named in Section 1 must begin the signature process by printing his or her name.

(12) Colorado Affiant Signature. The Colorado Affiant(s) must sign this document before a Notary Public in Colorado.

(13) Signature Date. After signing this form, the Colorado Affiant must document the date then give this form to the Notary Public observing this action.

(14) Notary Public Authentication. The Notary Public who has watched each Colorado Affiant sign this document will formally submit the Affiant’s signature to the notarization process.