Updated April 15, 2024

A Florida durable power of attorney form represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate. It is important that the principal picks someone they trust as this person will handle the assets of the principal and will have access to the principal’s financial matters.

Table of Contents |

Versions (1)

Download: PDF, MS Word, OpenDocument

Laws

Title XL, Chapter 709, Part II (Powers of Attorney)

Definition of “Durable”

“Durable” means, with respect to a power of attorney, not terminated by the principal’s incapacity (709.2102(4)).

Definition of “Power of Attorney”

“Power of attorney” means a writing that grants authority to an agent to act in the place of the principal, whether or not the term is used in that writing (709.2102(9)).

Signing Requirements

Required to be signed in the presence of a notary public and two (2) witnesses (§ 709.2105(2)).

Statutory Form

The Florida Statutes do not provide a sample durable power of attorney form, but language pertaining to durable powers can be found in § 709.2104.

How to Write

Download: PDF, MS Word, OpenDocument

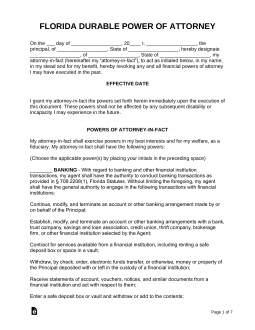

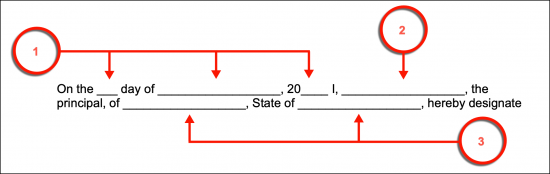

Opening Statement

(1) Document Date. The date that should be formally associated with this paperwork.

(2) Principal Name. The Florida Party seeking to grant authority over one or more matters to an Agent must be identified.

(3) Residential County And State. The County and State where you maintain your residence aids in securing your identity as the Principal issuing this document.

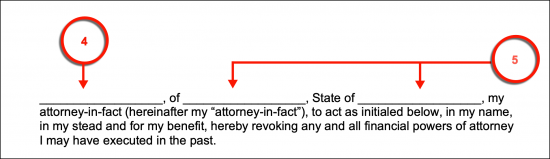

(4) Florida Attorney-in-Fact. officially name the Party you wish to act as your Attorney-in-Fact (or Agent) upon this document’s effect. The Attorney-in-Fact you name will be able to wield the same authority you have in Florida over the affairs of your choosing. The full name of the Attorney-in-Fact should be displayed to match his or her formal identification (i.e. Driver’s License).

(5) Agent’s County And State.

Effective Date

(6) Immediate Effect. This power of attorney shall be effective immediately upon signing and will continue until revoked.

(7) Delayed Effect. With the exception of a deployment-contingent military power of attorney (which may be signed in advance) or one executed before October 1st, 2011, that is is conditioned on the principal’s lack of capacity, a power of attorney is ineffective if the power of attorney provides that it is to become effective at a future date or upon the occurrence of a future event or contingency. In other words, a valid power of attorney must take effect immediately and not be signed in advance pending another date or occurrence (known often as a “springing” power of attorney), notwithstanding the two aforementioned exceptions.

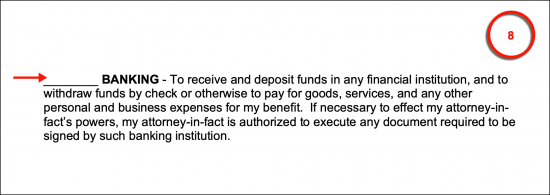

Powers Of Attorney-in-Fact

(8) Banking. A list of topics will display the powers you can grant your Attorney-in-Fact the power to perform in your name as well as the decisions he or she can make on your behalf. None of these powers are granted by default. To grant one of the power topics to the scope of your Attorney-in-Fact’s principal powers, you must initial the statement defining it. The first item gives your Attorney-in-Fact the ability to handle your transactions with banking and financial accounts as well as opening, closing, and maintaining such accounts.

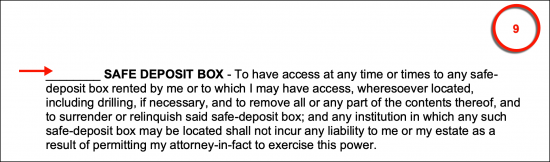

(9) Safe Deposit Box. The Principal can grant the Attorney-in-Fact the ability to access safe deposit boxes in his or her name using the same authority he or she possesses through the second power statement. To grant your Agent this principal power, supply your initials.

(10) Lending Or Borrowing. The Principal can deliver the power needed by the Agent to engage in managing the debts owed to the Principal and those owed by the Principal. For this power to be granted, tender your initials to the third item.

(11) Government Benefits. The Principal’s eligibility and authority over government benefits such as Medicare can be handled by the Attorney-in-Fact if such powers are approved. By producing your initials here, you will give the Florida Agent the power to apply for government benefits and even receive payments in your name. To restrict this power from your Agent, leave this item unattended.

(12) Retirement Plan. The Florida Principal can delegate power to the Attorney-inFact so that the concerned Agent can manage the Principal’s retirement planning and IRA’s on the Principal’s behalf. This appointment of power would require your initials to engage.

(13) Taxes. The Principal’s tax forms and required administrative tasks can be placed in the Attorney-in-Fact’s granted authority provided your initials (as the Principal) are delivered to the sixth topic.

(14) Insurance. The Attorney-in-Fact can be given the power to handle the Principal’s insurance policies (ranging from car insurance to pet insurance) so long as the Principal’s initials are presented to approve these actions. If desired, initial this item to grant this power to your Attorney-in-Fact.

(15) Real Estate. The eighth subject must be initialed by the Principal if he or she requires the Attorney-in-Fact to have the authority to initiate, maintain, or terminate dealings in real property. For your Attorney-in-Fact is required to represent your real estate interests then initial eighth listed power description.

(16) Personal Property. If appropriate, the Attorney-in-Fact can be granted the principal power to purchase, sell, and maintain personal property (i.e. boats, computers, etc.). This power can be approved for your Attorney-in-Fact by initialing the ninth power topic as the Principal behind this paperwork.

(17) Power To Manage Property. The Florida Principal can approve the Attorney-in-Fact’s right to perform actions such as leasing, renting, repairing, and other actions needed to manage property on the Principal’s behalf. If desired such actions can be delegated to your Attorney-in-Fact through your initials of approval.

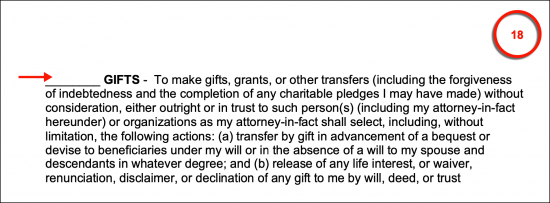

(18) Gifts. Transfers, grants, debt forgiveness, and other gifts can be made by or received int he Principal’s name by the Attorney-in-Fact, if such powers are approved in this document with your initials, then your Attorney-in-Fact will be able to represent your directives regarding gifts.

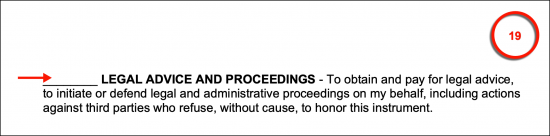

(19) Legal Advice And Proceedings. If the Principal requires that the Attorney-in-Fact have the ability to seek out and engage legal advice in his or her name as well as perform administrative tasks needed to enforce this document, then direct approval must be displayed. To give your Attorney-in-Fact this power in the State of Florida, initial the final item.

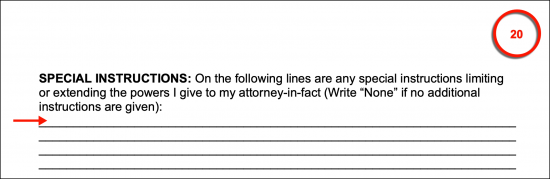

Special Instructions

(20) Principal Instructions. Any conditions or limitations the Principal wishes included to control the Attorney-in-Fact’s actions must be documented within this form or attached to this form by the time it is executed.

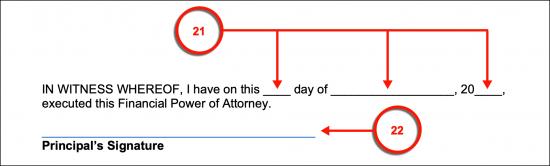

Florida Principal’s Witnessed Signature

(21) Signing Date. The day, month, and year that you sign this document should be recorded immediately before providing your signature.

(22) Florida Principal Signing. Your act of signing must be performed before two Witnesses and a Notary Public.

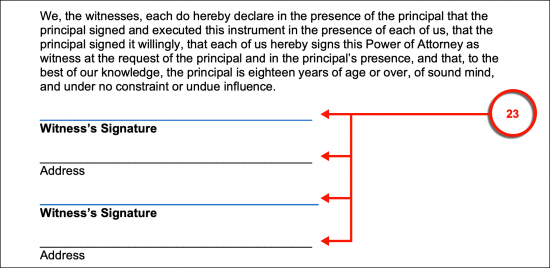

(23) Witness Requirement. After signing this document, relinquish possession of it to the Witnesses observing you. Each Witness must sign a unique Witness line and record his or her address to show agreement to the testimony on display.

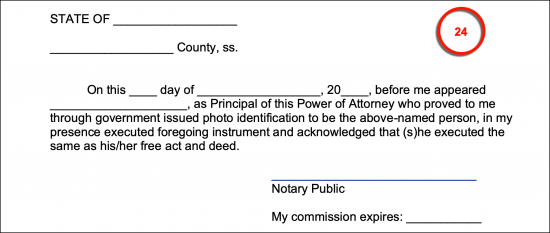

(24) Florida Notarization. The Notary Public overseeing this signing will provide the notary seal as well as his or her credentials as proof of notarization.

Specimen Signature And Acceptance Of Appointment

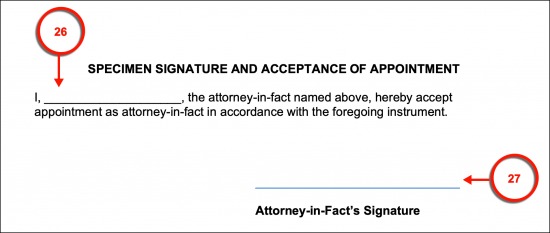

(25) Attorney-in-Fact Name. Notice the attached document to the appointment form just completed. This is a declaration of acceptance from the Attorney-in-Fact regarding the Principal and the authority being conveyed above. The statement presented requires the Attorney-in-Fact’s name transcribed from the power to document to its content.

(26) Attorney-in-Fact Signature. The Florida Attorney-in-Fact should read the statement of acceptance then sign his or her name to confirm its accuracy. This act should be performed a Florida Notary Public.

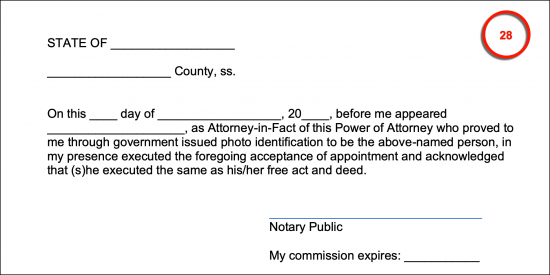

(27) Specimen Signature Notarization. The Notary Public will verify the Attorney-in-Fact’s signing by notarizing this acknowledgement.

Related Forms

Download: PDF

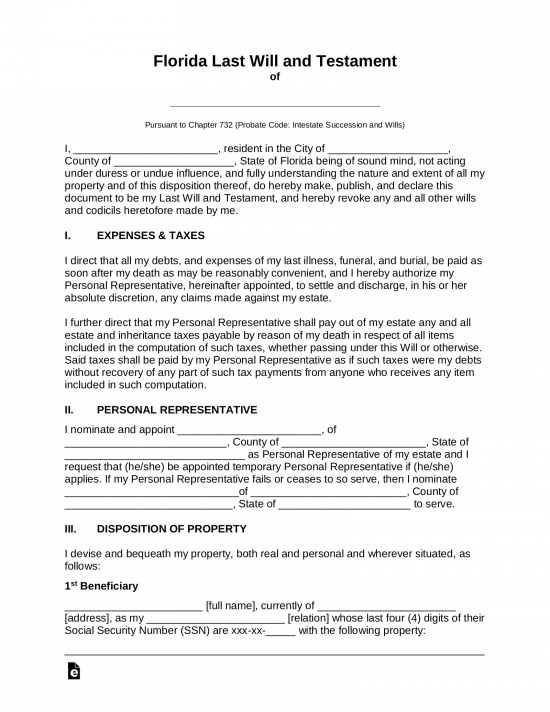

Download: PDF