Updated August 11, 2023

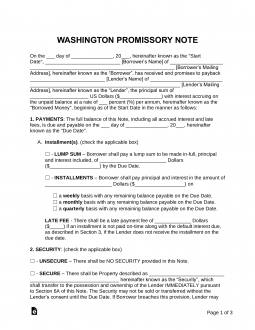

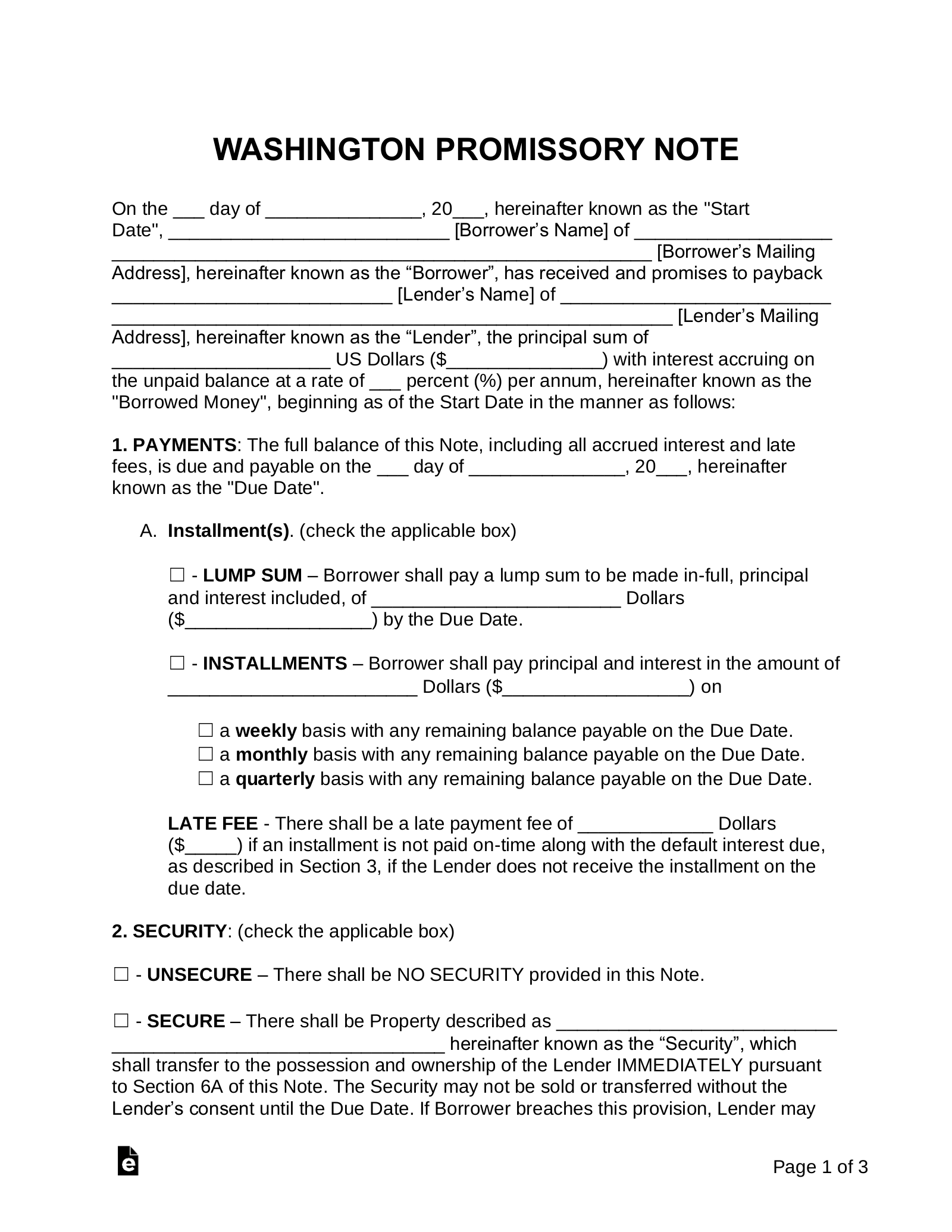

Washington promissory notes are documents signed by both a lender and a borrower that spell out the details of a money-lending agreement. The documents cover areas ranging from late fees to payment types plus many more important sections.

Table of Contents |

By Type (2)

Secured Promissory Note – The ‘secured’ part of the document refers to a section in which an item is declared as security. This item is typically a home, vehicle, or boat. The item is given to the lender if the borrower cannot repay the loaned balance to help cover the remaining unpaid note.

Secured Promissory Note – The ‘secured’ part of the document refers to a section in which an item is declared as security. This item is typically a home, vehicle, or boat. The item is given to the lender if the borrower cannot repay the loaned balance to help cover the remaining unpaid note.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – This version does not include security, leaving the lender at an increased risk for losing the loaned balance. The lender should screen potential borrowers to ensure they have a strong credit history to avoid a financial loss.

Unsecured Promissory Note – This version does not include security, leaving the lender at an increased risk for losing the loaned balance. The lender should screen potential borrowers to ensure they have a strong credit history to avoid a financial loss.

Download: PDF, MS Word, OpenDocument

Usury Statute

(1) Except as provided in subsection (4) of this section, any rate of interest shall be legal so long as the rate of interest does not exceed the higher of: (a) Twelve percent per annum; or (b) four percentage points above the equivalent coupon issue yield (as published by the Board of Governors of the Federal Reserve System) of the average bill rate for twenty-six week treasury bills as determined at the first bill market auction conducted during the calendar month immediately preceding the later of (i) the establishment of the interest rate by written agreement of the parties to the contract, or (ii) any adjustment in the interest rate in the case of a written agreement permitting an adjustment in the interest rate. No person shall directly or indirectly take or receive in money, goods, or things in action, or in any other way, any greater interest for the loan or forbearance of any money, goods, or things in action.

(2)(a) In any loan of money in which the funds advanced do not exceed the sum of five hundred dollars, a setup charge may be charged and collected by the lender, and such setup charge shall not be considered interest hereunder.

(b) The setup charge shall not exceed four percent of the amount of funds advanced, or fifteen dollars, whichever is the lesser, except that on loans of under one hundred dollars a minimum not exceeding four dollars may be so charged.

(3) Any loan made pursuant to a commitment to lend at an interest rate permitted at the time the commitment is made shall not be usurious. Credit extended pursuant to an open-end credit agreement upon which interest is computed on the basis of a balance or balances outstanding during a billing cycle shall not be usurious if on any one day during the billing cycle the rate at which interest is charged for the billing cycle is not usurious.

(4)(a) Prejudgment interest charged or collected on medical debt, as defined in RCW 19.16.100, must not exceed nine percent.

(b) For any medical debt for which prejudgment interest has accrued or may be accruing as of July 28, 2019, no prejudgment interest in excess of nine percent shall accrue thereafter.