Updated February 20, 2023

A promissory note release is given to a borrower after the final payment on a loan to release them of all further liabilities and obligations. The borrower will commonly request this as part of accepting the final payment for the borrowed money and that they have paid back all principal and interest under the note.

The release is required to be signed by the lender (only).

Requirements for a Release

The release should contain the following:

- Names of the borrower and lender;

- Dates of both the original note and the release;

- Total amount of the borrowed money; and

- the signature of the lender.

What to do AFTER Signing?

The promissory note and its release are bookends on a lending relationship. For best practices, the borrower should file them in a safe and accessible place in case the lender attempts to claim the loan repayment was not satisfied.

In addition, if the IRS performs an audit, the borrower will need the release to verify dates and figures.

Sample

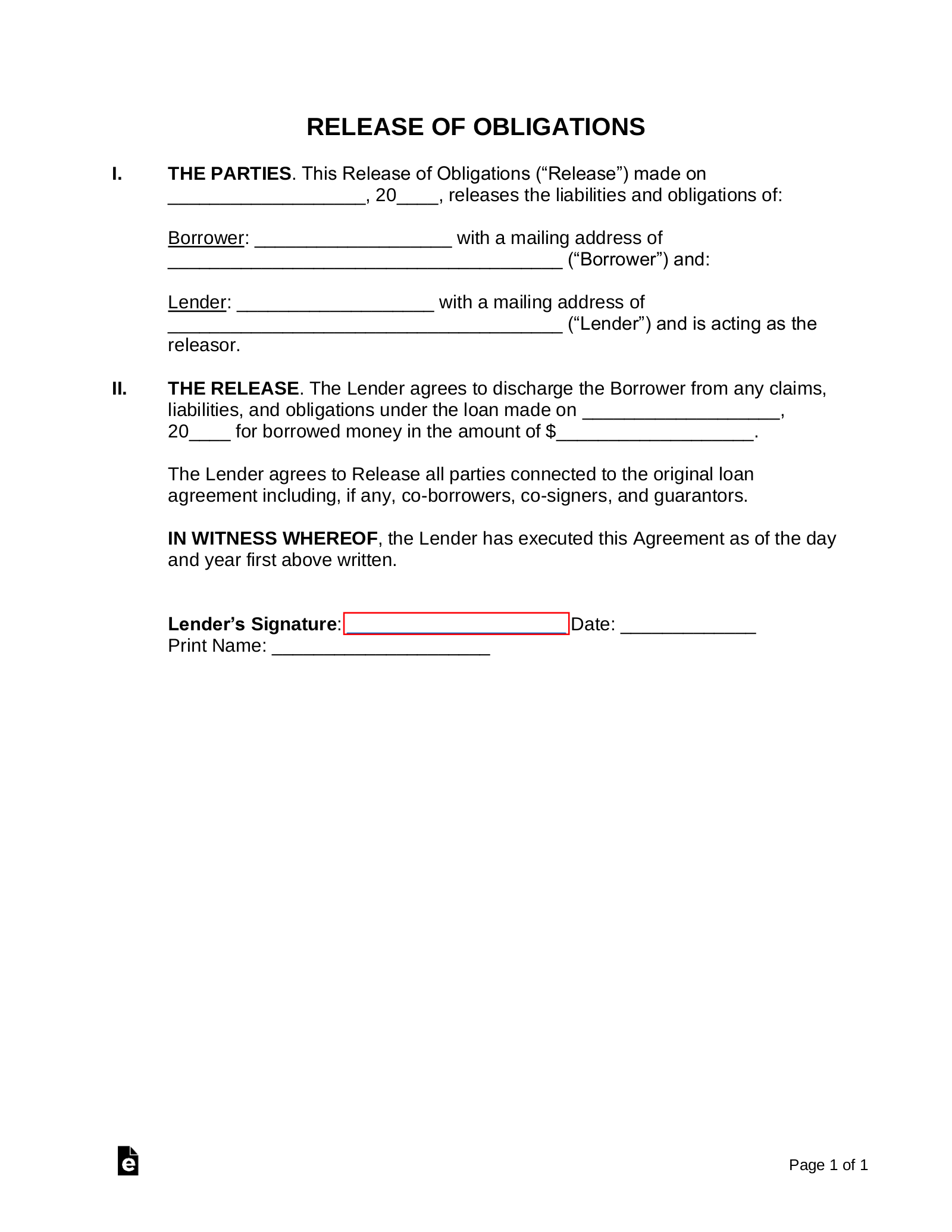

RELEASE OF OBLIGATIONS

I. THE PARTIES. This Release of Obligations (“Release”) made on [DATE], releases the liabilities and obligations of:

Borrower: [BORROWER’S NAME] with a mailing address of [ADDRESS] (“Borrower”) and:

Lender: [LENDER’S NAME] with a mailing address of [ADDRESS] (“Lender”) and is acting as the releasor.

II. THE RELEASE. The Lender agrees to discharge the Borrower from any claims, liabilities, and obligations under the loan made on [DATE] in the amount of $[AMOUNT].

The Lender agrees to Release all parties connected to the original loan agreement, including, if any, co-borrowers, co-signers, and guarantors.

IN WITNESS WHEREOF, the Lender has executed this Agreement as of the day and year first above written.

Lender’s Signature: _____________________ Date: _____________

Print Name: _____________________