Updated September 05, 2023

Illinois bill of sale forms are documents that provide information about the sale, purchase, or trade of property. Primarily used for vehicle transfers, a signed copy will be needed by the buyer to register with the Secretary of State.

Forms (5)

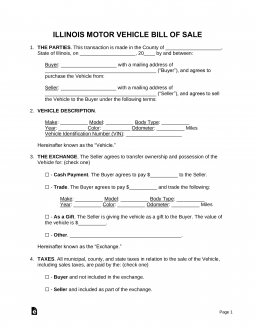

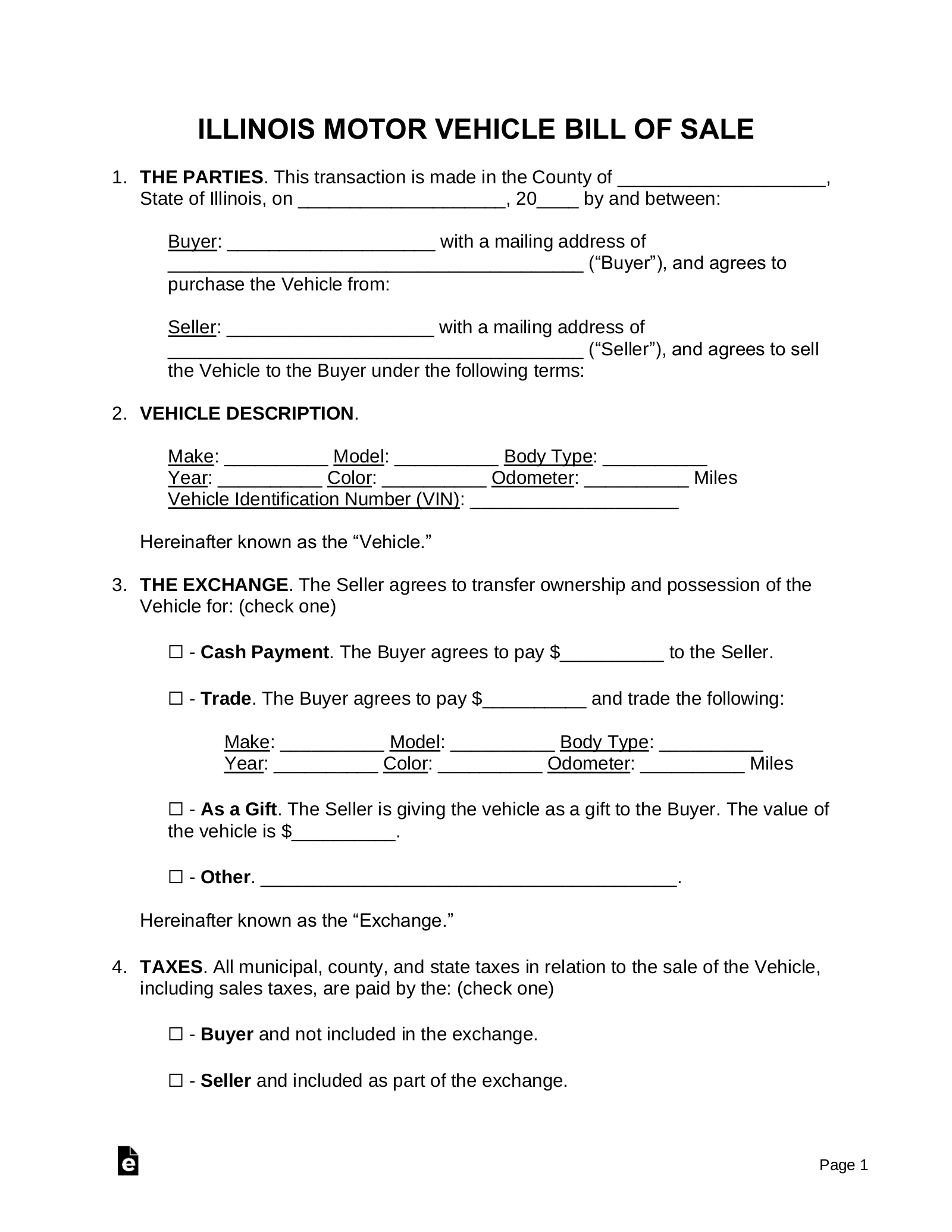

Motor Vehicle Bill of Sale – Use to sell, purchase and change ownership of an automobile. Motor Vehicle Bill of Sale – Use to sell, purchase and change ownership of an automobile.

Download: PDF, MS Word, OpenDocument |

Boat Bill of Sale – To be used in the sale, purchase, and change of ownership for a vessel/boat. Boat Bill of Sale – To be used in the sale, purchase, and change of ownership for a vessel/boat.

Download: PDF, MS Word, OpenDocument |

General Bill of Sale – To be used, for the most part, between two individuals when sale and purchase of personal property changes ownership. General Bill of Sale – To be used, for the most part, between two individuals when sale and purchase of personal property changes ownership.

Download: PDF, MS Word, OpenDocument |

Gun Bill of Sale – Transfer ownership of a firearm after the sale between buyer and seller. Gun Bill of Sale – Transfer ownership of a firearm after the sale between buyer and seller.

Download: PDF, MS Word, OpenDocument |

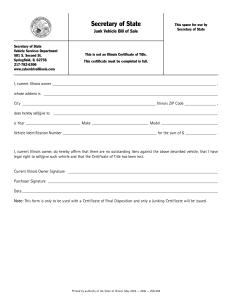

Junk Vehicle Bill of Sale (Form VSD 658) – Available to validate a sale of a junk vehicle to an individual or salvage business. Junk Vehicle Bill of Sale (Form VSD 658) – Available to validate a sale of a junk vehicle to an individual or salvage business.

Download: PDF |

Vehicle Registration Forms

- Bill of Sale;

- Odometer Disclosure Statement for Title Transfers (VSD 333.4);

- Application for Vehicle Transaction (Form VSD 190), if filled online, it must be submitted to a local SOS office within seven (7) days;

- Seller’s Report of Sale (VSD-703);

- Certification of Title, signed by the previous owner;

- Tax RUT-50 (obtained at SOS office);

- Valid Illinois Driver’s License;

- Registration Fees (typically $150-$165);[1]

- Proof of Car Insurance; and

- Motor Vehicle Power of Attorney, if an agent will represent the seller or buyer in any vehicle-related matters.

Boat Registration Forms

- Bill of Sale;

- Completed Watercraft Registration/Title Application (Form IL 422-0321);

- Signed Certificate of Title or Current Registration (only for used boats);

- Manufacturer’s Certification of Origin (only for new boats);

- Valid Illinois Driver’s License or Proof of Identity;

- Watercraft Power of Attorney (only if vessel has a lien); and

- Registration Fees (rates vary depending on the vessel’s classification).[2]