Updated July 27, 2023

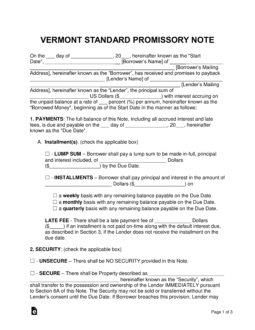

A Vermont promissory note template is designed for transactions involving the loaning of money from a lender to a borrower. The templates help to ensure both parties are clear on the terms and conditions of the agreement as well as give the transactions some legal validity.

Table of Contents |

By Type (2)

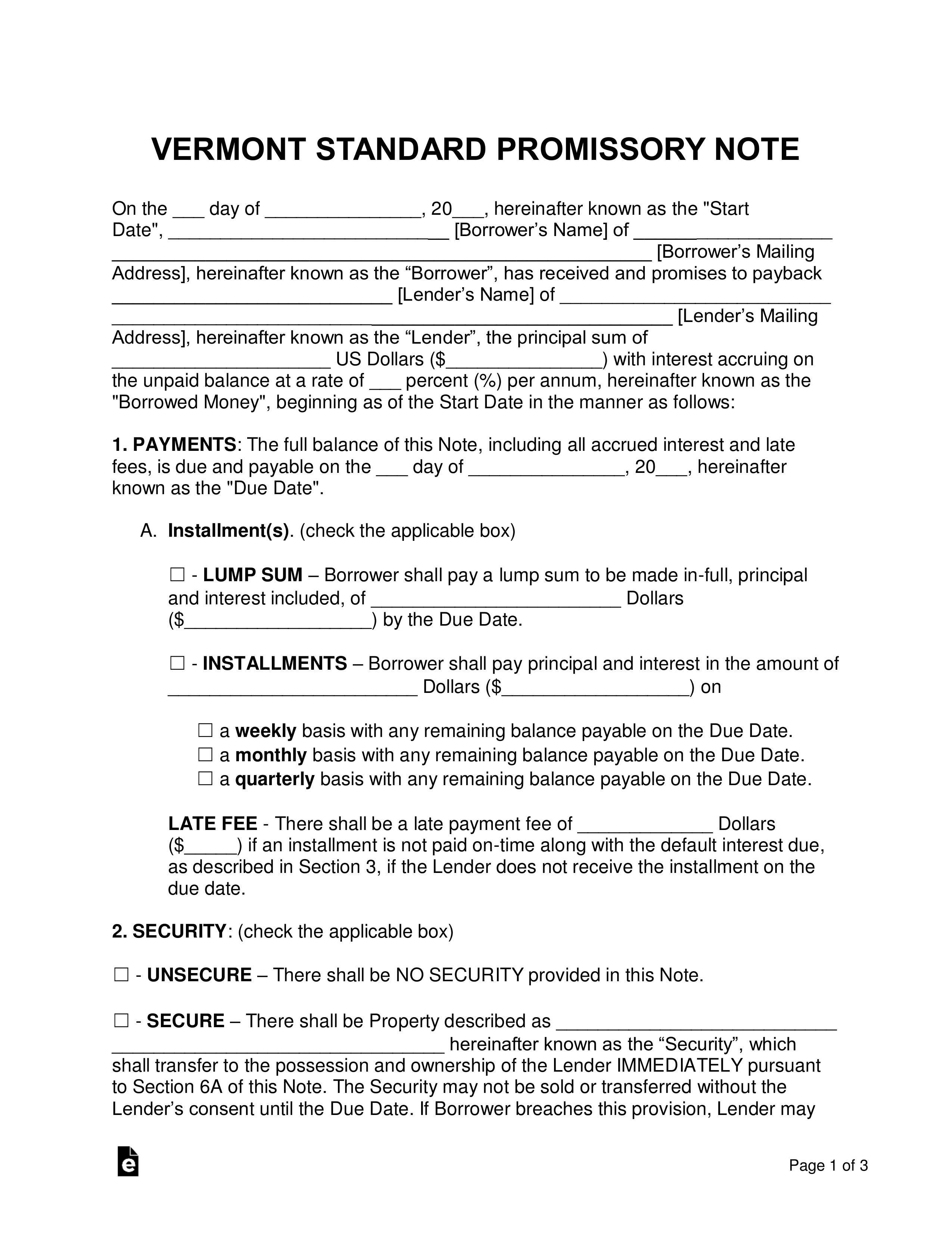

Secured Promissory Note – Provides the lender with a form of monetary protection. If the borrower defaults on the balance and cannot recover, the item put into security is automatically given to the lender to help cover the remaining unpaid balance.

Secured Promissory Note – Provides the lender with a form of monetary protection. If the borrower defaults on the balance and cannot recover, the item put into security is automatically given to the lender to help cover the remaining unpaid balance.

Download: PDF, MS Word, OpenDocument

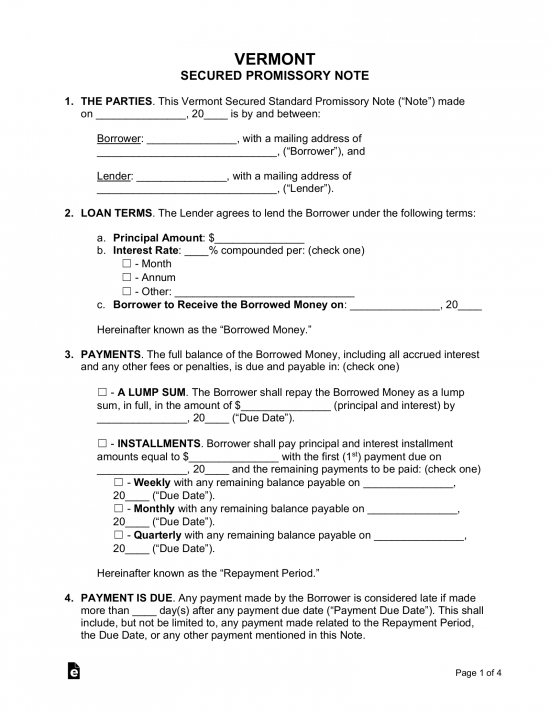

Unsecured Promissory Note – Does not include security, leaving the lender at an increased risk for losing the loaned balance if the borrower cannot make payments. Screening potential borrowers and only working with family and friends can help decrease the risk of financial loss to the lender.

Unsecured Promissory Note – Does not include security, leaving the lender at an increased risk for losing the loaned balance if the borrower cannot make payments. Screening potential borrowers and only working with family and friends can help decrease the risk of financial loss to the lender.

Download: PDF, MS Word, OpenDocument

Usury Statute

(a) Except as specifically provided by law, the rate of interest or the sum allowed for forbearance or use of money shall be 12 percent per annum computed by the actuarial method.

(b) The rate of interest or the sum allowed:

(1) For single payment loans by lenders regulated by Title 8 and federal savings and loan associations, the finance charge shall not exceed 18 percent per annum.

(2) For a retail installment contract the finance charge shall not exceed 18 percent per annum of the first $500.00 of the balance subject to finance charges and 15 percent per annum of the balance subject to finance charges in excess of $500.00.

(3) For a bank credit card account or revolving line of credit the rate shall be the rate agreed upon by the lender and the borrower. However, except for cash advances, no finance charge may be imposed for any monthly billing period in which there is no previous balance, or during which the sum of the payments received and other credits issued are equal to or exceed the amount of the previous balance.

…